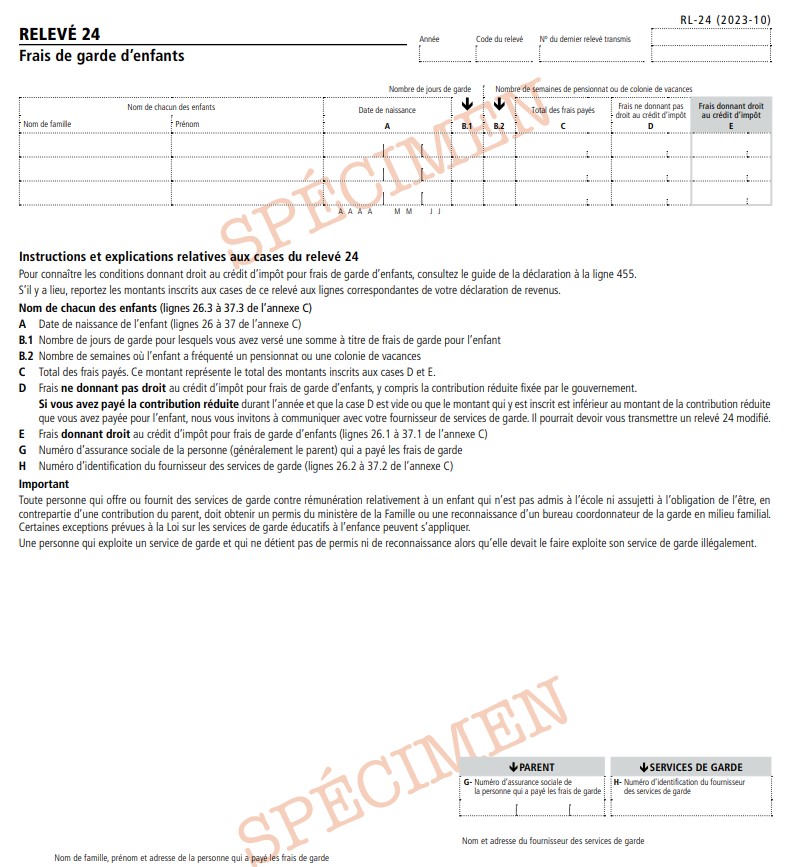

RL-24 Slip – Childcare Expenses

The RL-24 slip (see courtesy translation RL-24-T) must be filed by any person that, in exchange for remuneration, provided childcare services in Québec for which the tax credit for childcare expenses can be claimed. Such a person may operate:

The RL-24 slip is used to report childcare expenses that qualify for the tax credit for childcare expenses.

How to Complete the RL-24 Slip (Box by Box Instructions) Box ADate of birth (YYYY-MM-DD, lines 26 to 37 of Schedule C)

Box B.1Number of days of care for which you paid an amount as childcare expenses

Box B.2Number of weeks spent at a camp or a boarding school

Box CTotal childcare expenses paid (total of amounts in boxes D and E)

Box DChildcare expenses that do not qualify for the tax credit, including the reduced contribution set by the government. If you paid this contribution during the year and box D is empty or the amount entered there is less than the contribution you paid for the child, contact your childcare service provider as they may need to send you an amended RL-24 slip.

Box EChildcare expenses that qualify for the tax credit (lines 26.1 to 37.1 of Schedule C)

Box GSocial insurance number of the person (usually a parent) who paid the childcare expenses

Box HIdentification number of the childcare provider (lines 26.2 to 37.2 of Schedule C)

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 12 July 2024