Federal and Quebec tax rules allow transport employees to deduct work-related expenses, particularly for meals, lodging, and vehicle costs, when working away from their home terminal. The employer must operate a transportation business: If the employee works for a transport company (e.g., airline, railway, or bus) or regularly picks up or delivers goods, the employee may be able to deduct the cost of meals, lodging, and showers. The employer must certify this by signing Federal Form TL2 and Quebec TP-66, confirming that the conditions are met and indicating any reimbursements paid.

Deductible Expenses for Transport Employees

Meals and Lodging: Transport employees can deduct expenses for meals and lodging incurred while regularly travelling away from their home terminal, generally requiring overnight travel.

- Simplified method: Claim a flat rate per meal without receipts—$17 per meal, up to $51 per day.

- Detailed method: Claim actual amounts spent, keeping all receipts.

- Long-haul truck drivers: If away from home terminal for at least 24 continuous hours, 80% of meal expenses can be claimed (higher than the standard 50%).

Showers: Costs for showers are deductible as part of lodging expenses, especially when sleeping in a vehicle.

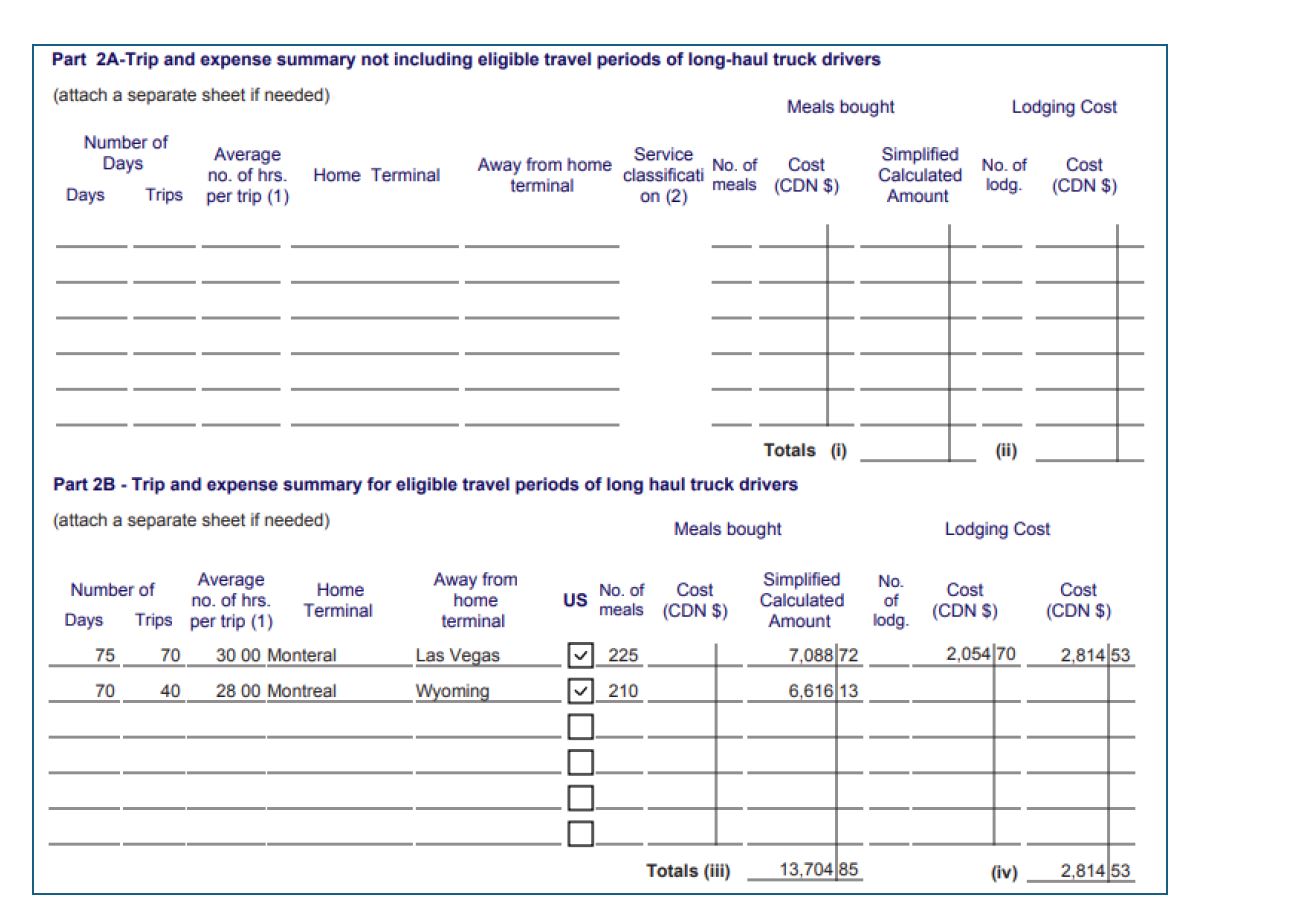

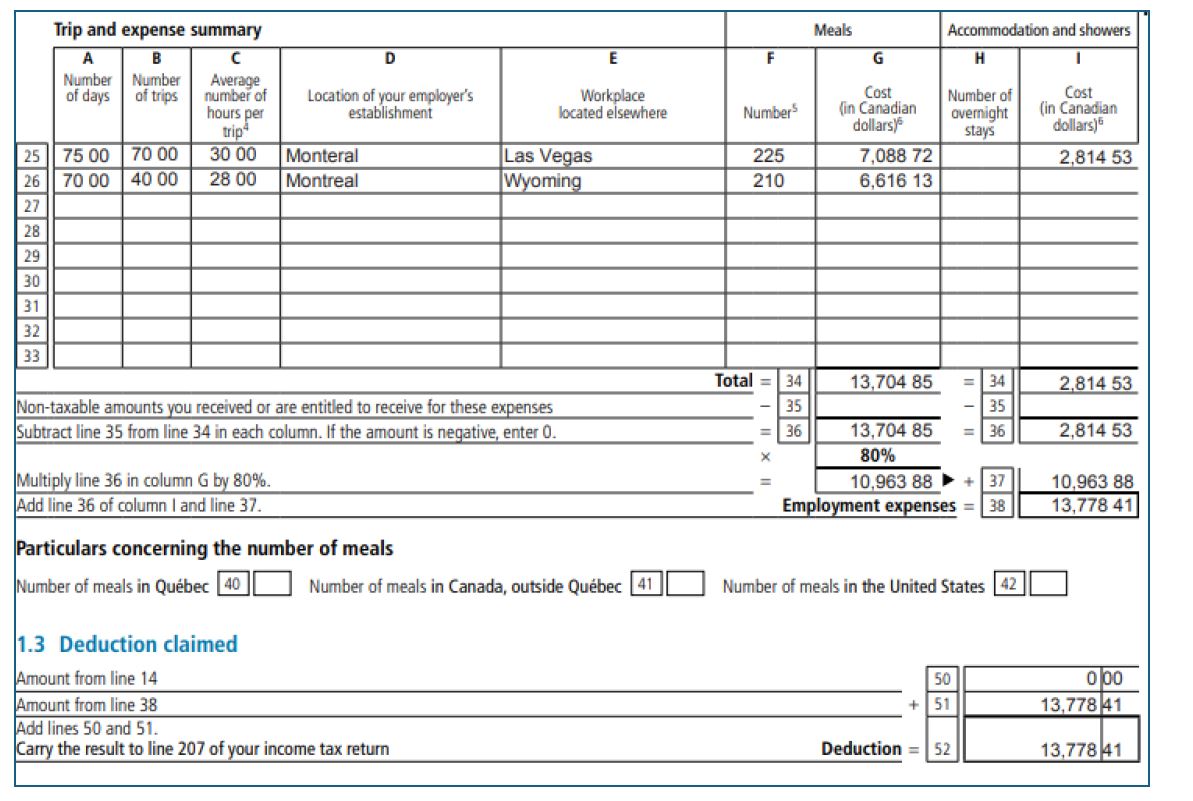

Example 12:

Arthur Lavoie, a long-haul truck driver based in Montréal, Québec, worked 145 days and completed 70 trips averaging 30 hours each. His home terminal is Montréal, and his Away from Terminals was Las Vegas (30 trips over 75 days) and Wyoming (40 trips over 70 days, averaging 28 hours each trip). He spends US $1,500 on shower expenses. He kept the logbook but did not keep meals receipts.

Answer: An average exchange rate of 1.3698 is used in the calculation. As a long-haul truck driver, Arthur can claim the maximum allowance of three meals per day for each day he is away from his home terminal.

Posted on 8 January, 2026