A forestry worker is an individual employed in the forestry industry who performs work related to the planting, cultivation, maintenance, or harvesting of trees and other forest resources. This includes jobs such as:

- Tree planters

- Loggers or timber fallers

- Forestry technicians or assistants

- Equipment operators in forestry operations

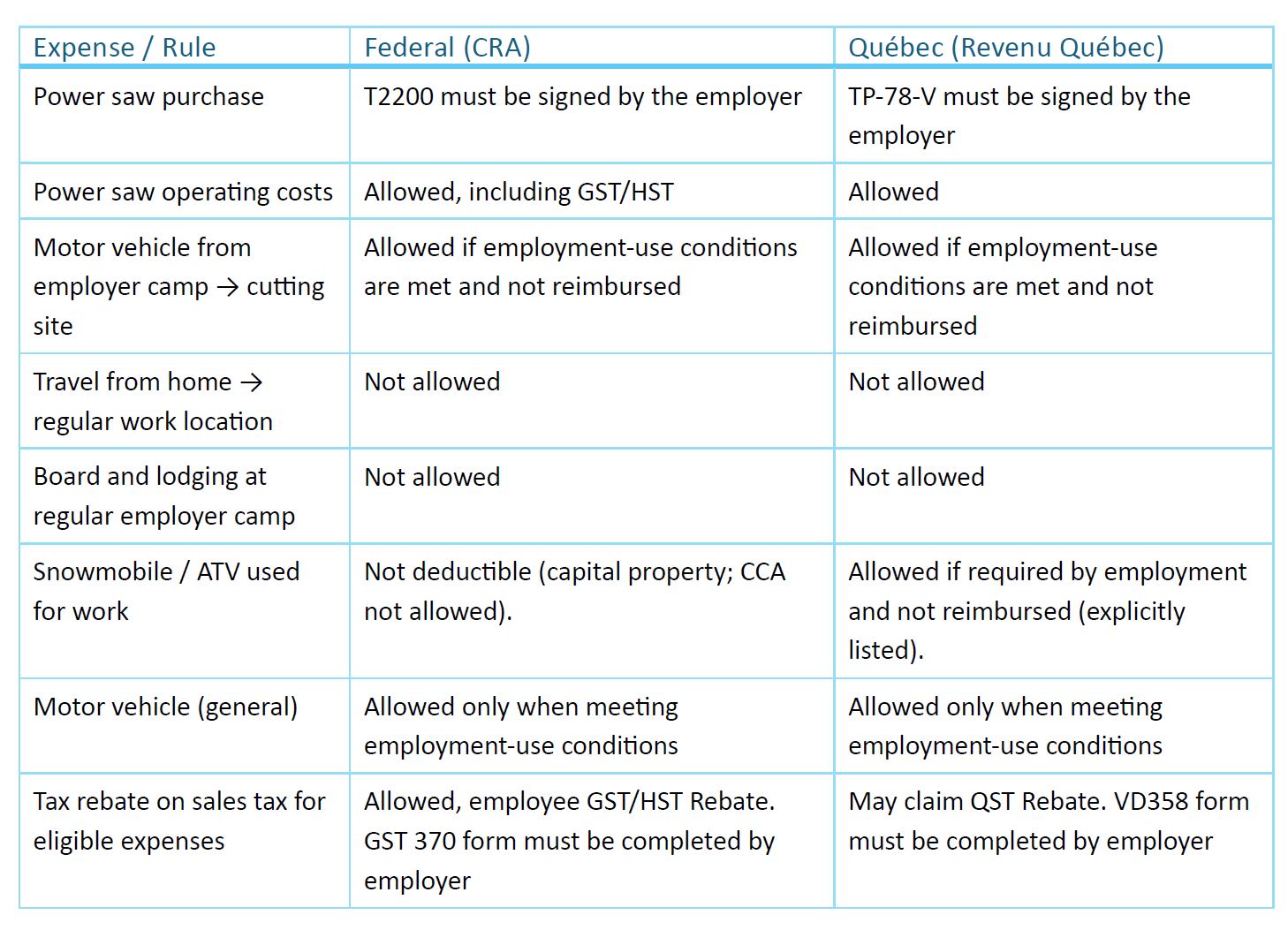

Forestry workers often incur job-related expenses such as travel to remote worksites, chain-saw or brush-cutter expenses, snowmobile or all-terrain vehicle (ATV) expenses, and vehicle costs which can be claimed as deductions if certified by their employer on Form T2200 (Federal) and TP-78 (Quebec).

Forestry Work Expenses – Federal (CRA) vs Québec (Revenu Québec)

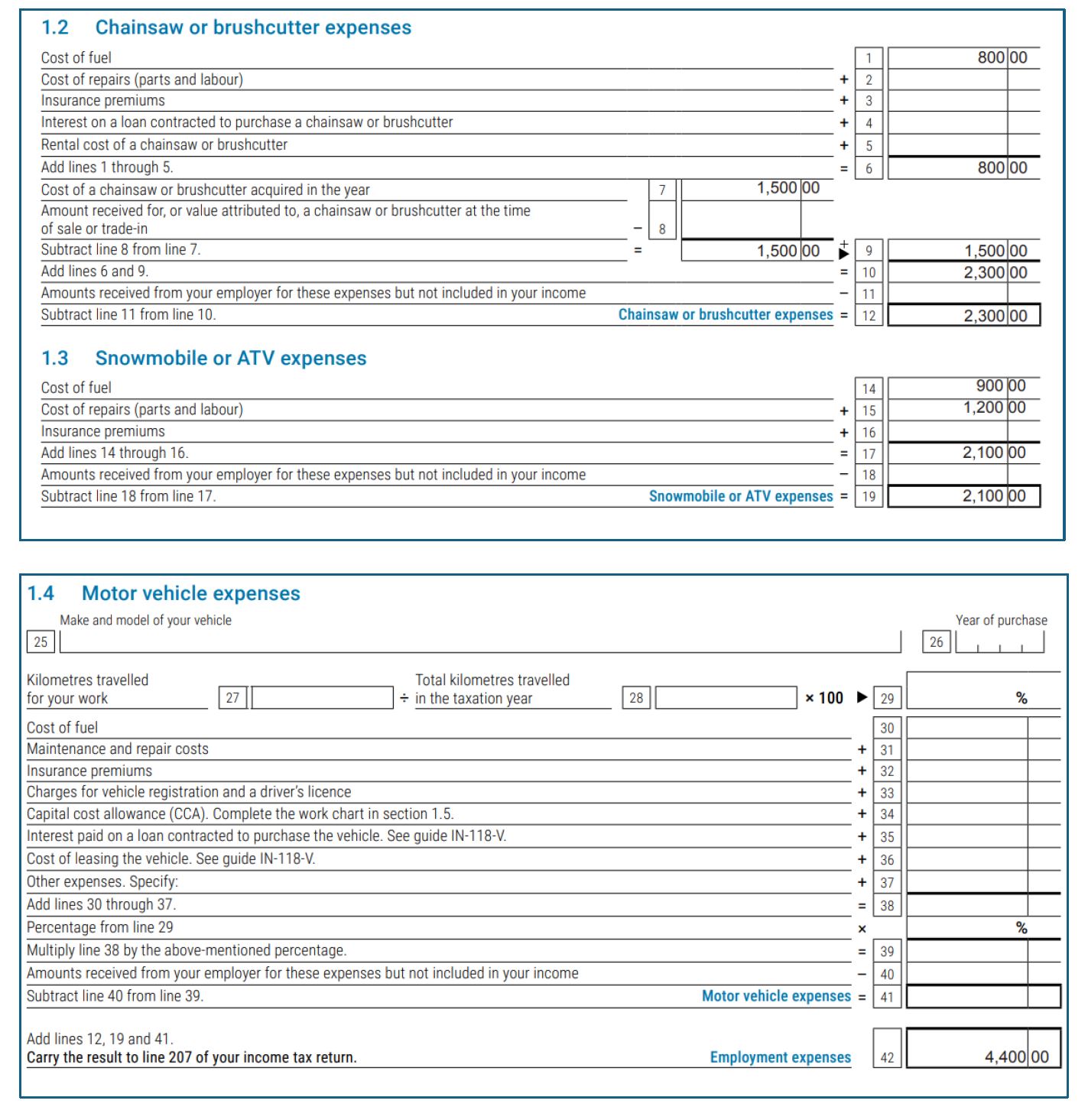

Example:

Marc Leblanc is a forestry worker. He purchased a chainsaw for $1,500, spent $800 on chainsaw fuel, $900 for ATV fuel, and $1,200 for ATV maintenance expenses.

Answer: Deduction on Line 207 is $4,400.

How to do in TaxTron? Enter the amount from the T4 slip in the Income section. Select “Yes” to indicate that an RL-1 slip was received, and under Deduction Tab, choose Work Expenses and choose the appropriate category.

Posted on 8 January, 2026