Do you do partial work or full time work from your home?

If so, you are entitled to deduct home office expenses on your tax return!

In Canada, both employees and the self-employed can claim expenses. These claims are subject to specified conditions and the available deductions vary significantly.

If you're self-employed or an employee, read on to find out what you can claim as home office expenses.

The Canada Revenue Agency (CRA) allows self-employed taxpayers to deduct business-use-of-home. Employees, as well, may deduct workspace-in-the-home expenses from their income. These deductions lower the amount of taxable income being claimed, thus reducing the overall tax burden.

Watch the video below to learn more about claiming work from home expenses during COVID-19 :

For the self-employed, the first step is to identify a Home Office:

All expenses claimed must be prorated based on the area your home office represents relative to your entire home (i.e., if your home office space represents 15% of the total square footage of your home, you can only claim 15% of the eligible expenses).

Note: For employees (commission or salary), the arrangement to work from home must be a part of their contract. Form T2200 (Declaration of Conditions of Employment), must be signed by your employer to claim the work-at-home expenses.

The second step is to determine what expenses can be claimed:

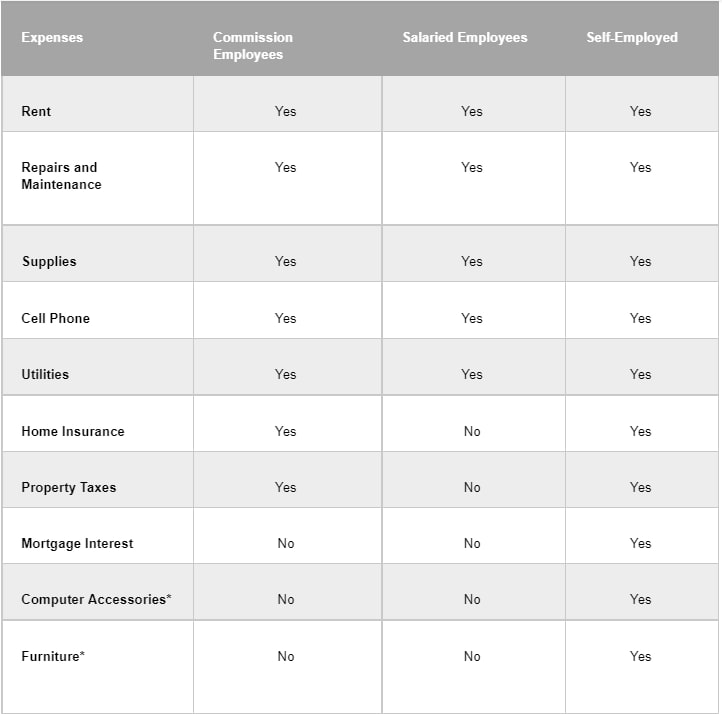

Generally, a self-employed individual can claim more expenses than an employee. There are some similarities between what a salary/commission employee vs a self-employed individual can claim. Below is a table that shows which expenses are claimable by each group:

Note:- For self-employed individuals, these expenses can be claimed under depreciation.

Commission-based employees can also claim lease of a cell phone, computer, laptop, tablet, and fax machine if these items reasonably relate to earning a commission income.

Employees can claim expenses on form T777. A self- employed person uses Form T2125 to claim income/expenses of a business.

Employees cannot claim the part of their expenses that their employer reimburses to them or those that are included as income on the T4 slip.

Do you work from home during COVID-19?

Many Canadians found themselves working from home in 2020 and, for some, going forward indefinitely. When preparing your tax return for the upcoming year, it is essential to consider tax implications of working from home.

You have the option to use a flat rate method (i.e., $2 per day towards home office expenses [maximum deduction- $400] Form T777S). This claim does not require form T2200 nor supportings required to be kept. Here, the condition is that the employee works 50 % of time at home for a period of at least 4 consecutive weeks (part time or full time).

GST/HST Rebate

This rebate is claimed through filing Form GST 370 on line 45700 of the tax return. The employer must be a GST/HST registrant. It is taxable income in the year the rebate is received (e.g., if you have claimed the rebate on your 2020 tax return and received it in 2021, it is part of your 2021 taxable income- Line 10400)

It is still beneficial to apply for this rebate. You can file the application up to 4 years from the year in which the expenses were paid.

Now that you know, employ your maximum deductions when you work from home!

Posted on 21 Oct 2021