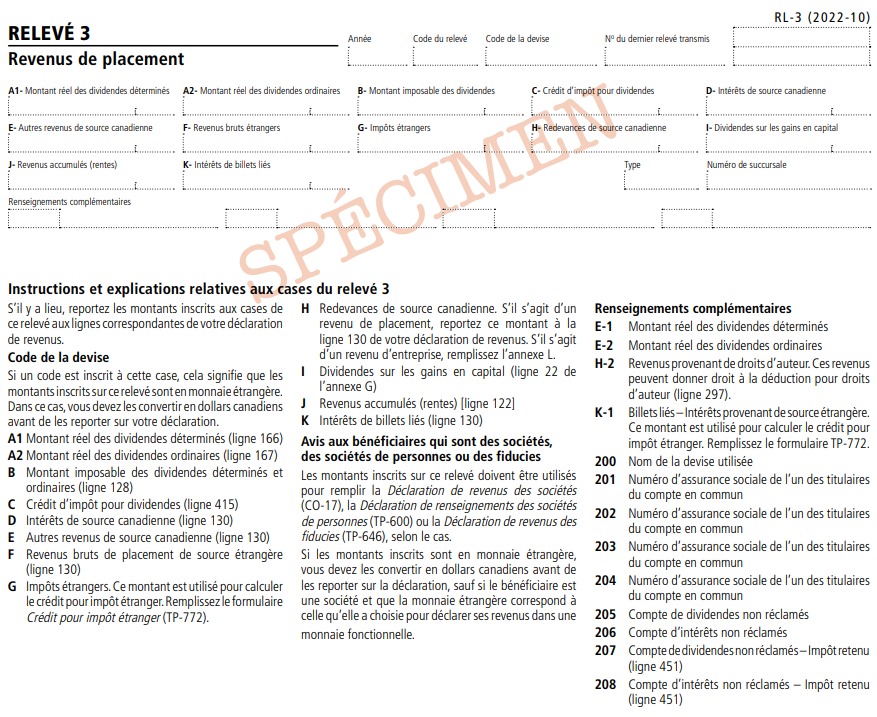

RL-3 Slip – Investment Income

The RL-3 slip must be filed by:

The RL-3 slip is used to report interest, dividends, capital gains dividends or royalties paid or credited to a recipient.

How to Complete the RL-3 Slip (Box by Box Instructions) Box A1 – Actual amount of eligible dividendsEnter the actual amount of eligible dividends that were paid or are deemed to have been paid to an individualresident in Québec by a taxable Canadian corporation and are eligible for the dividend tax credit.Eligible dividends paid to a minor by a private Canadian corporation must also be included in this box.

Box A2 – Actual amount of ordinary dividendsEnter the actual amount of ordinary dividends that were paid or are deemed to have been paid to an individual resident in Québec by a taxable Canadian corporation and are eligible for the dividend tax credit. Ordinary dividends paid to a minor by a private Canadian corporation must also be included in this box.

Box B – Taxable amount of dividendsEnter the taxable amount of eligible and ordinary dividends. Add the results of the following calculations to determine the taxable amount:

Enter the amount of the dividend tax credit the recipient can claim if they are an individual resident in Québec on December 31 of the year in question. Add the results of the following calculations to determine the tax credit amount:

Enter the amount of interest from Canadian sources paid or credited during the year to a recipient. Also enter the interest accrued on behalf of a recipient who is an individual resident in Québec, in respect of an investment contract .

Box E – Other income from Canadian sourcesEnter all other investment income, such as:

In box E, custodians of funeral arrangements (that is, funeral or cemetery services) must enter the lesser of the following amounts:

If you are a mandatary or hold a power of attorney, enter the gross income from foreign sources that you received on behalf of a recipient. Gross income is the net amount received, plus the foreign income tax withheld. Foreign income paid to a minor by a corporation must be included in this box.

Box G – Foreign income taxEnter the amount of income tax paid on income from foreign sources to the government of a foreign country or a political subdivision of a foreign country

Box H – Royalties from Canadian sourcesEnter the amount of royalties from Canadian sources paid to the recipient.If the amount in box H includes income from a copyright (of which an artist or professional artist is the first owner), enter “H-2” in one of the blank boxes, followed by the amount.

Box I – Capital gains dividendsEnter the amount of capital gains dividends paid to a recipient by a mutual fund corporation, an investment corporation or a mortgage investment corporation.

Box J – Accrued income: annuitiesEnter the amount of income accrued under a life insurance policy or annuity contract that must be included in the recipient’s income calculation.

Box K – Interest from linked notesEnter the total deemed interest accrued following the assignment or transfer of linked notes. Any gain realized at the time of an assignment or transfer is deemed interest accrued on the debt obligation for the period beginning before the time of the transfer and ending at the time of the transfer.

If the amount in box K includes foreign interest from linked notes, enter “K-1” in one of the blank boxes, followed by the amount of interest.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 25 June 2024