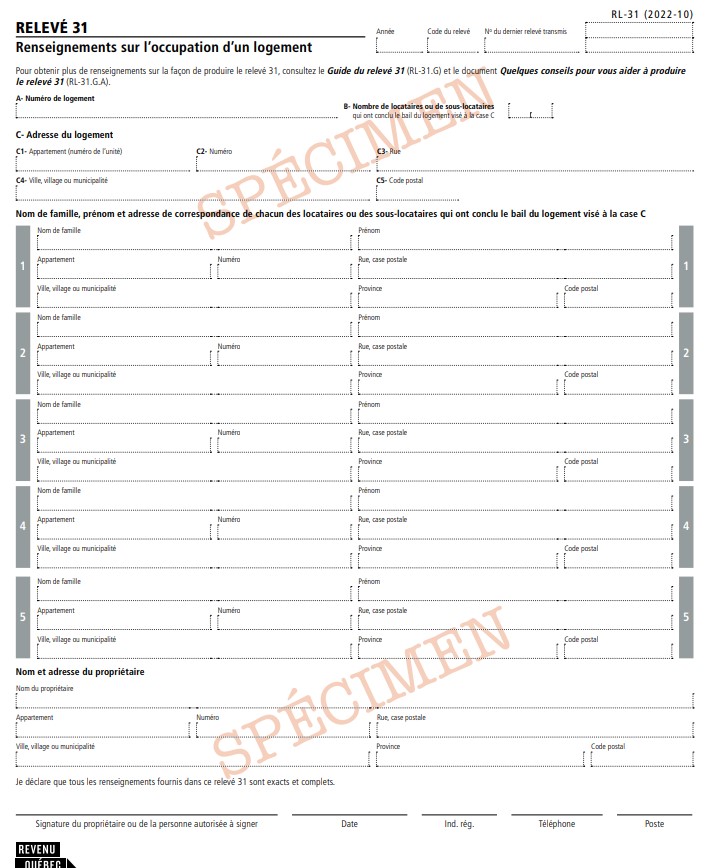

What is RL-31 Slip – Information About a Leased Dwelling

The RL-31 slip must be filed by any person or partnership that is the owner of a residential complex and leases a dwelling for which rent was paid or was payable on December 31 of a given year.

Purpose of the RL-31 slipThe RL-31 slip is used to report information about a leased dwelling as at December 31 of a given year.The information is used by tenants and subtenants who wish to claim the solidarity tax credit in their income tax returns.

How to Complete the RL-31 Slip (Box by Box Instructions) Box ADwelling number

Box BTotal number of tenants and subtenants who signed the lease for the dwelling identified in box C

Box CAddress of the dwelling

Box C1Apartment (unit) number

Box C2Street number

Box C3Street name

Box C4City, town or municipality

Box C5Postal code

Space marked “Nom et adresse du propriétaire”Name and address of the landlord

Space marked “Nom de famille, prénom et adresse de correspondance de chacun des locataires ou des sous-locataires qui ont conclule bail du logement visé à la case C”Last name, first name and address of the tenants and subtenants who signed the lease for the dwelling identified in box C

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 15 July 2024