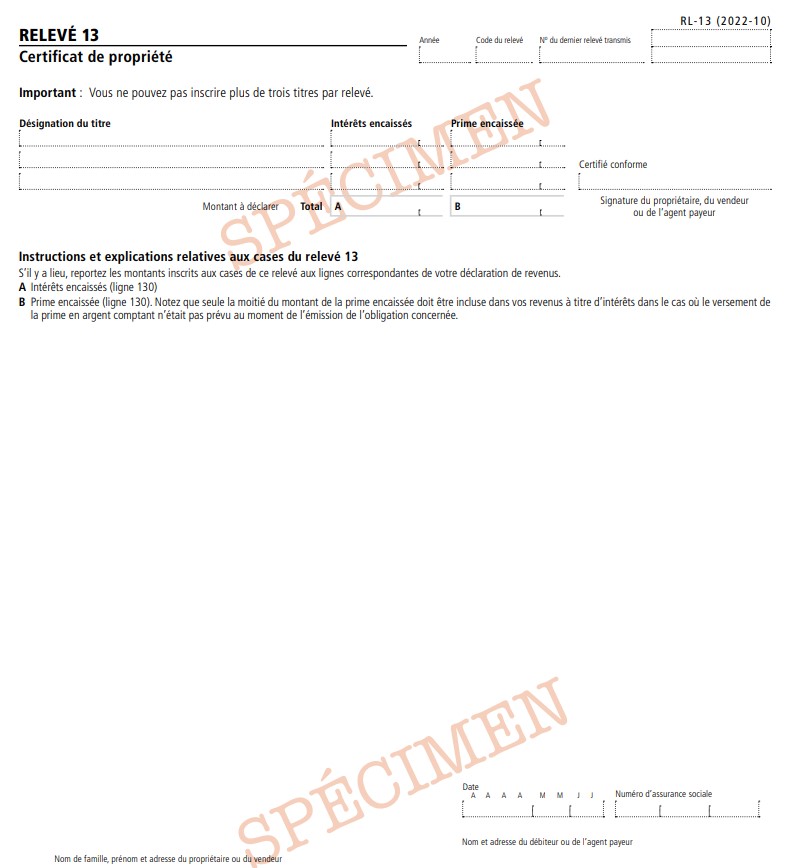

RL-13 Slip – Ownership Certificate

The RL-13 slip must be completed by or on behalf of a security owner or seller resident in Québec before they trade any coupon or share warrant representing interest or dividends payable by a debtor, or a cheque representing interest or dividends payable by a non-resident debtor.

The RL-13 slip must also be completed by a paying agent when interest on the sale, redemption, assignment or transfer of a bond, debenture or similar security is paid or credited to a security owner or seller resident in Québec. This does not apply to interest resulting from an investment contract or an income bond.

Purpose of the RL-13 slipThe RL-13 slip is used to report the interest, dividends and bonuses received by the security owner or seller.

Deadline for filing and distributing RL slipsThe debtor or paying agent must file the RL-13 slips with Revenu Québec by the 15th day of the month following the month in which the payment was made.

The slips must be filed online (in an XML file) using authorized software or by mail (on paper). If the slips are filed on paper, the debtor or paying agent must send only copy 1 of each slip

In addition, the debtor or paying agent must send RL-13 slips to the security owners or sellers when the securities are cashed. If paper RL slips are filed, the debtor or paying agent must give the security owners or sellers copy 2 of the slip in person or send them copy 2 by mail or by some other means. If the RL slips are sent electronically, the debtor or paying agent must obtain the security owner’s or seller’s prior written consent by mail, electronically or by some other means.

In addition, the debtor or paying agent must send RL-13 slips to the security owners or sellers when the securities are cashed. If paper RL slips are filed,the debtor or paying agent must give the security owners or sellers copy 2 of the slip in person or send them copy 2 by mail or by some other means. If the RL slips are sent electronically, the debtor or paying agent must obtain the security owner’s or seller’s prior written consent by mail, electronically or by some other means.

How to Complete the RL-13 Slip (Box by Box Instructions) Box AEnter the Interest received (line 130)

Box BBonus received (line 130). Please note that only half of the amount of the bonus received must be included in your interest income if payment of the cash bonus was not anticipated when the bond in question was issued.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 12 July 2024