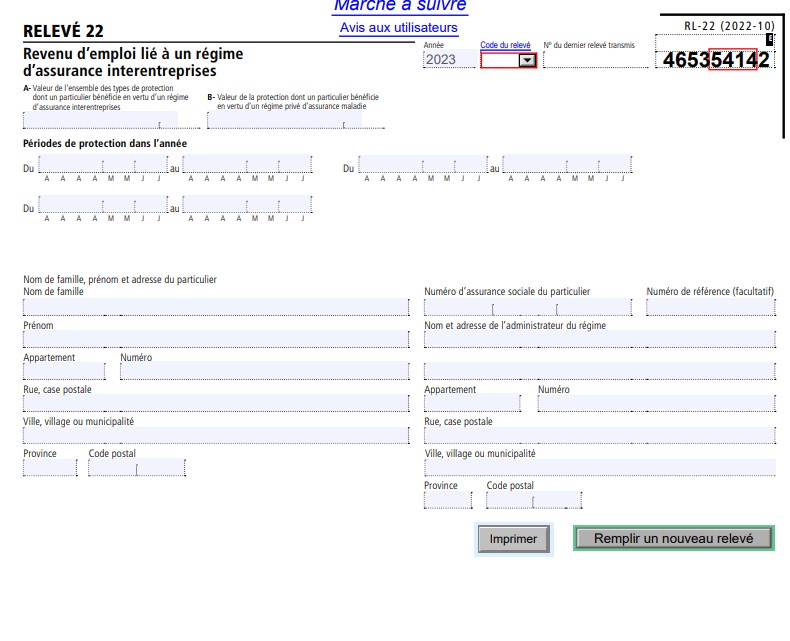

RL-22 Slip – Employment Income Related to Multi-Employer Insurance Plans

The RL-22 slip must be filed by any administrator of a multi-employer insurance plan.

Purpose of the RL-22 slipThe RL-21 slip is used to report farm support payments.The RL-22 slip is used to report an individual's coverage under a multi-employer insurance plan (other than a plan covering total or partial loss of business, office-related or employment income).

How to Complete the RL-22 Slip (Box by Box Instructions) Box AValue of all the coverage you had under a multi-employer insurance plan (other than coverage for the total or partial loss of income from an office or employment). If you are an employee, enter this amount on line 1 of work chart 105 of your income tax return. If you are self-employed, enter the amount directly on line 105 of your income tax return.

Box BValue of the coverage you had under a private health services plan. This amount is included in the amount in box A and may give entitlement to the tax credit for medical expenses. See the instructions for line 381 in the guide to the income tax return.

Boxes under “Périodes de protection dans l’année” (periods of coverage in the year)Periods during which you were covered by a private health services plan and enjoyed a benefit included in box B. If you were not covered throughout the year, you may have to pay a premium under the Québec prescription drug insurance plan. See the instructions for line 447 in the guide to the income tax return.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 12 July 2024