Every tax season more and more clients are shunning the trip to an accountant's office in favour of filing their taxes remotely. This trend accelerated exponentially during the COVID- 19 pandemic and shows no sign of slowing down. Most often, the main complication of filing taxes remotely for professional accountants has been to obtain the client's signature on the forms. The forms need to be printed or printed as PDF then emailed to the client after which the client has to print, sign, scan and email the forms back to the accountant.

TaxTron has enabled Digital signatures and integrated e-signature feature in its Web based products namely TaxTron Pro T1, T2 and T3. This feature will allow professional accountants to obtain client e-signatures through email and cellular phone. This package is currently offered in TaxTron Web for Tax years 2018 and beyond. The e-signature feature must be bundled (added to the cart) and purchased simultaneously with any TaxTron Pro products.

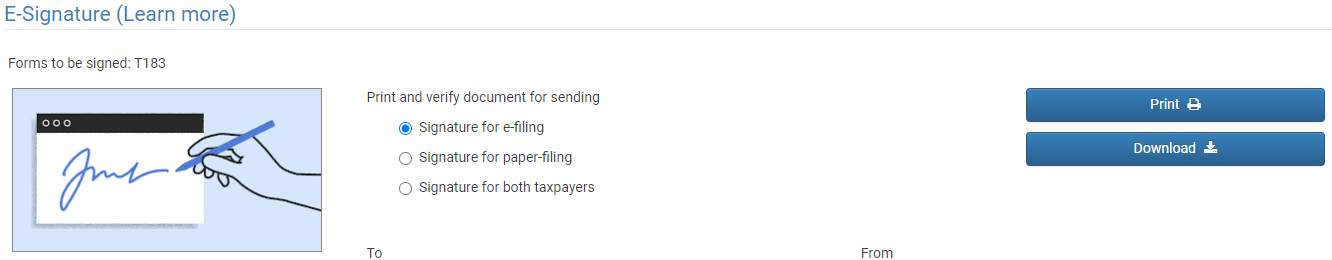

Obtaining the client's signature is quite straight forward. Once the return has been prepared, proceed to “Print and File Your Return” screen. Scroll down to “Digital Signature”. Your Digital Signature feature has three options:

Regardless which option the client chooses, the steps are relatively similar. The first two options are quite similar since in one option the signed copy is e-filed versus the other option in which it is printed and paper-filed. “Signature for both taxpayers” relates to cases where the signature of both spouse or common-law partners are required on the forms such as Form 1032-Joint Election To Split Pension Income. In all three cases, we first need to generate the document that will be digitally signed. The document is generated by clicking on the “Print” box.

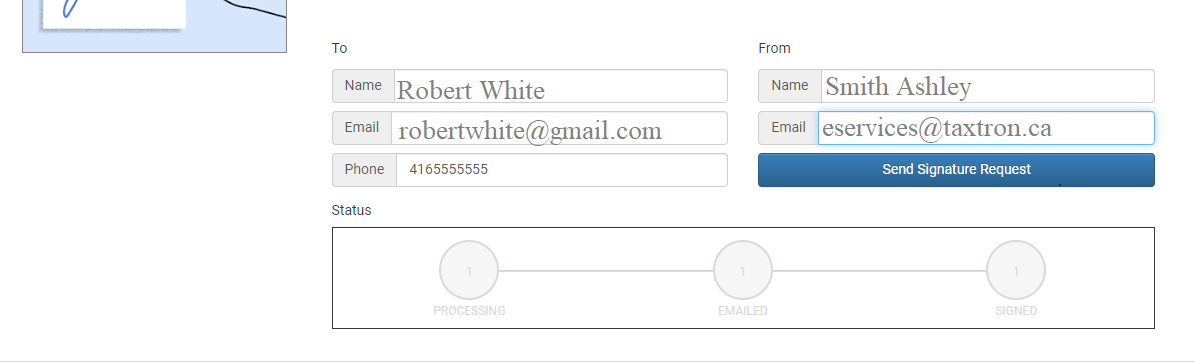

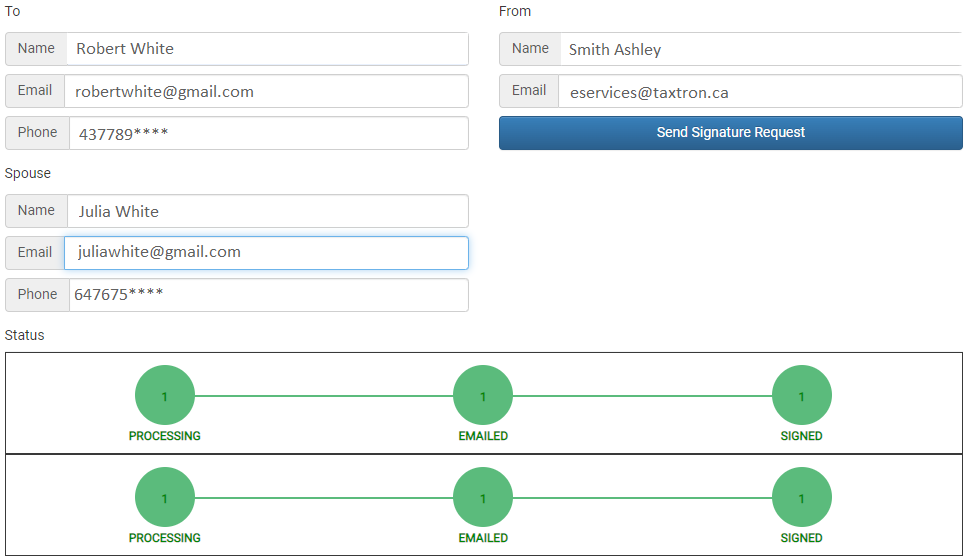

Once the document is generated and downloaded, you will then click on one of the options, enter the client(s) details in the appropriate boxes and click “Send Signature Request”.

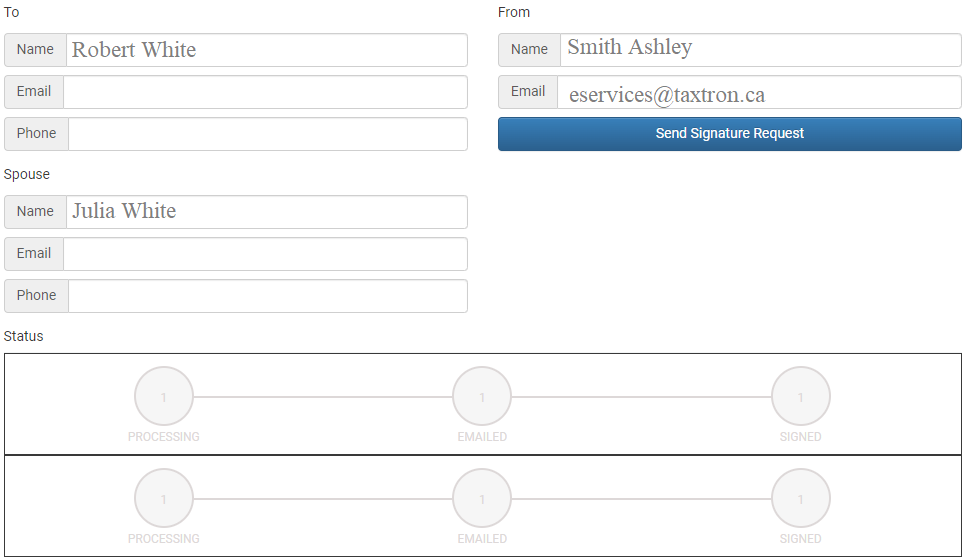

In the case of “Signature for both taxpayers”, you will be required to enter the details for both taxpayers:

The client will receive a Request for Signature email and a text from the accountant. The client has the option of replying via either his/her mobile or a PC browser.

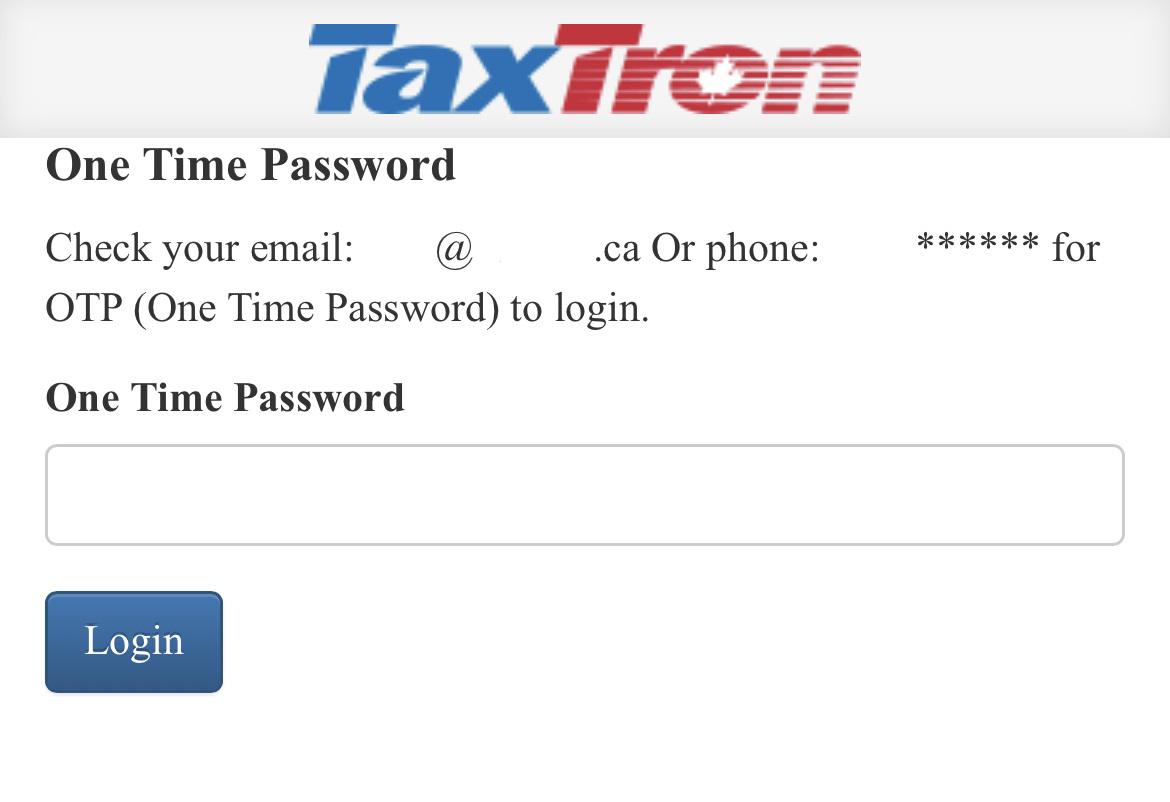

When the client clicks on the “Sign In” button, the system will send another email and/or text containing a six-digit authentication code. The client needs to input the code when opening the signature link.

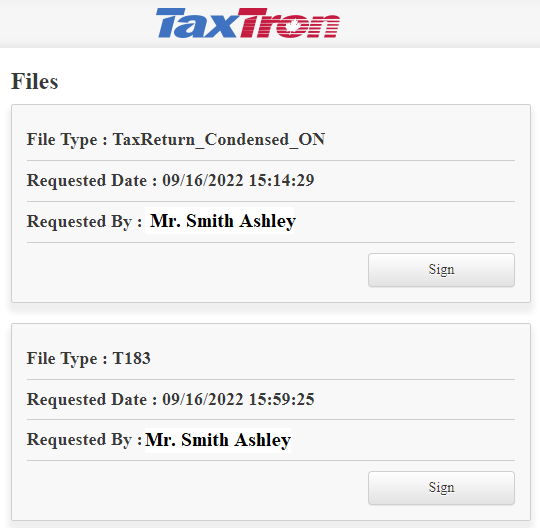

Once the client completes the login, they will see the following screen:

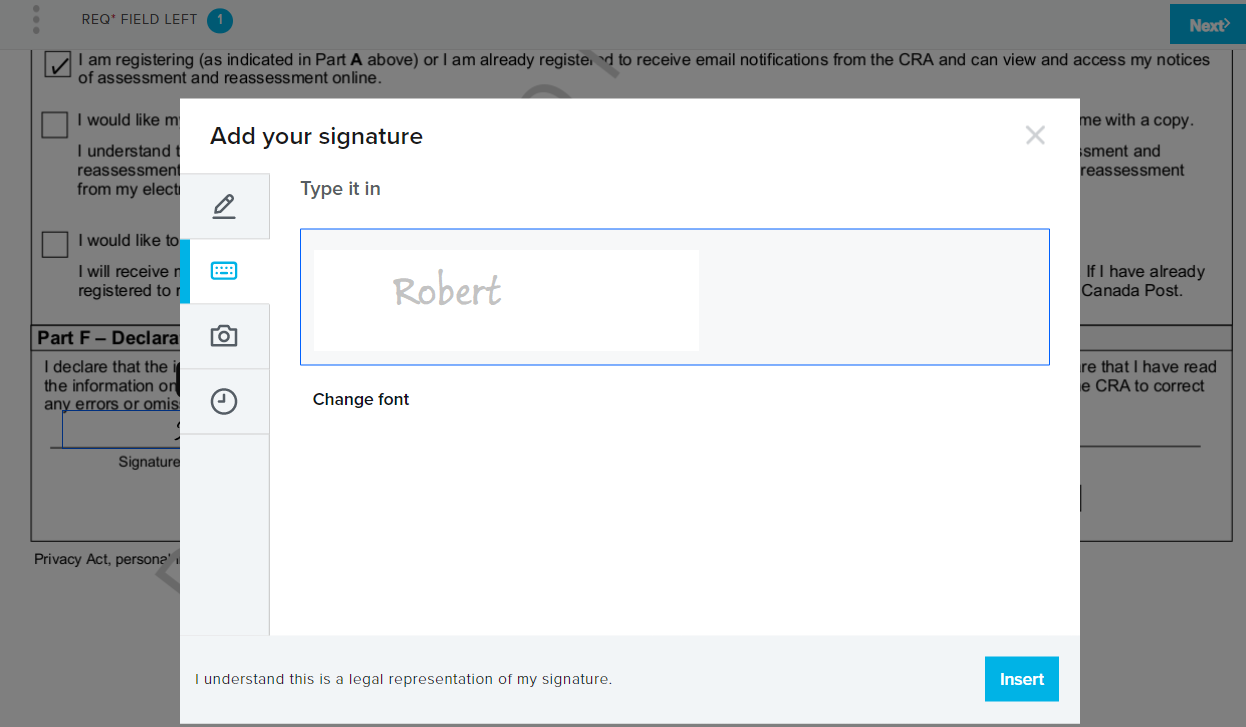

After clicking on the “Sign” button, the client will be directed to a new page where they will be asked to upload their signature. The uploaded signature can be inserted into various forms (T183, T2091, T1032...) and there is no need to upload a new signature each time.

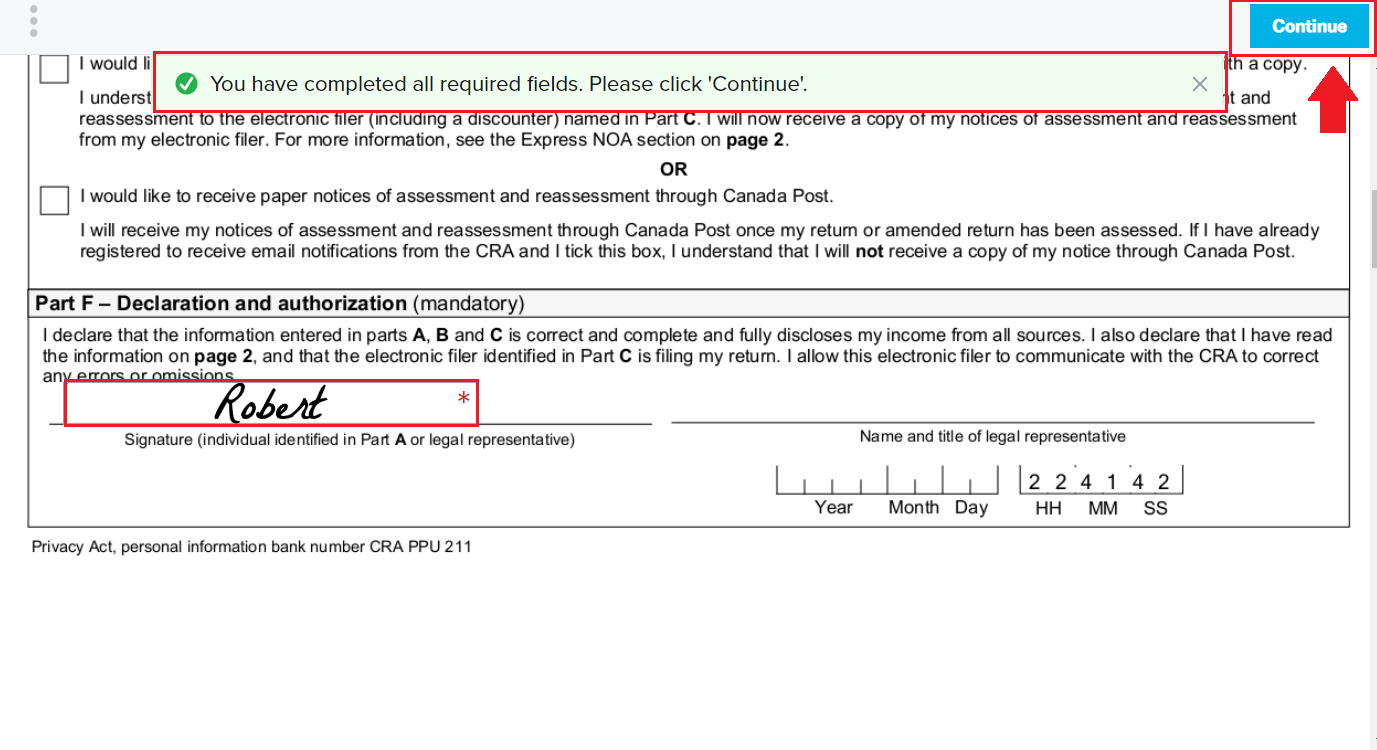

The uploaded signature is then inserted onto the document.

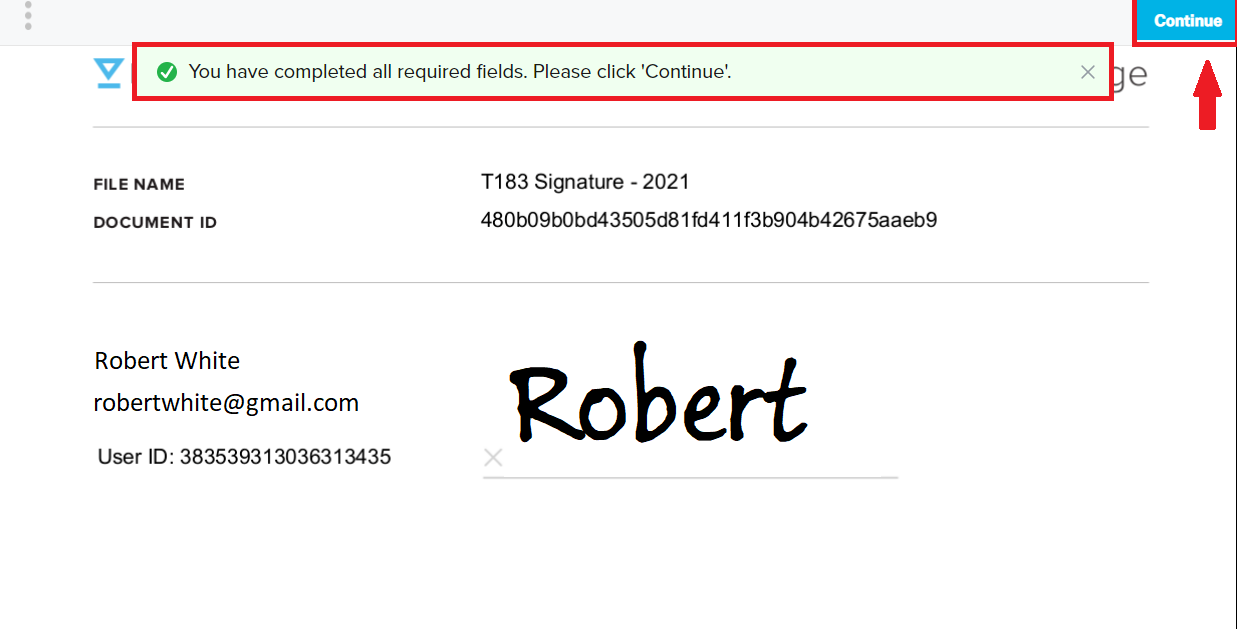

Once the signature is successfully pasted onto the document, the client will be directed to a new screen where they will be notified that they have completed all required fields. By pushing “Continue” on the upper-right hand corner of the screen, the signed document is transmitted to your TaxTron Pro screen.

The document status indicator will turn green when all signed documents are received.

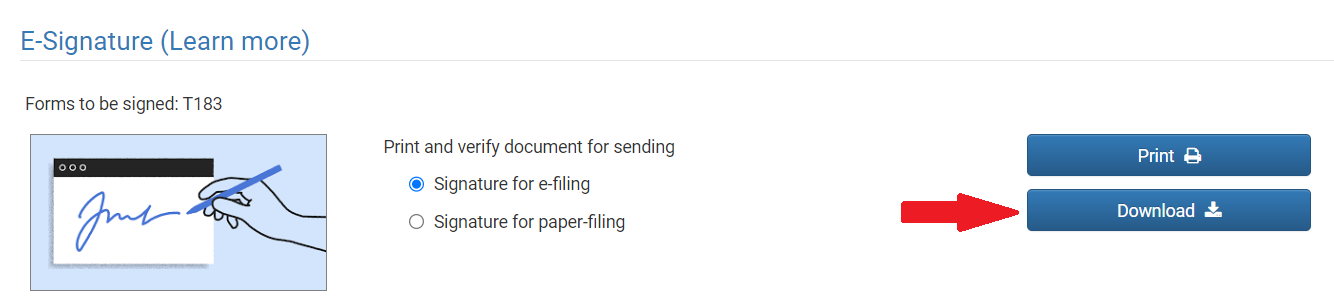

The signed documents can be downloaded by clicking on the “Download” icon.

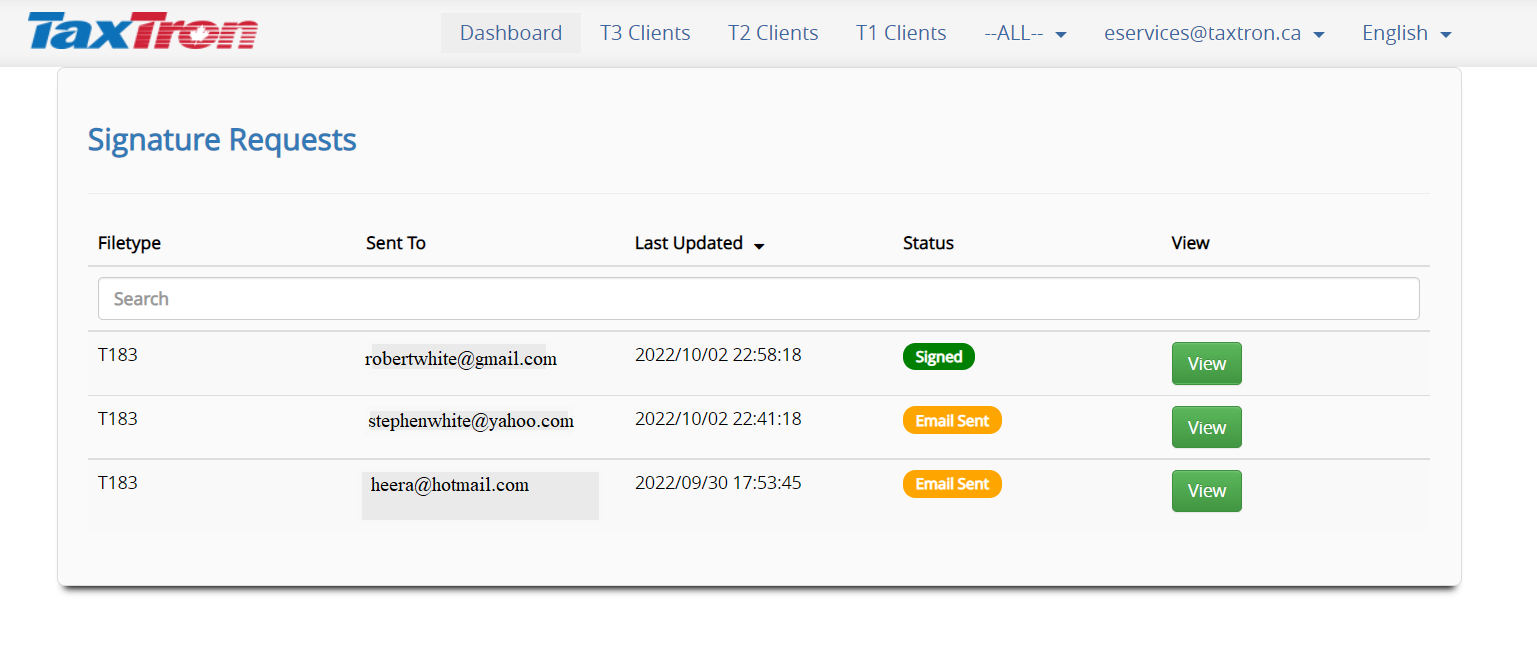

You can check the status of all signed documents on your “Dashboard” screen.

Posted on 29 Sept 2022