The TD1 form is a crucial document for every Canadian taxpayer, whether you’re starting a new job, changing your employment status, or simply updating your personal tax credits. It’s essential for determining the amount of income tax your employer should deduct from your paychecks. This guide will walk you through everything you need to know about the TD1 form, including how to fill it out, when to submit it, and how it impacts your tax situation.

1. What is the TD1 Form?

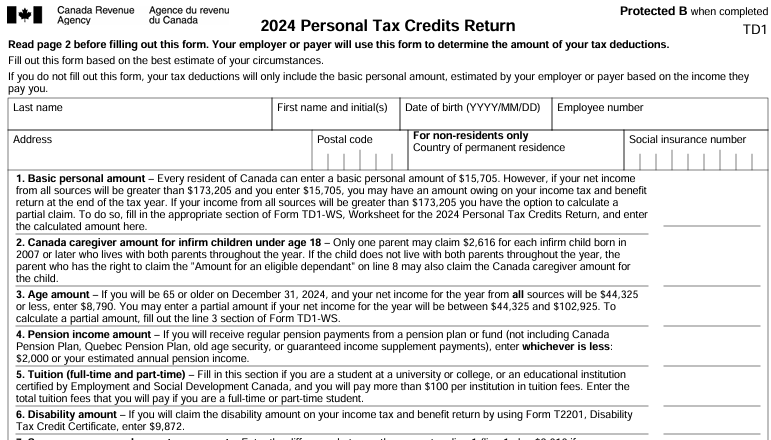

The TD1 form, officially known as the "Personal Tax Credits Return," is used by employers and payers to calculate the amount of federal and provincial or territorial tax to be deducted from an individual's income. There are two versions of the form:

2. Why is the TD1 Form Important?

The TD1 form directly impacts the amount of tax deducted from your paychecks. By correctly filling out the TD1 form, you ensure that your employer withholds the appropriate amount of income tax based on your personal situation. This helps to avoid overpayment or underpayment of taxes throughout the year, which can lead to a larger tax refund or a tax bill when you file your return.

3. When Do You Need to Complete a TD1 Form?

You need to complete and submit a TD1 form in the following situations:

4. How to Fill Out the TD1 Form

Filling out the TD1 form is straightforward, but it’s important to understand each section:

5. Submitting the TD1 Form

After completing the TD1 form, submit it to your employer or payer as soon as possible. Typically, you’ll submit the form on or before your first day of work, or when you experience a change in your personal circumstances. You don’t need to send the TD1 form to the Canada Revenue Agency (CRA) unless they request it specifically.

6. Impact of the TD1 Form on Your Paycheck

The information provided on the TD1 form determines the amount of tax deducted from your paycheck. If you claim more credits, less tax will be deducted, which means you’ll take home more pay each period. However, if you claim too many credits, you might end up owing taxes at the end of the year. On the other hand, if you claim fewer credits or don’t complete the form at all, your employer will withhold the standard amount of tax, which might result in a larger refund or lower tax liability when you file your tax return.

7. Updating Your TD1 Form

It’s essential to update your TD1 form whenever there’s a significant change in your personal circumstances. For example:

8. Common Mistakes to Avoid

9. Frequently Asked Questions

Yes, you can submit a new TD1 form to your employer at any time if your circumstances change.

You can complete a TD1 form for each employer but be careful not to overclaim your credits across different jobs.

No, you only need to fill it out when you start a new job or when there’s a significant change in your personal situation.

For more information, visit: Canada Revenue Agency - Filing Form TD1

Posted on 25 October 2024