RL-18 Slip – Securities Transactions

The RL-18 slip (see courtesy translation RL-18-T) must be filed by the following persons (provided the person is either an individual resident in Québec or a corporation with an establishment in Québec):

a trader or dealer in securities that:

purchases a security as principal, or

sells a security as a mandatary;

a person that, in the ordinary course of business, buys and sells precious metals in the form of certificates, bullion or coins, and that makes a payment to another person (also an individual resident in Québec or a corporation with an establishment in Québec) related to the sale of precious metals by that other person;

a person that, as the agent or mandatary of an individual resident in Québec or a corporation with an establishment in Québec, receives the proceeds of a transaction made in the name of the mandatary or agent;

a person that, when a bearer debt obligation is disposed of or redeemed, makes a payment to an individual resident in Québec or acts as the agent or mandatary of the individual;

a person (with the exception of an individual that is not a trust) that issues a security and subsequently purchases, redeems or cancels it, except when the transaction involves:

a bond conversion, that is, the exchange of a bond for another bond of the same debtor, where the terms of the original bond give the holder the right to make the exchange, and where the amount payable on the acquired bond at maturity is the same as the amount payable on the exchanged bond at maturity,

the exchange of a share, bond or note for a share of the same corporation (see section 301 of the Taxation Act), if the share is the only consideration given in exchange,

the exchange of a share for a new share in the course of the reorganization of a corporation's capital, if the new share is the only consideration given in exchange (see sections 541 and following of the Taxation Act),

the acquisition, redemption or cancellation of a security where there is an amalgamation (see section 544 of the Taxation Act),

the disposition of a security upon the dissolution of a partnership (see sections 620 to 622, 624 and 625 of the Taxation Act), or

the transfer of a security, upon the dissolution of a partnership, to another partnership that is deemed to be the continuation of the dissolved partnership (see section 633 of the Taxation Act).

Purpose of the RL-18 slip

The RL-18 slip is used to report securities transactions (purchase, sale, redemption, acquisition or cancellation).

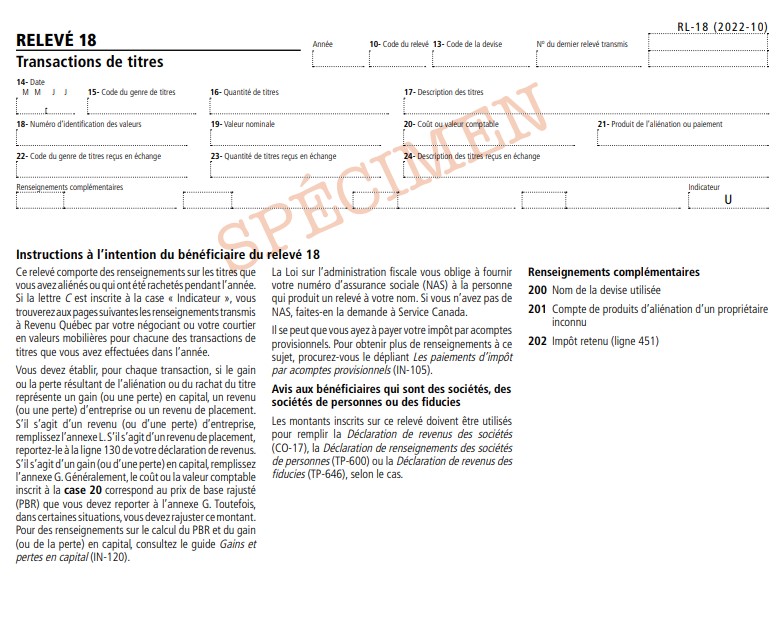

How to Complete the RL-18 Slip (Box by Box Instructions)

Box 10

RL-slip code

Box 11

Type of recipient

Box 12

Recipient's social insurance number or identification number

Box 13

Currency code

Box 14

Date (month and day)

Box 15

Type code of securities

Box 16

Quantity of securities

Box 17

Identification of securities

Box 18

Identification number (ISIN or CUSIP number)

Box 19

Face value

Box 20

Cost or book value

Box 21

Proceeds of disposition or settlement amounts

Box 22

Code for type of securities received in exchange

Box 23

Quantity of securities received in exchange

Box 24

Identification of securities received in exchange

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca