For those of you who contributed to a First-Home Savings Account or FHSA in 2023, you will receive a T4FHSA Statement from the bank or the financial institution for the contributions that you made. In this blog we will explain each box on the slip and their effect on your T1 Income Tax and Benefits Return. For those who are not familiar with the subject lets briefly discuss the details of this benefit.

First-Home Saving Account (FHSA), is an investment product available to resident Canadians between the ages of 18 to 71, which is designed to save for the down-payment of a first-home tax-free. Similar to RRSP, contributions to an FHSA account are deductible from income. A first-time home buyer refers to an individual that has not owned a home, in which he/she lived in, any time during the year the account is opened or at any time in the preceding four calendar years. The maximum FHSA contribution limit for 2023 and subsequent years is $8,000 and a lifetime contribution limit of $40,000. The unused contribution room can be carried forward indefinitely and can be made in excess of the annual limit in future years.

A withdrawal from your FHSA is not required to be included in your income if it is a qualifying withdrawal, a designated amount, or an amount otherwise included in your income. In all other cases, an amount withdrawn from your FHSAs must be included as income on your income tax and benefit return for the year the withdrawal is received. This amount will be subject to income tax withholding, which can be claimed on your income tax and benefit return as a credit towards any tax owing for the year of the withdrawal. (Source: Canada.ca)

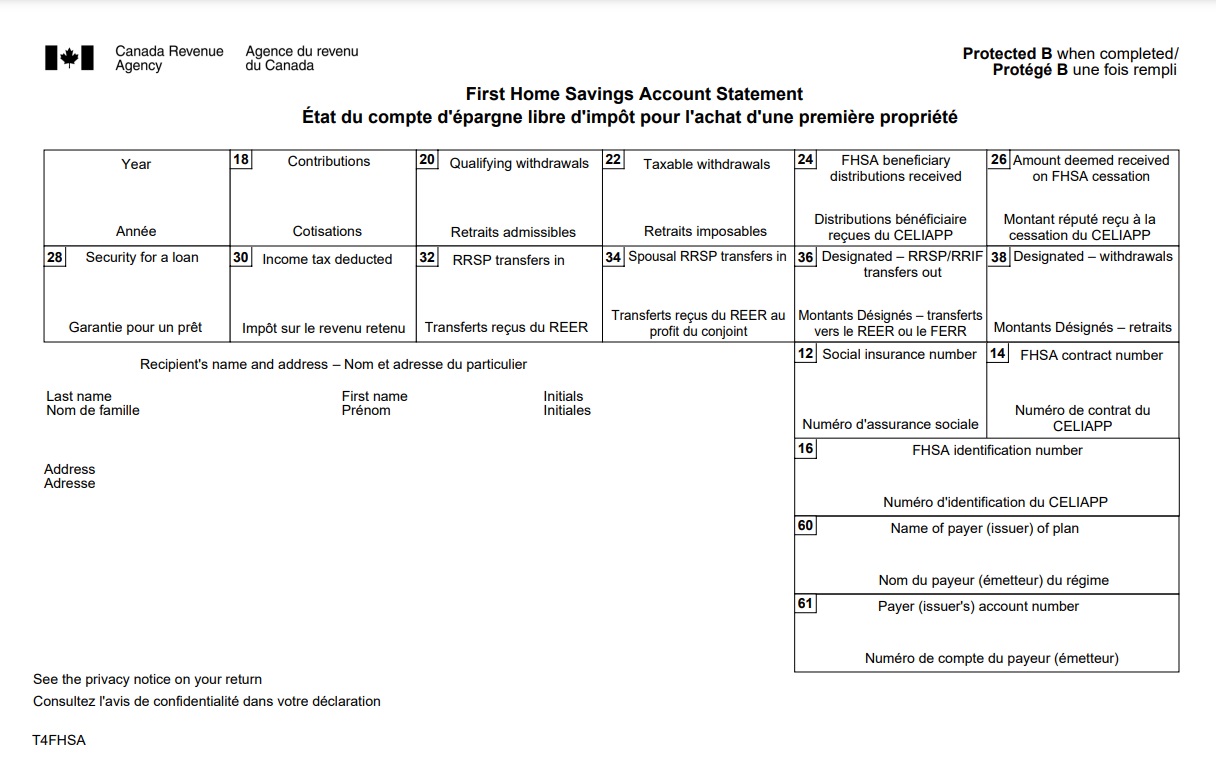

The first box which is not numbered is the year in which the contributions were made.

Box 18 – This is the amount of your FHSA contributions made in the year. Enter this amount on line 68935 of your Schedule 15.

Box 20 – This is the amount of qualifying withdrawals made in the year from your FHSA to buy or build a qualifying home. Enter this amount on line 68960 of your Schedule 15.

Box 22 – This is the amount of taxable withdrawals made in the year from your FHSA. Enter this amount on line 12905 of your return. The amounts in this box as well as Box 26 will be added to the income in Box 12905 of T1 General and the individual will be taxed on the amounts.

Box 24 – This is the amount of taxable distributions that you received in the year as a beneficiary upon the death of an FHSA holder. Enter this amount on line 12906 of your return.

Box 26 – This is the amount that must be included in your income if property remained in your account when it ceased to be an FHSA or if you are a beneficiary who is entitled to the property that remains in the deceased holder's FHSA at the end of the exempt period. Enter this amount on line 12905 of your return.

Box 28 – This is the fair market value of any property in the FHSA that was used as security for a loan. Enter this amount on line 12906 of your return.

If the property in the FHSA ceases to be pledged as security for a loan, an amount may be deductible by the holder in the year the property ceases to be security for a loan. Enter any deduction (amount shown in brackets) on line 23200 of your return.

Box 30 – The amount of taxes which were withheld on non-qualifying withdrawals are included in this box. Enter this amount on line 43700 of your return.

Box 32 – This is the amount transferred from your RRSPs to your FHSA in the year. Enter this amount on line 68950 of your Schedule 15.

Box 34 – This is the amount transferred from your spousal RRSPs to your FHSA in the year. Enter this amount on line 68950 of your Schedule 15.

Box 36 – This is the amount of designated transfers from your FHSA to your RRSPs or RRIFs to eliminate an excess FHSA amount. Enter this amount on line 68955 of your Schedule 15.

Box 38 – This is the amount of designated withdrawals from your FHSA to eliminate an excess FHSA amount. Enter this amount on line 68945 of your Schedule 15.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.caPosted on 8 February 2024