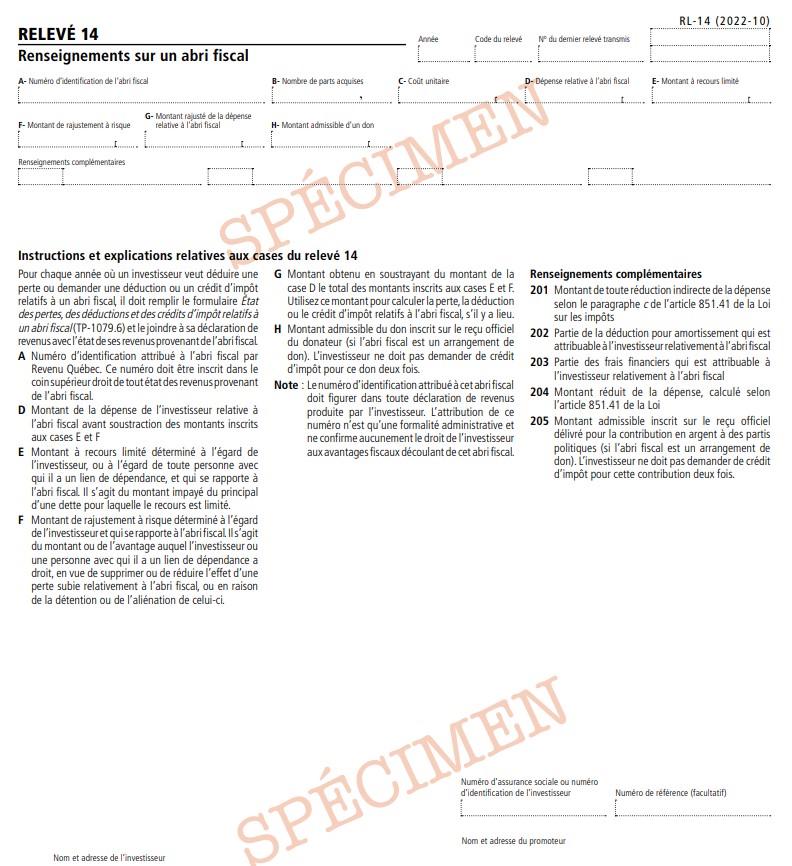

RL-14 Slip – Information About a Tax Shelter

The RL-14 slip must be filed by any tax shelter promoter (other than a partnership that is a tax shelter, that is required to file the Partnership Information Return and RL-15 slips and that files those documents within the time allowed) that, in a calendar year, accepted consideration from an individual who, at the time of the acceptance, was resident in Québec, or acted as a mandator or mandatary in respect of such an acceptance.

Purpose of the RL-14 slipThe RL-14 slip is used to report certain information regarding tax shelters, such as amounts received by individuals.

How to Complete the RL-14 Slip (Box by Box Instructions) Box AIdentification number assigned to the tax shelter by Revenu Québec. This number must be indicated in the upper right-hand corner of every statement of earnings from the tax shelter.

Box BNumber of units acquired

Box CNumber of units acquired

Box DInvestor's expenditure in respect of the tax shelter, before subtracting the amounts in boxes E and F

Box ELimited-recourse amount determined in regard to the tax shelter and the investor or any person with whom the investor is not dealing at arm’s length. The limited-recourse amount is the unpaid principal amount of any indebtedness for which recourse is limited.

Box FAt-risk adjustment determined in regard to the investor and the tax shelter. The at-risk adjustment is the amount or the benefit to which the investor or a person with whom the investor is not dealing at arm’s length is entitled, for the purpose of reducing, in whole or in part, the impact of any loss sustained in respect of the tax shelter, including a loss from the holding or disposition of the tax shelter.

Box GAmount obtained by subtracting the total of the amounts in boxes E and F from the amount in box D. Use this amount to calculate (if applicable) the loss, deduction or tax credit respecting the tax shelter.

Box HEligible amount of the gift entered on the donor’s official receipt (if the tax shelter is a gifting arrangement). The investor must not claim the tax credit for the gift twice.

Boxes under “Renseignements complémentaires” (additional information) Box 2011 Amount of any indirect reduction of an expenditure pursuant to paragraph (c) of section 851.41 of the Taxation Act

Box 202Investor's share of the capital cost allowance respecting the tax shelter

Box 203Investor's share of the carrying charges respecting the tax shelter

Box 204Reduced expenditure amount calculated pursuant to section 851.41 of the Taxation Act

Box 205Eligible amount entered on the official receipt issued for cash contributions to political parties (if the tax shelter is a gifting arrangement).The investor must not claim the tax credit for the contributions twice.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 12 July 2024