A member of the clergy may claim a residence deduction for tax purposes if specific eligibility criteria are met and the required forms are properly completed. The deduction amount and calculation method depend on whether the residence is provided by the employer or owned or rented by the individual. The eligibility rules and calculation methods under Revenu Québec generally align with those at the federal level. For both the federal Form T1223 (CRA) and Québec Form TP-76.V, the employer must certify the individual’s eligibility.

Eligibility for the Clergy Residence Deduction

To qualify for the deduction, the individual must be a member of the clergy, a member of a religious order, or a regular minister of a religious denomination. In addition, the person must either be in charge of or ministering to a diocese, parish, or congregation, or be engaged exclusively in full-time administrative service as appointed by a religious order or denomination. The employer must certify eligibility on the required form.

The deduction is claimed on Form T1223, Clergy Residence Deduction. If the employer provides a residence (including utilities), the taxable benefit reported in Box 30 of the T4 slip can be deducted on line 23100 of the federal tax return. If the residence is owned or rented, the deductible amount is the lowest of:

- one-third of employment income from qualifying employment,

- the fair rental value (if owned) or total rent and eligible utilities paid (if rented), or

- $1,000 multiplied by the number of months of eligible employment during the year.

Claiming the Deduction: Employer-Provided Residence

When a member of the clergy receives employer-provided housing or utility benefits, the taxable amount is reported in Box 30 of the T4 slip. This amount can be deducted on both the federal and Quebec tax returns.

For the federal return (CRA), the deduction is claimed by completing Form T1223, Clergy Residence Deduction, and reporting the amount on line 23100 of the tax return.

For the Quebec return (Revenu Québec), the same amount is deducted using Form TP-76-V, Residence Deduction for a Member of the Clergy or a Religious Order.

Example 15:

Father John, a Quebec resident, receives a $12,000 taxable housing benefit reported in Box 30 of his T4 slip.

Answer: He completes Form T1223 to claim the $12,000 deduction on his federal return and Form TP-76-V to claim the same deduction on his Quebec return.

How to do in TaxTron? Enter the amount from the T4 slip in the Income section. Select “Yes” to indicate that an RL-1 and under Deduction Tab choose clergy residence.

Claiming the Deduction: Owned or Rented Residence

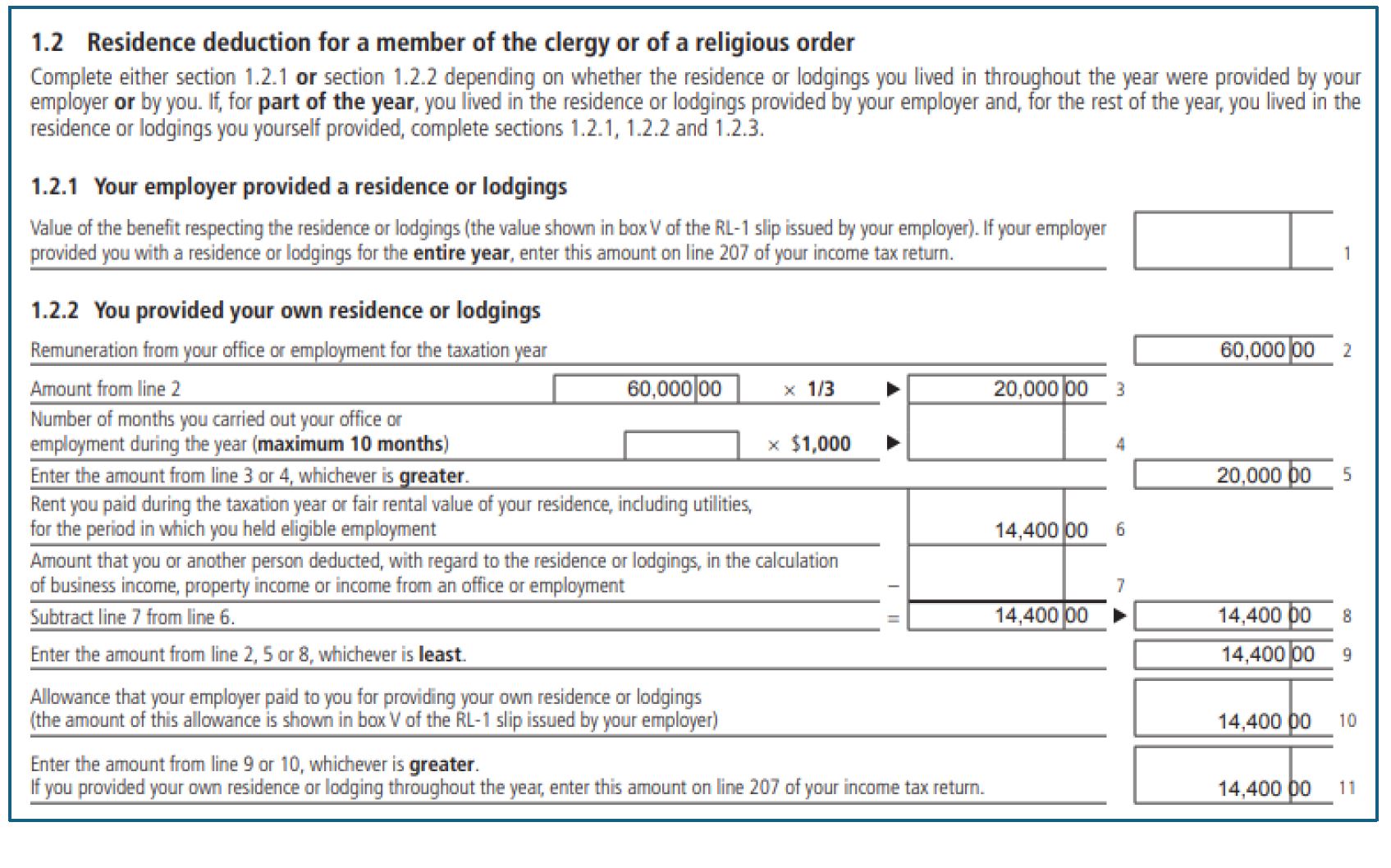

When a member of the clergy owns or rents their home, the residence deduction is calculated using the same general rules for both the federal (CRA) and Quebec (Revenu Québec) tax returns. The deduction is determined as the lowest of the following three amounts:

- One-third of your qualifying employment income.

- The fair rental value (FRV) of the home if owned, or the total rent and eligible utilities paid if rented.

-

The greater of:

- $1,000 per month of eligible employment (up to a maximum of 10 months, or $10,000), or

- One-third of your qualifying remuneration.

For the federal return, this calculation is completed on Form T1223, Clergy Residence Deduction, and the amount is reported on line 23100. For the Quebec return, the same calculation is performed on Form TP-76-V, Residence Deduction for a Member of the Clergy or a Religious Order.

Example :

Pastor David, a Quebec resident, earns $60,000 annually and pays $1,200 per month in rent.

One-third of income: $20,000

Rent paid: $14,400

The greater of $12,000 (12 × $1,000) or $20,000 is $20,000

Answer: The deduction is the lowest of these three amounts — $14,400. Pastor David reports this deduction on both his federal and Quebec tax returns by completing Forms T1223 and TP-76-V, respectively.

Example :

Sister Maria earns $48,000 annually and lives in a home she owns with a fair rental value of $1,800 per month ($21,600 per year)

Answer: One-third of her income is $16,000, and the greater of $10,000 or one-third of income is $16,000. Therefore, her deduction is the lesser of $16,000 and $21,600, resulting in a maximum deduction of $16,000.

| Rule | Federal (CRA) | Québec |

|---|---|---|

| Eligibility requirements | Must be a clergy member, religious order member, or regular minister engaged in full-time service or administration to a diocese/parish/congregation. | Same eligibility criteria as Federal |

| Form required | Form T1223 | Form TP-76-V |

| Residence provided by employer |

|

Same criteria as Federal |

| Residence owned or rented |

|

Same criteria as Federal |

| Capping / Deduction limit |

|

Same criteria as Federal |

| Mixed situations (employer-provided + owned/rented) | Total cannot exceed employment income. | Same criteria as Federal |

Posted on 8 January, 2026