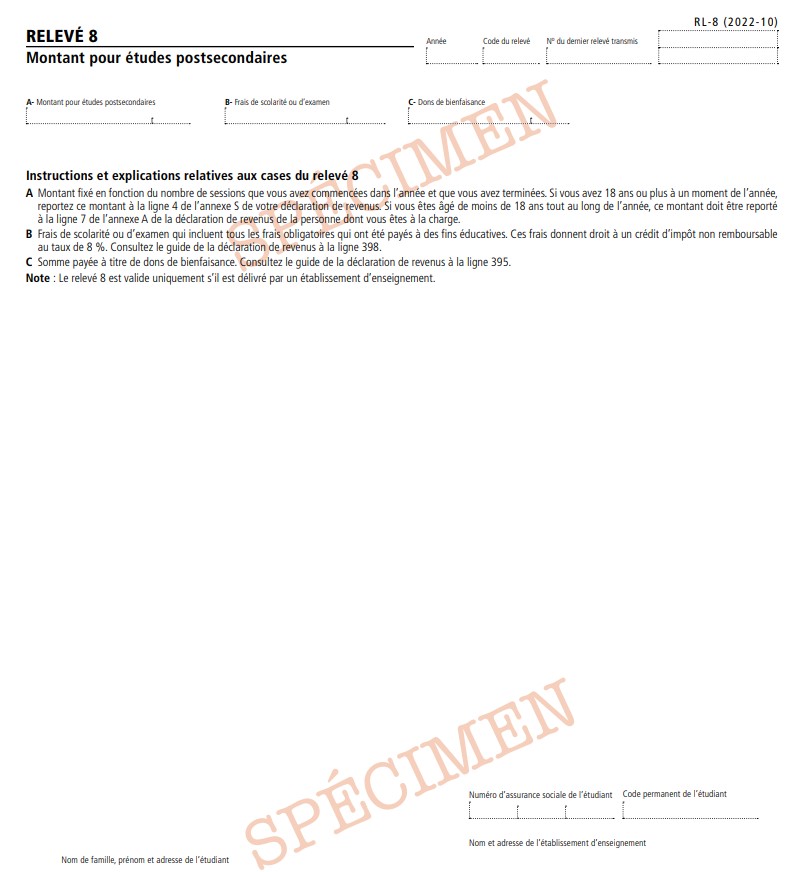

RL-8 Slip – Amount for Post-Secondary Studies

The RL-8 slip must be filed by:

The RL-8 slip is used to report amounts for full-time post-secondary studies as well as student tuition and examination fees.

How to Complete the RL-8 Slip (Box by Box Instructions) Box AAmount for post-secondary studies, determined on the basis of the number of terms that you started in the year and completed. If you were 18 or older at some point during the year, enter this amount on line 4 of Schedule S of your income tax return. If you were under 18 all year long, this amount must be entered on line 7 of Schedule A of the in-come tax return of the person claiming you as a dependant.

Box BTuition or examination fees, including compulsory fees paid for education purposes. These fees give entitlement to a non-refundable tax credit at a rate of 8%. See the instructions for line 398 in the guide to the in-come tax return.

Box CAmount paid as charitable donations. See the instructions for line 395 in the guide to the income tax return

Note : The RL-8 slip is valid only if it is issued by an educational institution.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 25 June 2024