When are tax instalments required?

If your employer does not withhold income tax (i.e., if you have more than one employer or are earning income through self-employment, rental income, investment income, pensions etc.) tax installment payments may have to be paid.

Installment payments must be paid if the net tax owing exceeds $3000 ($1800 for Quebec residents).

If you expect more income this year, compared to prior years, instalment amounts can be increased. However, if you expect lower income this year, you can ignore the instalment reminder(s) through the CRA or lower the instalment amount.

When are instalments due?

Installments are due on the 15th each year for everyone. The CRA will send notices twice a year to remind you to pay the installments. A February reminder for March and June payments, and an August reminder for September and December payments.

Non-payment on stipulated date(s) will attract interest on a daily compounding basis and in some cases, a penalty, if the installment interest exceeds $1,000.

How to pay?

There are many options to pay including: online, in-person, and through mail.How to enter instalments on the TaxTron Web?

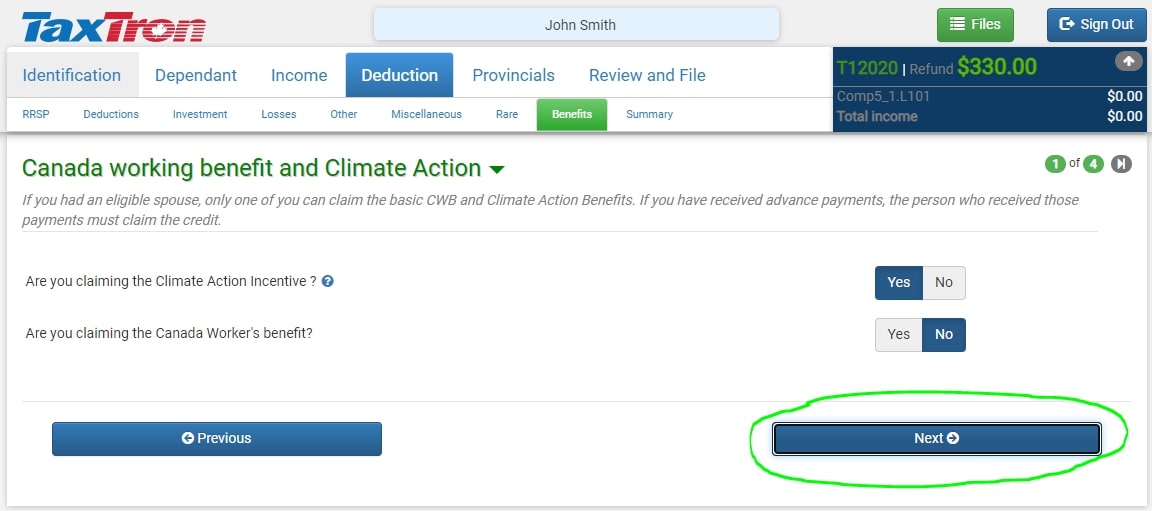

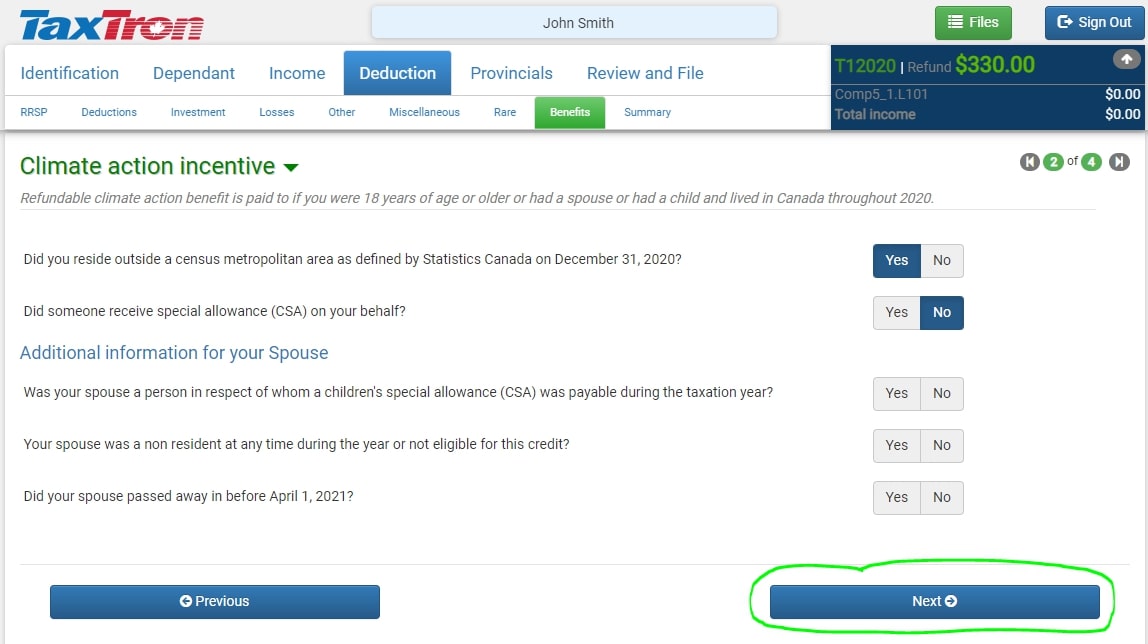

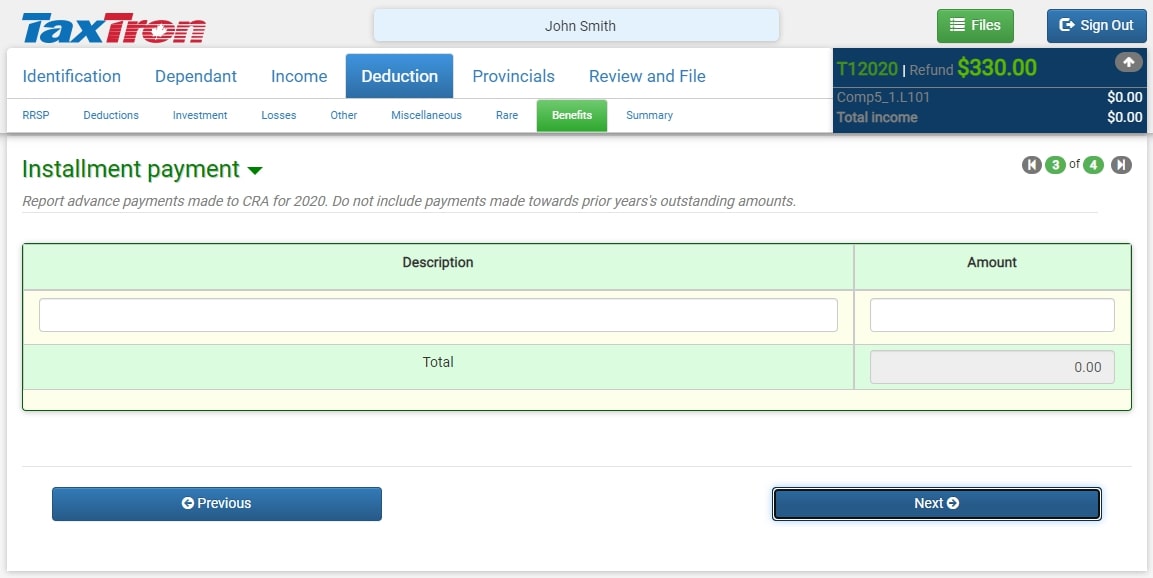

On the TaxTron Web, please go to the Deduction page. Click “Benefits” and answer questions with reference to the Canada Working Benefit (CWB) and the Climate Action Incentive(CAI). When answering CAI questions, please click “next” and you will find the section to enter installment payments.

Posted on 21 Oct 2021