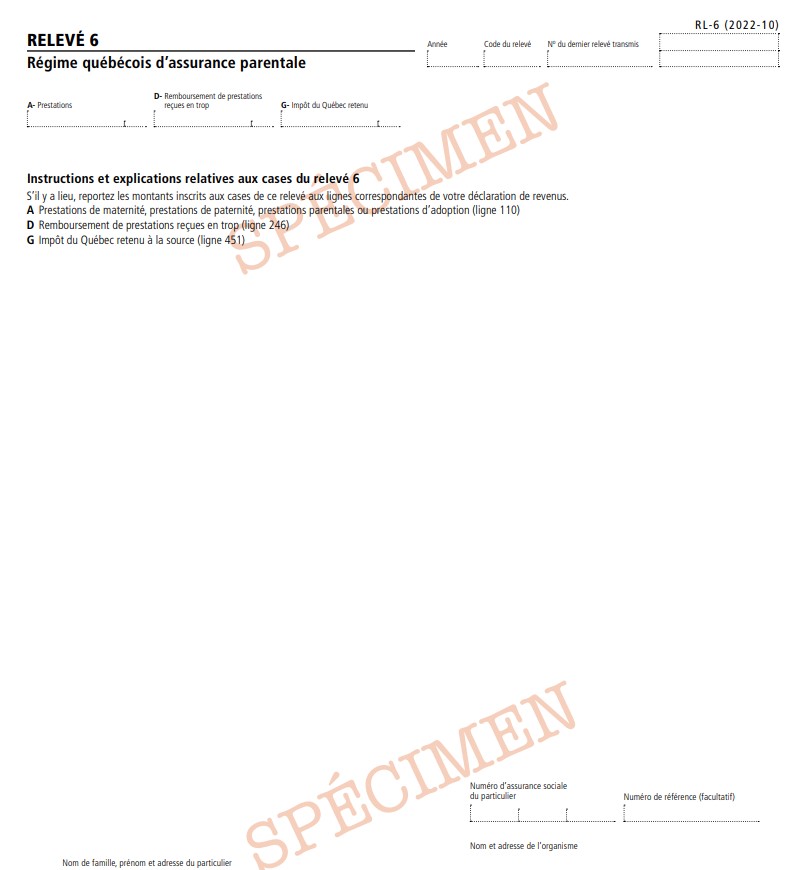

RL-6 Slip: Québec Parental Insurance Plan

The RL-6 slip must be filed by the Ministère de l'Emploi et de la Solidarité sociale to report amounts paid to individuals as parental, maternity, paternity or adoption benefits.The information on the RL-6 slip is used by individuals to complete the personal income tax return

Purpose of the RL-6 slipThe RL-6 slip is used to report amounts paid to individuals as parental, maternity, paternity or adoption benefits.

How to Complete the RL-6 Slip (Box by Box Instructions) Box AMaternity, paternity, parental and adoption benefits (line 110)

Box DRepayment of benefits overpaid to you (line 246)

Box GQuébec income tax withheld at source (line 451)

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 25 June 2024