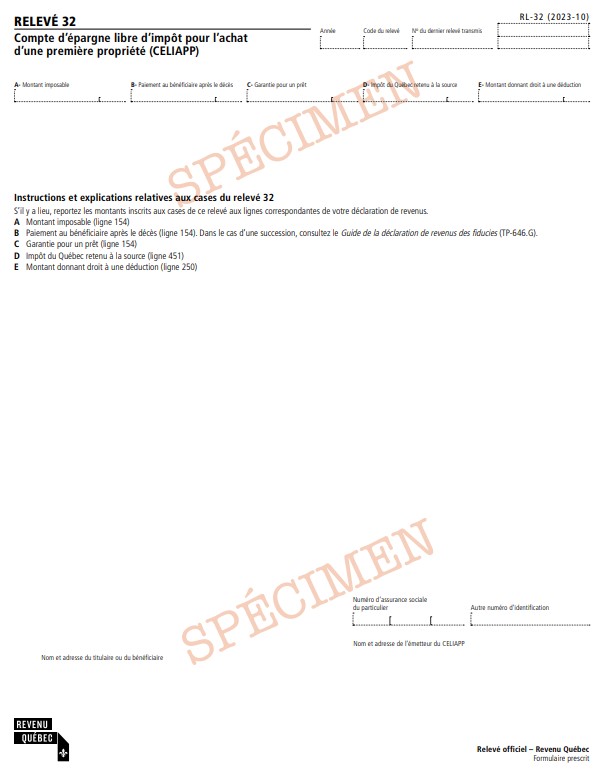

What is RL-32 Slip – First Home Savings Account

The RL-32 slip must be filed by issuers of a first home savings account (FHSA).

Purpose of the RL-32 slipThe RL-32 slip is used by issuers to report taxable amounts allocated to FHSA holders or paid to FHSA beneficiaries. It is also used to report the Québec income tax that has been withheld from the amounts.

How to Complete the RL-32 Slip (Box by Box Instructions) Box ATaxable amount (line 154)

Box BPayment to beneficiary after death of holder (line 154). See the Guide to the Trust Income Tax Return for a succession.

Box CLoan guarantee (line 154)

Box DQuébec income tax withheld at source (line 451)

Box EAmount giving entitlement to a deduction (line 250)

Box marked “Nom et adresse du titulaire ou du bénéficiaire, Nom de famille ou raison sociale”Name and address of holder or beneficiary, Last name or corporate name

Box marked “Nom et adresse de l’émetteur du CELIAPP”Name and address of the FHSA issuer

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 15 July 2024