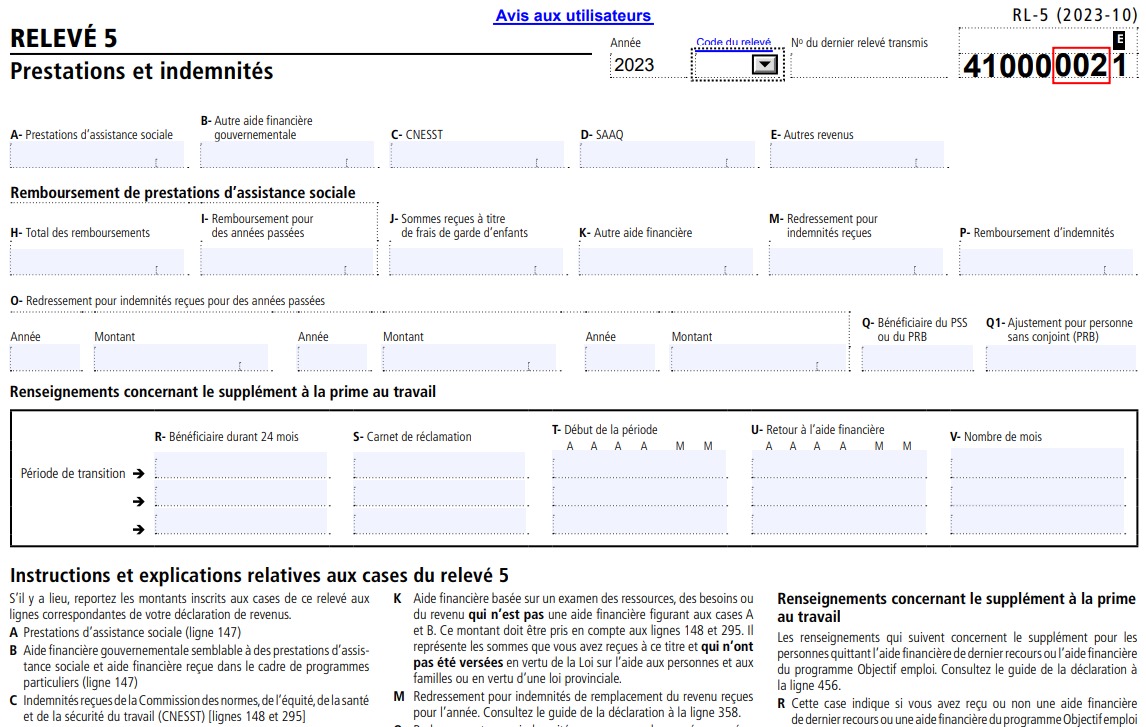

RL-5 Slip – Benefits and Indemnities

The RL-5 slip must be filed by:

The RL-5 slip is used to report amounts of social assistance payments and indemnities paid to beneficiaries.

How to Complete the RL-5 Slip (Box by Box Instructions) Box ASocial assistance payments (line 147)

Box BOther government financial assistance similar to social assistance payments and financial assistance received under specific programs (line 147)

Box CWorkers’ compensation received from the Commission des normes, de l’équité, de la santé et de la sécurité du travail (CNESST) (lines 148 and 295)

Box DIndemnities received from the Société de l’assurance automobile du Québec (SAAQ) (lines 148 and 295)

Box EOther income. Indemnities received in relation to a precautionary cessation of work, an act of good citizenship, a crime of which you were the victim or a program providing for income replacement assistance (lines 148 and 295).

Box HTotal repayment of social assistance payments. This amount may be taken into account on line 246 if it has been included in your income or your spouse’s income.

Box IRepayment, included in box H, of social assistance payments relating to a year before 1998. This amount may be taken into account on line 276.

Box JAllowance for childcare expenses (line 40 of Schedule C)

Box KFinancial assistance provided on the basis of a means, needs or income test, other than financial assistance shown in boxes A and B. This amount, which must be taken into account on lines 148 and 295, represents the amounts you received as financial assistance that were not paid under the Individual and Family Assistance Act or any other provincial law

Box MAdjustment for income replacement indemnities received for the year concerned. See the instructions for line 358 in the guide to the income tax return.

Box OAdjustment for indemnities received for previous years. Revenu Québec will make the necessary adjustments, where applicable. See the instructions for line 358 in the guide to the income tax return.

Box PRepayment of indemnities. The amount of repaid indemnities that exceeds the amount of indemnities received in the year. This amount must be taken into account on lines 246 and 276

Box QThis box indicates whether you received benefits under the Social Solidarity Program or the Basic Income Program and had a severely limited capacity for employment. See the instructions for line 456 pertaining to the adapted work premium in the guide to the income tax return.

Box Q1This box indicates whether you received benefits under the Basic Income Program and received the monthly adjustment for a single person in addition to the basic benefit. See the instructions for line 361 in the guide to the income tax return.

Information pertaining to the supplement to the work premiumThe following information concerns the supplement for former recipients of last-resort financial assistance or financial assistance from the Aim for Employment Program. See the instructions for line 456 in the guide to the income tax return.

Box RRecipient for 24 months. This box indicates whether or not you received last-resort financial assistance or financial assistance under the Aim for Employment Program during 24 of the 30 months preceding the month and year in box T

Box SClaim slip. This box indicates whether or not you held a claim slip enabling you to receive certain dental and pharmaceutical services for the month in box T

Box TStart of the period of transition to work. The first month in which you did not receive last-resort financial assistance or financial assistance under the Aim for Employment Program because of work income that you or your spouse earned. It is the first month of your period of transition to work

Box UResumption of financial assistance. The month, after the start of your period of transition to work (box T), in which you once again began receiving last-resort financial assistance or financial assistance under the Aim for Employment Program.

Box VThe number of months in the year and in your period of transition to work during which you did not receive last-resort financial assistance or financial assistance under the Aim for Employment Program (line 57 of Schedule P)

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 25 June 2024