The Basic Personal Amount (BPA) (line 30000) is a federal non-refundable tax credit in Canada that reduces the amount of income tax payable. A non-refundable tax credit reduces what you may owe. However, if your total non-refundable tax credits are more than what you owe, you will not get a refund for the difference. Starting in 2023, it’s based on your net income for the year. The maximum basic personal amount for individuals with a net income less than $173,205 is $15,705. For individuals with a net income more than $173,205, the base amount is reduced to $14,156. In previous years, the amount varied, but the goal is to keep it in line with inflation. For example, in 2021, the basic personal amount was set at $13,808 for taxpayers with a net income of $150,473 or less, for 2022, it increased to $14,398, and for 2023 the amount was $15,000.

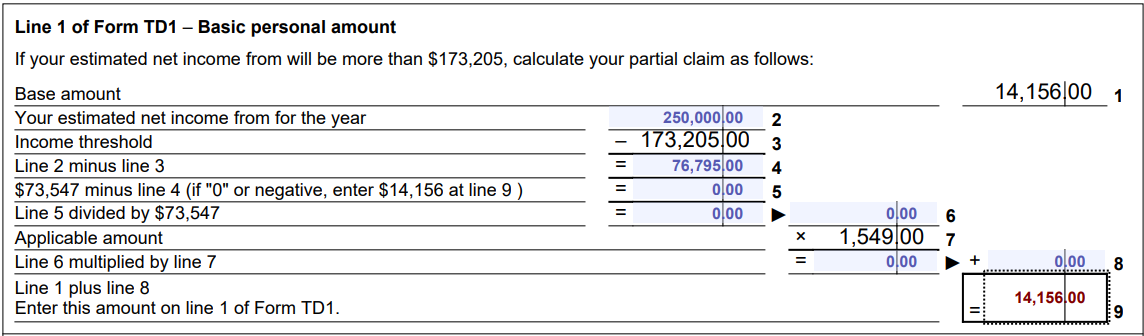

To demonstrate how the personal amount is linked to the individual’s net income, lets look at an example. Let’s assume John’s net income for 2024 is $250,000:

As you can see from the example, John could still receive additional partial amounts if his income was less than the threshold.

The Spouse or Common-Law Partner Amount (line 30300) is a non-refundable tax credit that you can claim if, at any time during the year, you supported your spouse or common-law partner, and their net income from line 23600 of their tax return (or the amount it would be if they filed a return) was less than your basic personal amount. The spousal amount moves in tandem with the basic personal amount. For the 2024 tax year the spousal amount is set at $15,705. If your spouse or partner was also dependent on you due to an impairment in physical or mental functions, you can claim an additional amount. Only one spouse or common-law partner can claim this amount for each other in the same tax year.

The credit is calculated by subtracting your partner’s net income from $15,000 and multiplying the remainder by 15%. The maximum credit is $2,250 ($15,000 x 15%).

The corresponding provincial or territorial non-refundable tax credit on line 58120 of your provincial or territorial Form 428.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 19 July 2024