If you are a salaried tradesperson (such as a hairdresser, cook, plumber, or apprentice mechanic), complete this form to claim a deduction for eligible tools purchased during the year. Eligible apprentice mechanics can also claim an additional deduction for tools acquired in the same year on this form. To claim tradesperson or apprentice expenses, you must have a signed Form T2200 (federal) and Form TP-75.2-V (Quebec) from your employer. Tradespersons or apprentices can claim the following common expenses:

- Cost of eligible tools purchased during the year.

- Additional tool deduction (for eligible apprentice mechanics).

- Travel expenses between temporary worksites (if required by the job).

- Vehicle expenses (if required to transport tools or equipment).

- Protective clothing and safety gear (e.g., boots, helmets, gloves).

- Supplies and materials used directly in the trade.

- Union or professional dues related to the trade.

- Meals and lodging (if working away from the regular place of employment).

- Home office expenses (if required by employer and used for employment duties).

Both CRA and Revenu Québec require the employer to sign the certification forms (T2200 and TP-75.2-V) confirming that the employee was required to incur these expenses.

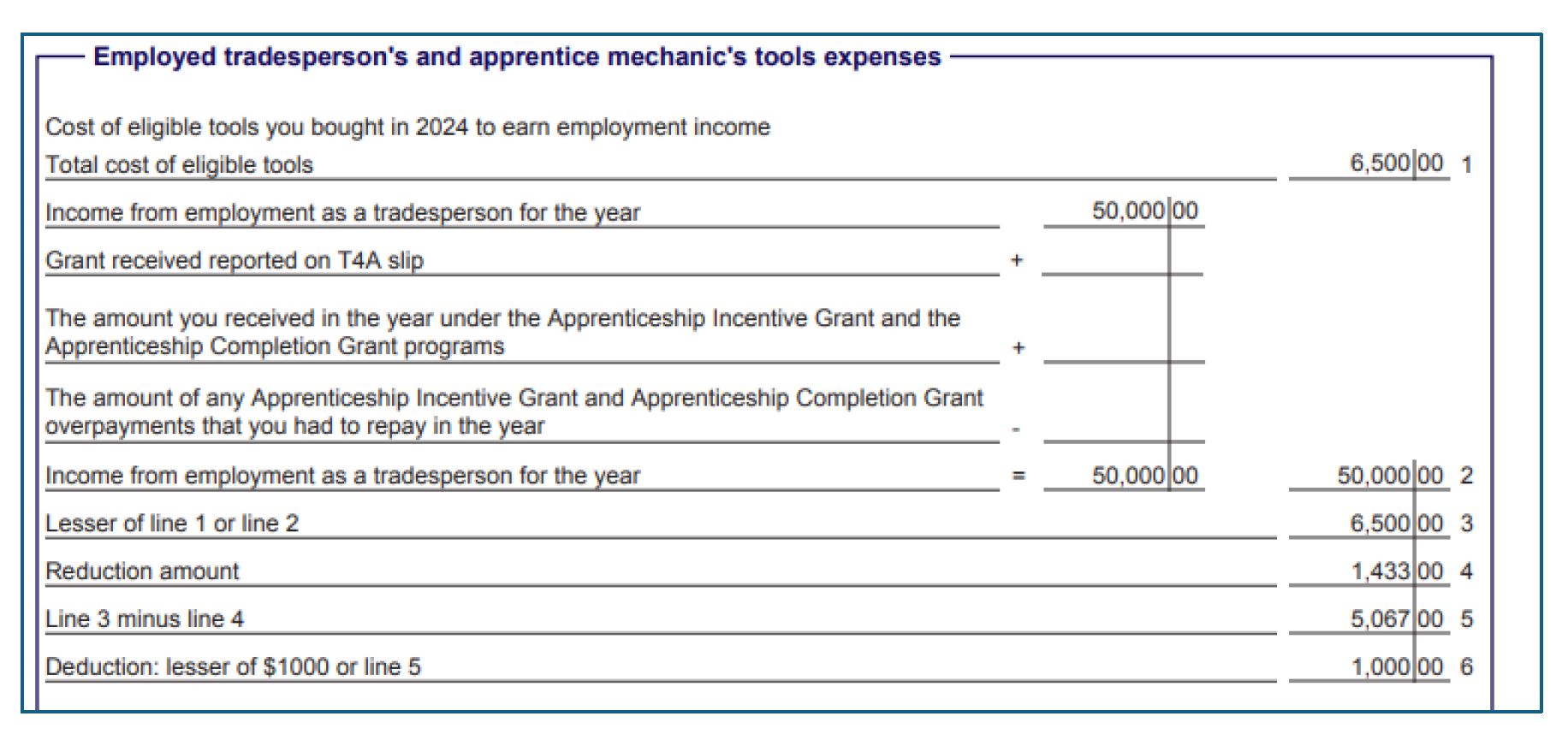

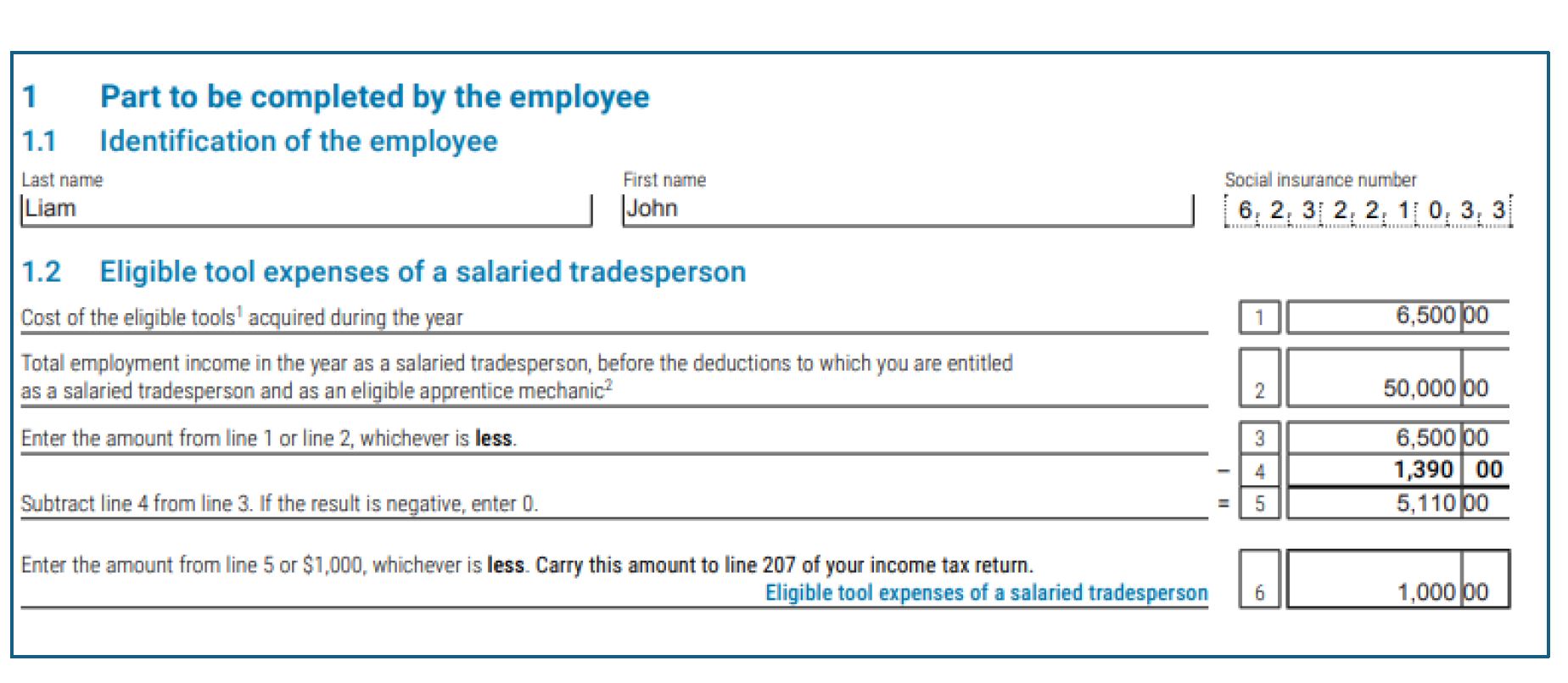

Example :

John, a salaried plumber, earns an annual salary of $50,000 and purchased tools costing $6,500.

Answer: John can claim maximum of $1,000 for tradesperson deduction on Federal & Quebec tax return.

Posted on 8 January, 2026