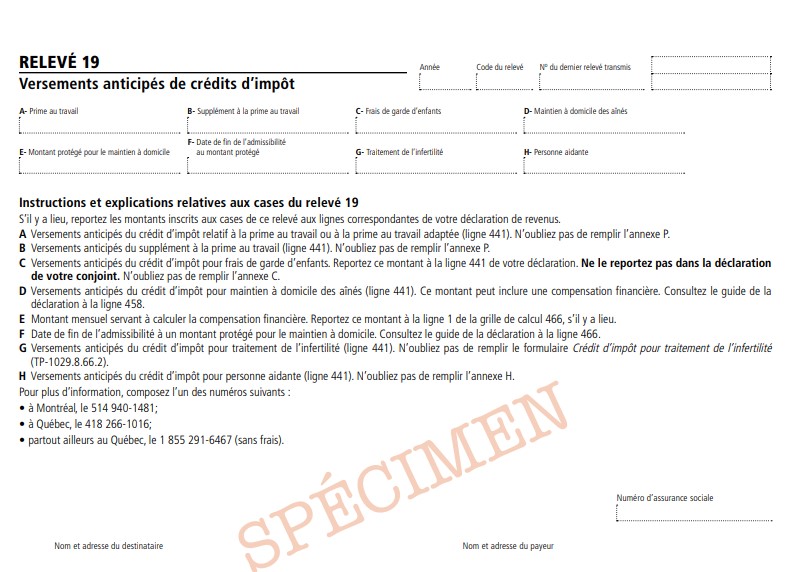

RL-19 Slip – Advance Payments of Tax Credits

The RL-19 slip is filed by Revenu Québec. The information on the RL-19 slip is used by individuals to complete the personal income tax return (TP-1-V).

Purpose of the RL-19 slipThe RL-19 slip is used to report advance payments of the tax credit for childcare expenses, the tax credit for home-support services for seniors, the tax credit for the treatment of infertility and the tax credits respecting the work premium.

How to Complete the RL-19 Slip (Box by Box Instructions) Box AAdvance payments of the tax credit respecting the work premium or the adapted work premium (line 441). Remember to file Schedule P

Box BAdvance payments of the supplement to the work premium (line 441). Remember to file Schedule P

Box CAdvance payments of the tax credit for childcare expenses. Enter this amount on line 441 of your income tax return. Do not enter it on your spouse’s return. Remember to file Schedule C.

Box DAdvance payments of the tax credit for home-support services for seniors (line 441). This amount may include financial compensation. See the instructions for line 458 in the guide to the income tax return.

Box EMonthly amount used to calculate the financial compensation. Enter this amount on line 1 of Work Chart 466, if applicable.

Box FEnd date of eligibility for the protected credit for home-support services. See the instructions for line 466 in the guide to the income tax return.

Box GAdvance payments of the tax credit for the treatment of infertility (line 441). Remember to complete form TP-1029.8.66.2-V, Tax Credit for the Treatment of Infertility.

Box HAdvance payments of the tax credit for caregivers (line 441). Complete Schedule H.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 12 July 2024