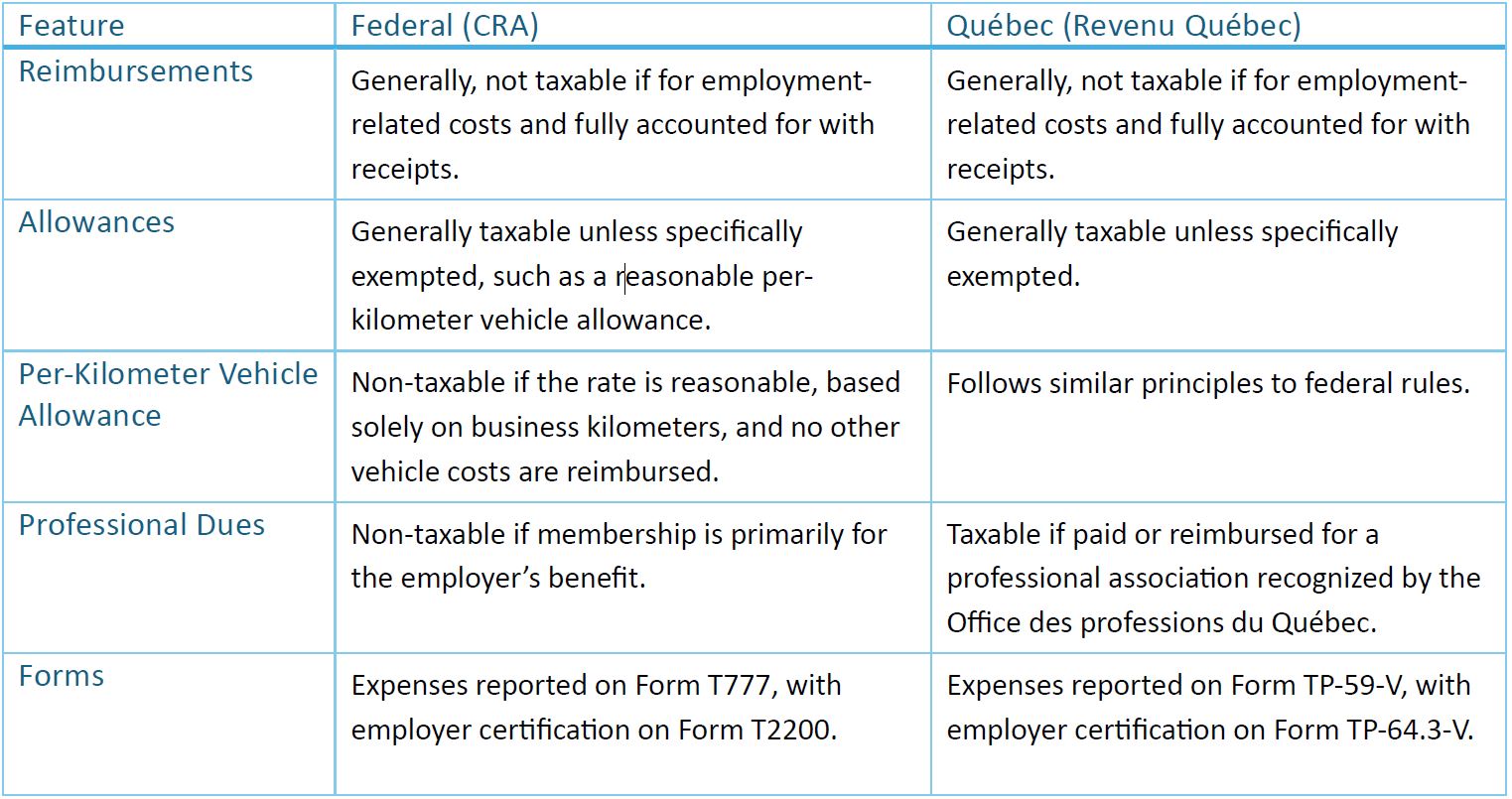

Reimbursements and allowances from an employer are treated differently for tax purposes, both federally and in Quebec. The primary distinction is whether the employee must provide receipts for their expenses. Quebec's tax rules for reimbursements and allowances generally align with the federal approach, but with some specific differences.

Reimbursements:

Generally, a reimbursement is not a taxable benefit for the employee, as long as it's for legitimate, employment-related expenses and is fully accounted for with receipts. If a reimbursement covers a personal expense or exceeds the amount actually spent, the excess portion is a taxable benefit.

Allowances:

An allowance is typically a taxable benefit that must be included in the employee's income unless it meets specific criteria for an exemption. Allowances are generally taxable, similar to federal rules.

Common non-taxable exceptions:

-

Reasonable per-kilometer vehicle allowance: An allowance for using a personal vehicle for business is not taxable if it meets the following conditions:

- It's based only on the number of business kilometers driven.

- The rate is reasonable (based on CRA-prescribed rates).

- The employer does not also reimburse for the same expenses (e.g., fuel).

-

Reasonable travel allowance:

An allowance for travel away from the municipality where the employee typically reports to work can be non-taxable, provided the allowance is reasonable and for employment-related travel. -

Specific Quebec rules:

Professional dues: For Quebec, dues paid to professional associations recognized by the Office des professions du Québec are a taxable benefit for the employee if paid or reimbursed by the employer, even if membership is required by the job. The same applies to initial registration fees.

Example:

Julie received salary with commission and was required to use her personal vehicle for work. TopTech Corp. provides Julie with a per-kilometer vehicle allowance based on the reasonable federal rates. For 2025, the reasonable allowance is $0.72 for the first 5,000 business kilometers and $0.66 for each additional kilometer.

Allowance for first 5,000 km: 5,000 km × $0.72 = $3,600 + additional km: 15,000 km × $0.66 = $9,900 = Total allowance received: $3,600 + $9,900 = $13,500.

Total kilometers driven in 2025:

Total kilometers: 30,000 km

Business kilometers: 20,000 km

Personal kilometers: 10,000 km

Answer: Since the allowance is based on the number of business kilometers and the rate is reasonable, it is not a taxable benefit for Julie. TopTech Corp. does not include this amount on her T4 slip. Quebec's rules for a reasonable per-kilometer allowance align with the federal rules. The allowance of $13,500 is not taxable, and TopTech Corp. does not include it on Julie's RL-1 slip.

Example :

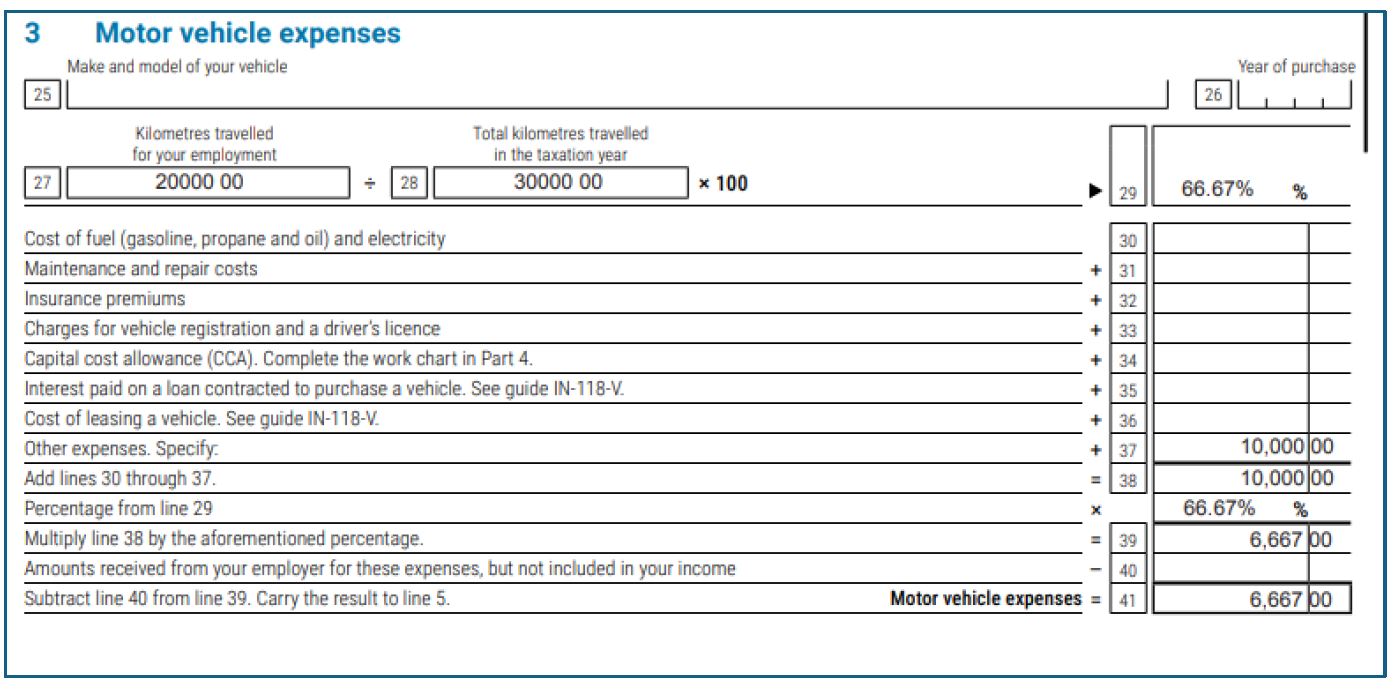

All the other information is same except TopTech Corp. provides Julie with a fixed, flat-rate allowance of $500 per month ($6,000 annually) for vehicle expenses, regardless of the kilometers driven. TopTech Corp. added the $6,000 allowance to Julie's employment income and reported it on her T4 and Releve slip showing $40,000. Actual total vehicle expenses are $10,000 for the year.

Answer: Business use percentage is 20,000 km ÷ 30,000 km = 66.7%, making deductible expenses $10,000 × 66.67% = $6,667; the net deduction is $6,667 on Line 22900 of T1 return and Line 207 of TP1 return.

Example :

All the other information is same except TopTech Corp. provides Julie with a per cent km allowance. Total allowance paid to Julie is $6,000 for vehicle expense. Julie's employment income is $40,000. Actual total vehicle expenses are $10,000 for the year.

Answer: Business use percentage is 20,000 km ÷ 30,000 km = 66.7%, making deductible expenses $10,000 × 66.67% = $6,667. Since the per cent km is reasonable and not taxable on T4 slip, Julie must reduce employment expenses with allowance. Total allowable expenses $6,667 minus $6,000, leaving the net deduction to be $667 on Line 22900 of T1 return and Line 207 of TP1 return.

Example :

TopTech Corp. reimburses Julie based on the actual expenses she incurs for business travel, provided she submits receipts.

Answer: Reimbursements for legitimate, employment-related expenses that are fully supported by receipts are not considered taxable benefits; TopTech Corp. does not include them on Julie's T4, or RL-1 slip, and Julie cannot claim these expenses.

Posted on 8 January, 2026