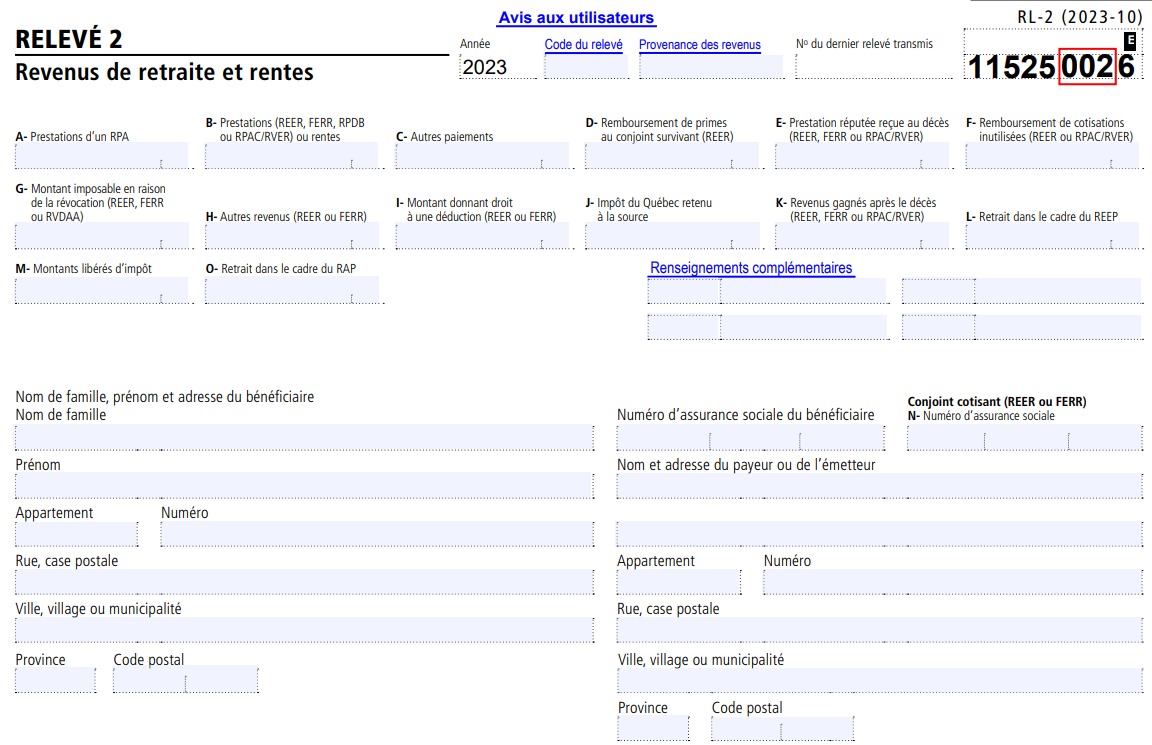

RL-2 Slip – Retirement and Annuity Income

The RL-2 slip must be filed by:

a payer of retirement benefits or annuities;

an issuer of a registered retirement savings plan (RRSP) that paid amounts from that plan;

an issuer of a registered retirement income fund (RRIF) that paid amounts from that fund;

an administrator of a pooled registered pension plan (PRPP) that paid amounts from that plan;

an administrator of a voluntary retirement savings plan (VRSP) that paid amounts from that plan;

a trustee of a deferred profit sharing plan (DPSP) that paid amounts from that plan;

a payer of an income-averaging annuity; or

a payer of an income-averaging annuity for artists; or

an administrator of an advanced life deferred annuity (ALDA) contract that paid amounts under that contract.

Purpose of the RL-2 slip

The RL-2 slip is primarily used to report:

retirement income and annuity income paid during a given year to a person resident in Québec on December 31 of that year or to a person resident in Québec immediately before ceasing to be resident in Canada during the year;

amounts paid during a year to the surviving spouse and to the recipient of the property further to the death of an annuitant;

Québec income tax withheld from certain amounts;

the total amount paid to an annuitant of an RRSP under the Home Buyers' Plan (HBP) or Lifelong Learning Plan (LLP);

the contributions (or premiums) that a retired employee paid to a private health services plan; and

the total amount of charitable donations collected during the year.

How to Complete the RL-2 Slip (Box by Box Instructions)

BOX A – PAYMENTS FROM A REGISTERED PENSION PLAN

Enter in box A of the RL-2 slip (see courtesy translation RL-2-T) the amount of payments made under a registered pension plan (RPP), such as:

life annuities (including variable pension benefits and variable payment life annuities);

bridging benefits;

periodic payments (other than life annuities) made under a defined contribution plan.

If all or part of the payment made to an Indian under an RPP is situated on a reserve or premises, enter “A-1” in a blank box followed by the amount that is situated on a reserve or premises.

BOX B – PAYMENTS UNDER AN RRSP, A RRIF, A DPSP, A PRPP, A VRSP OR ANNUITIES

In box B of the RL-2 slip , you must, under certain circumstances, enter the following amounts:

payments under a registered retirement income fund (RRIF);

payments under a deferred profit-sharing plan (DPSP);

payments under a pooled registered pension plan (PRPP);

payments under a registered retirement savings plan (RRSP);

payments under a voluntary retirement savings plan (VRSP);

payments under an income-averaging annuity contract;

annuity payments resulting from a refund of premiums, a designated benefit, the commutation of an annuity, or an amount in excess of the minimum amount;

payments under an advanced life deferred annuity (ALDA) contract.

You must also enter:

payments of annuities acquired with a payment made under a plan or fund;

the portion of ordinary annuities that constitutes income.

BOX C – OTHER PAYMENTS

In box C of the RL-2 slip (see courtesy translation RL-2-T), you must enter certain payments made under:

an income-averaging annuity;

an income-averaging annuity for artists;

the Home Buyers' Plan (HBP);

the Lifelong Learning Plan (LLP);

a deferred profit-sharing plan (DPSP);

a registered pension plan (RPP);

an unregistered pension plan;

the Québec Pension Plan (QPP);

a registered retirement savings plan (RRSP);

an advanced life deferred annuity (ALDA) contract.

BOX D – REFUND OF RRSP PREMIUMS PAID TO A SURVIVING SPOUSE

Enter in box D of the RL-2 slip (see courtesy translation RL-2-T) the amount of the refund of RRSP premiums paid to the surviving spouse of an unmatured registered retirement savings plan (RRSP) annuitant if all of the following conditions are met:

The surviving spouse was named as the beneficiary of all property held in an unmatured RRSP, pursuant to the applicable legislation, or the total value of the property held in an RRSP is payable to the surviving spouse under the provisions of the annuitant's will.

The full amount of the refund of premiums is transferred to the RRSP, the registered retirement income fund (RRIF), the pooled registered pension plan (PRPP) or to a voluntary retirement savings plan (VRSP) of the surviving spouse or used to purchase an annuity in the surviving spouse's name.

The issuer of the RRSP carries out the transfer or purchase before the end of the year following the year of death.

BOX E – BENEFIT DEEMED TO HAVE BEEN RECEIVED AT THE TIME OF DEATH (RRSP, RRIF, PRPP OR VRSP)

In certain situations, you must enter in box E of the RL-2 slip (see courtesy translation RL-2-T) the fair market value (FMV) of the property held in a plan or fund of a deceased person at the time of his or her death where the deceased is an annuitant of one of the following:

a registered retirement income fund (RRIF);

a pooled registered pension plan (PRPP);

a registered retirement savings plan (RRSP);

a voluntary retirement savings plan (VRSP).

BOX F – REFUND OF UNUSED CONTRIBUTIONS (RRSP, PRPP OR VRSP)

RRSP : Enter in box F of the RL-2 slip (see courtesy translation RL-2-T) the amount of the excess registered retirement savings plan (RRSP) contributions that were made in a given year and refunded to the annuitant in the year following the one for which federal form T3012A was completed respecting unused RRSP contributions made after 1990.If the form was not filed, the amounts withdrawn by the annuitant during the year must be entered in box C rather than box F.

PRPP : Enter the amount of the excess pooled registered pension plan (PRPP) contributions that were made in a given year and refunded to the annuitant in the year following the one for which federal form T3012A was completed respecting unused PRPP contributions. If the form was not filed, the amounts withdrawn by the annuitant during the year must be entered in box B rather than box F.

VRSP : Enter the amount of the excess voluntary retirement savings plan (VRSP) contributions that were made in a given year and refunded to the annuitant in the year following the one for which federal form T3012A was completed respecting unused VRSP contributions. If the form was not filed, the amounts withdrawn by the annuitant during the year must be entered in box B rather than box F.Note that in federal form T3012A, the term “pooled registered pension plan” (PRPP) refers to both a PRPP and a VRSP.

BOX G – AMOUNT THAT IS TAXABLE BECAUSE OF THE REVOCATION OF THE REGISTRATION OF AN RRSP, A RRIF OR AN ALDA

RRSP : Enter in box G of the RL-2 slip (see courtesy translation RL-2-T) the fair market value (FMV) of all property held in a registered retirement savings plan (RRSP) immediately prior to the date on which the plan was amended.

RRIF : Enter the FMV of all property held in a registered retirement income fund (RRIF) immediately prior to the date on which the fund was amended.

ALDA : Enter the FMV of an advanced life deferred annuity (ALDA) contract immediately prior to the date on which the contract was amended if, after the amendments, it no longer meets the conditions to be an ALDA contract.

BOX H – OTHER INCOME (RRSP OR RRIF)

Trusteed RRSP : Enter in box H of the RL-2 slip the total of all other amounts that the annuitant of a trusteed registered retirement savings plan (RRSP) must include in his or her income when filing his or her income tax return, including:

the fair market value (FMV) of the property as at the time the trust started, during the year, to use the property or to allow the property to be used as security for a loan;

the amount corresponding to the difference between the FMV of the property acquired or disposed of during the year and its consideration, where the trust acquired the property for a consideration greater than the property's FMV at the time of acquisition and/or disposed of the property for no consideration or for a consideration less than the property's FMV at the time of disposition.

Trusteed RRIF : Enter the total of all other amounts that the annuitant of a trusteed registered retirement income fund (RRIF) must include in his or her income when filing his or her income tax return, including the following:

the FMV of the property as at the time the trust started, during the year, to use the property or to allow the property to be used as security for a loan;

the amount corresponding to the difference between the FMV of the property acquired or disposed of during the year and its consideration, where the trust:

acquired the property for a consideration greater than the property's FMV at the time of acquisition, and / or

disposed of the property for no consideration or for a consideration less than the property's FMV at the time of disposition.

from employment income subject to QPIP premiums that was paid by mistake, except if the employee repaid an amount equal to the net income;

by a person with whom you are not dealing at arm's length who paid employment income to your employee;

by amalgamated corporations and by the corporation resulting from the amalgamation;

by a parent corporation and a wound-up subsidiary, if at least 90% of the subsidiary's property was attributed to the parent corporation.

Also enter in box H any employee QPIP premium that you paid that is included in box L.

Do not correct the amount in box H if it is too high. Leave the box blank if you did not withhold QPIP premiums.

BOX I – AMOUNT GIVING ENTITLEMENT TO A DEDUCTION (RRSP OR RRIF)

Trusteed RRSP : If, during the year, the trust governed by the registered retirement savings plan (RRSP) disposed of a non-qualifying investment that was acquired before March 23, 2011, enter the lesser of the following amounts in box I of the RL-2 slip :

the amount included in the annuitant's income for the year the property was acquired;

the proceeds of disposition for the property.

If the trust governed by the RRSP used property as security for a loan or permitted such use and this use ended during the year, enter in box I the result of the following calculation:

the amount included in the annuitant's income because the trust used property or permitted the use of property as security for a loan;

minus the net loss sustained by the trust because it used property or permitted the use of property as security for a loan (do not take into account amounts paid by the trust as interest nor the variation of the property's fair market value [FMV]).

Trusteed RRIF : If, during the year, the trust governed by the registered retirement income fund (RRIF) disposed of a non-qualifying investment that was acquired before March 23, 2011, enter the lesser of the following amounts in box I:

the amount included in the annuitant's income for the year the property was acquired;

the proceeds of disposition for the property.

If the trust governed by the RRIF used property as security for a loan or permitted such use and this use ended during the year, enter in box I the result of the following calculation:

the amount included in the annuitant's income because the trust used property or permitted the use of property as security for a loan;

minus the net loss sustained by the trust because it used property or permitted the use of property as security for a loan (do not take into account amounts paid by the trust as interest nor the variation of the property's FMV).

BOX J – QUÉBEC INCOME TAX WITHHELD AT SOURCE

Enter in box J of the RL-2 slip (see courtesy translation RL-2-T) the amount of Québec income tax withheld at source during the year, including the special tax withheld at source from an eligible income-averaging annuity for artists. Leave box J blank if no Québec income tax was withheld.If the amount in box J includes the special tax withheld at source from an eligible income-averaging annuity for artists, write “C-9” in a blank box, followed by the amount of the special tax.

BOX K – INCOME EARNED AFTER DEATH (RRSP, RRIF, PRPP OR VRSP)

In box K of the RL-2 slip (see courtesy translation RL-2-T), you must enter certain amounts paid to the beneficiary of property held in a plan or fund following the death of an annuitant of:

a registered retirement savings plan (RRSP);

a registered retirement income fund (RRIF);

a pooled registered pension plan (PRPP);

a voluntary retirement savings plan (VRSP).

BOX L – WITHDRAWAL UNDER THE LLP

If, under the Lifelong Learning Plan (LLP), you paid an amount to the annuitant of a registered retirement savings plan (RRSP), enter in box L of the RL-2 slip (see courtesy translation RL-2-T) the lesser of the following amounts:

the amount paid under the LLP;

$10,000.

If the amount exceeds $10,000, you must enter $10,000 in box L and the excess amount in box C

BOX M – TAX-PAID AMOUNTS

Death of an RRSP annuitant : Enter in box M of the RL-2 slip the amount paid to the beneficiary of property held in a registered retirement savings plan (RRSP) that represents:

in the case of a depositary RRSP, the interest or income credited or added to the RRSP after the end of the year following the year of death (the amount must also be entered on an RL-3 slip; see courtesy translation RL-3-T);

in the case of a trusteed RRSP, the income accrued after the end of the year following the year of death that would be included in the trust's income if the income were specified income without taking into account section 657 of the Taxation Act.

Death of a RRIF annuitant : Enter in box M the amount paid to the beneficiary of property held in a registered retirement income fund (RRIF) that represents:

in the case of a depositary RRIF, the interest or income accrued or credited to the RRIF after the end of the year following the year of death (the amount must also be entered on an RL-3 slip);

in the case of a trusteed RRIF, the income accrued after the end of the year following the year of death that would be included in the trust's income if the income were specified income without taking into account section 657 of the Taxation Act.

BOX N – SOCIAL INSURANCE NUMBER OF THE CONTRIBUTOR SPOUSE (RRSP OR RRIF)

Spousal RRSP : Enter the social insurance number of the annuitant's spouse in box N of the RL-2 slip (see courtesy translation RL-2-T) if the following conditions are met:

There is an amount in box B, box C, box F or box G.

The annuitant's spouse contributed to the registered retirement savings plan (RRSP), or a payment or property was transferred from another RRSP or spousal registered retirement income fund (RRIF) to the spousal RRSP.

Spousal RRIF : Enter the social insurance number of the annuitant's spouse in box N if the following conditions are met:

There is an amount in box C or box G.

A payment or property was transferred from another RRIF or spousal RRSP to the spousal RRIF.

BOX O – WITHDRAWAL UNDER THE HBP

If, under the Home Buyers' Plan (HBP), you paid an amount to the annuitant of a registered retirement savings plan (RRSP), enter in box O of the RL-2 slip (see courtesy translation RL-2-T) one of the following amounts, whichever is less:

the amount paid under the HBP;

$35,000.

If the amount paid exceeds $35,000, you must also enter the excess amount in box C

ADDITIONAL INFORMATION TO BE ENTERED ON THE RL-2 SLIP

To provide additional information on the RL-2 slip (see courtesy translation RL-2-T), enter a code in a blank box, followed by the corresponding amount or information.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca