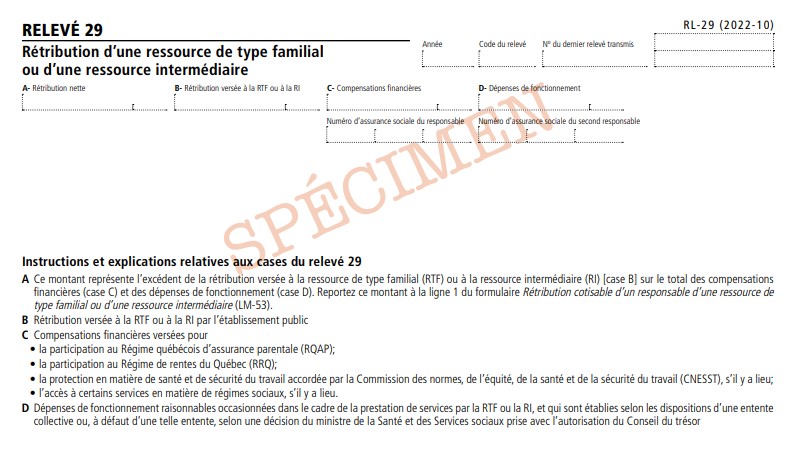

What is RL-29 Slip – Remuneration of a Family-Type Resource or an Intermediate Resource

The RL-29 slip must be filed by any public institution that paid remuneration to a person responsible for a family-type resource or an intermediate resource that takes in, at their principal place of residence, a maximum of nine users.

Purpose of the RL-27 slipThe RL-29 slip is used to report remuneration paid to persons responsible for a family-type resource or an intermediate resource.

How to Complete the RL-29 Slip (Box by Box Instructions) Box ANet remuneration. This amount is equal to the amount by which the remuneration paid to a family-type resource (FTR) or an intermediate resource (IR) (box B) exceeds the total amount of financial compensation (box C) and operating expenses (box D). Enter the amount that is shown in box A of the RL-29 slip on line 1 of form LM-53-V, Insurable Earnings Under the QPIP and Pensionable Earnings Under the QPP of a Person Responsible for a Family-Type Resource or an Intermediate Resource.

Box BRemuneration paid to an FTR or an IR. This amount is paid by a public institution.

Box CFinancial compensation. This amount is paid for:

Operating expenses. This amount is for reasonable operating expenses incurred in the course of providing the services of the FTR or IR. Such expenses are determined under a group agreement or, in the absence of such an agreement, under a decision of the Minister of Health and Social Services made with the authorization of the Conseil du trésor

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 15 July 2024