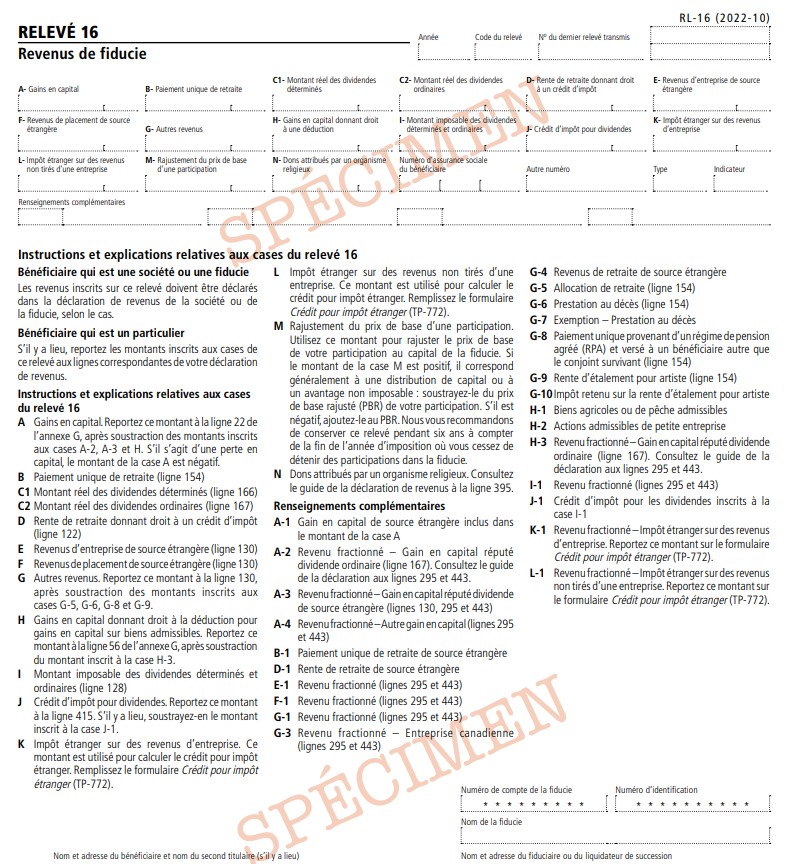

RL-16 SLIP: TRUST INCOME

The RL-16 slip must be filed by trusts to report amounts allocated to their beneficiaries.The information on the RL-16 slip is used by beneficiaries to complete the personal income tax return (TP-1-V), the Déclaration de revenus des sociétés (CO-17) or the Trust Income Tax Return

How to Complete the RL-16 Slip (Box by Box Instructions) Box ACapital gains. Subtract the amounts in boxes A-2, A-3 and H from the amount in box A and enter the result on line 22 of Schedule G. In the case of a capital loss, the amount in box A is negative.

Box BSingle pension payment (line 154).

Box C1Actual amount of eligible dividends (line 166).

Box C2Actual amount of ordinary dividends (line 167).

Box DRetirement pension giving entitlement to a tax credit (line 122).

Box EForeign business income (line 130).

Box FForeign investment income (line 130)

Box GOther income. Subtract the amounts in boxes G-5, G-6, G-8 and G-9 from the amount in box G and enter the result on line 130 of the return.

Box HCapital gains eligible for the capital gains deduction on qualified property. Subtract the amount in box H-3 from the amount in box H and enter the result on line 56 of Schedule G.

Box ITaxable amount of eligible dividends and ordinary dividends (line 128).

Box JDividend tax credit. Enter this amount on line 415 of the return, after subtracting, where applicable, any amount indicated in box J-1.

Box KForeign income tax on business income. This amount is used to calculate the foreign tax credit. Complete form TP-772-V, Foreign Tax Credit

Box LForeign income tax on non-business income. This amount is used to calculate the foreign tax credit. Complete form TP-772-V, Foreign Tax Credit.

Box MCost base adjustment of capital interest. Use this amount to adjust the cost base of your capital interest in the trust. If the amount in box M is positive, it generally corresponds to a distribution of capital or a non-taxable benefit. Subtract this amount from the adjusted cost base (ACB) of your capital interest. If the amount is negative, add it to your ACB. We recommend that you keep the RL-16 slip for six years after the end of the taxation year in which you cease to hold interests in the trust.

Box NDonations allocated by a religious organization. See the instructions for line 395 in the guide to the income tax return.

Boxes under “Renseignements complémentaires” (additional information) Box A-1Foreign capital gain included in box A

Box A-2Split income: Capital gain deemed to be an ordinary dividend (line 167). See the instructions for lines 295 and 443 in the guide to the income tax return.

Box A-3Split income: Capital gain deemed to be a foreign dividend (lines 130, 295 and 443)

Box A-4Split income – Other capital gain (lines 295 and 443)

Box B-1Single foreign pension payment

Box D-1Foreign retirement pension

Box E-1Split income (lines 295 and 443)

Box F-1Split income (lines 295 and 443)

Box G-1Split income (lines 295 and 443)

Box G-3Split income: Canadian corporation (lines 295 and 443)

Box G-4Foreign retirement income

Box G-5Retiring allowance (line 154)

Box G-6Death benefit (line 154)

Box G-7Death benefit: Amount of the exemption

Box G-8Single payment from a registered pension plan (RPP) made to a recipient other than the surviving spouse (line 154)

Box G-9Income-averaging annuity for artists (line 154)

Box G-100 Income tax deducted at source on the income-averaging annuity for artists

Box H-1Qualified farm or fishing property

Box H-2Qualified small business corporation shares

Box H-3Split income: Capital gain deemed to be an ordinary dividend (line 167). See the instructions for lines 295 and 443 in the guide to the income tax return

Box I-1Split income (lines 295 and 443)

Box J-1Tax credit for the dividends entered in box I-1

Box K-1Split income: Foreign income tax on business income. Enter this amount on form TP-772-V, Foreign Tax Credit

Box L-1Split income: Foreign income tax on non-business income. Enter this amount on form TP-772-V, Foreign Tax Credit

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 12 July 2024