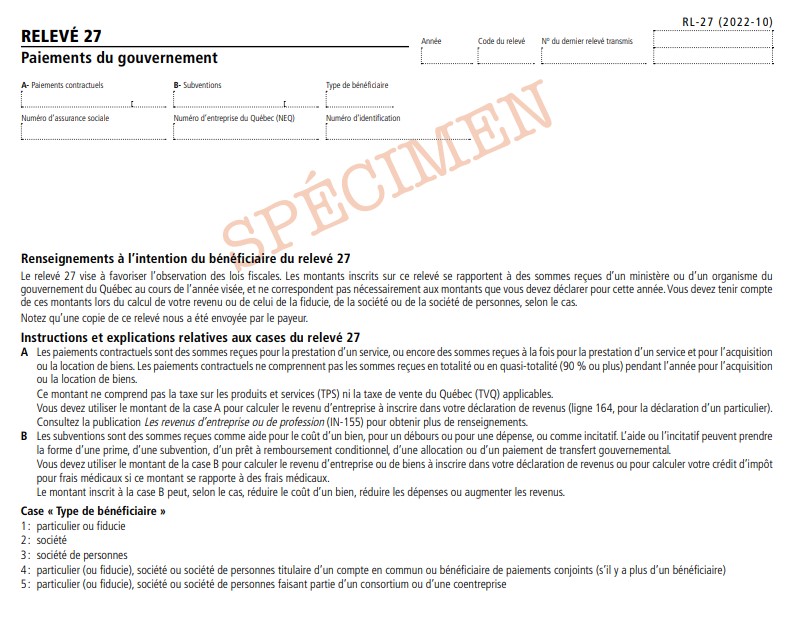

What is RL-27 Slip – Government Payments

The RL-27 slip must be filed by any department or agency of the Gouvernement du Québec that made contractual payments or paid a subsidy.

Purpose of the RL-27 slipThe RL-27 slip is used to report amounts (other than excluded amounts) paid to an individual, a trust, a corporation or a partnership as assistance in relation to the cost of property, an outlay or an expenditure or as an incentive:

Contractual payments. These are amounts received in payment of a service rendered, or in payment of a service rendered and the acquisition or lease of property. They do not include amounts received in the year entirely or almost entirely (90% or more) for the acquisition or lease of property

The amount in box A, which does not include goods and services tax (GST) or Québec sales tax (QST), must be used to calculate the business income to be reported in the recipient’s income tax return (line 164 of an individual’s income tax return). For more information, refer to guide IN-155-V, Business and Professional Income.

Box BSubsidies. These are amounts received as assistance in relation to the cost of property, an outlay or an expenditure, or as incentives. The assistanceor incentive may be in the form of a grant, a subsidy, a forgivable loan, an allowance or a government transfer payment.

You must use the amount in box B to calculate the amount of business or property income to be entered in your income tax return or, if the amount is related to medical expenses, to calculate your tax credit for medical expenses. The amount in box B may be used, as applicable, to reduce the cost of property or expenditures, or to increase income.

Box marked “Type de bénéficiaire” (type of recipient)

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 15 July 2024