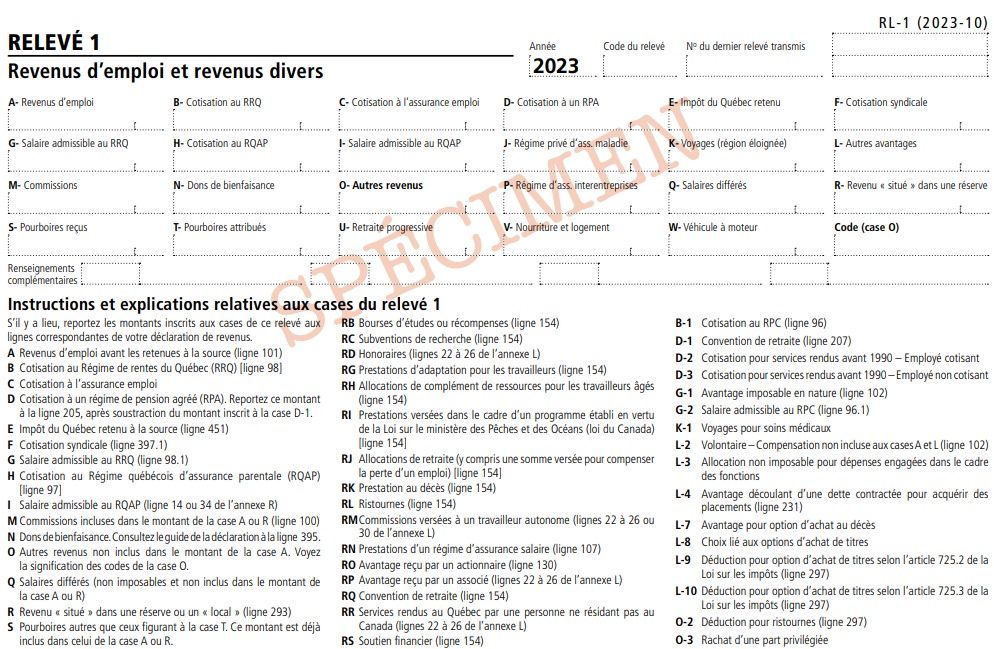

RL-1 Slip – Employment and Other Income

The RL-1 slip must be filed by

You are required to file an RL-1 slip if, in the year, you:

Enter in box A of the RL-1 slip (see courtesy translation RL-1-T) the salary or wages and any other remuneration (including bonuses) paid to an employee for an office or employment, except the portion of such income included in Box R that constitutes employment income situated on a reserve or premises. The amounts entered in box A must be calculated before source deductions.

You must enter the amounts in box A of the RL-1 slip for the year in which they are paid. For example, if you pay an amount on January 2, 2024, for the pay period covering December 22, 2023, to January 2, 2024, enter this amount in box A of the employee's RL-1 slip for 2024, not on the slip for 2023.

BOX BEnter in box B of an employee's RL-1 slip (see courtesy translation RL-1-T) the total Québec Pension Plan (QPP) contributions withheld (base contribution and first additional contribution), including amounts withheld:

Enter in box C of the RL-1 slip the total Employment Insurance premiums withheld. Leave the box blank if no amount was withheld.

BOX DEnter in box D of the RL-1 slip (see courtesy translation RL-1-T) the total of the following amounts:

Enter in box E of the RL-1 slip the total Québec income tax withheld, including income tax withheld:

Leave the box blank if you did not withhold any Québec income tax. Do not include in box E the income tax withheld pursuant to an order to seize property in the hands of a third person or a formal demand for payment regarding income tax owing with respect to a previous year. BOX F

Enter in box F of the RL-1 slip the total amounts you withheld as union dues if the following conditions are met:

Do not include membership fees in box F. BOX G

Enter in box G of the RL-1 slip (see courtesy translation RL-1-T) the pensionable salary or wages under the Québec Pension Plan (QPP) (maximum for 2023: $66,600). If there is no pensionable salary or wages under the QPP for the year, enter “0.”

BOX HEnter in box H of an employee's RL-1 slip the total Québec parental insurance plan (QPIP) premiums withheld during the year, including amounts withheld:

Also enter in box H any employee QPIP premium that you paid that is included in box L. Do not correct the amount in box H if it is too high. Leave the box blank if you did not withhold QPIP premiums. BOX I

Enter in box I of the RL-1 slip (see courtesy translation RL-1-T) the eligible salary or wages under the Québec parental insurance plan (QPIP) (maximum for 2023: $91,000). If there is no eligible salary or wages under the QPIP for the year, enter “0.” The amount of the eligible salary or wages under the QPIP generally corresponds to the amount of insurable earnings on which you withhold Employment Insurance premiums.

BOX JYour contribution to a private health services plan, for the coverage that a current, former or future employee receives during the year, may constitute a taxable benefit. If this is the case, you must enter the value of the benefit in box J of the RL-1 slip

BOX KTrips you pay for on behalf of an employee (or an eligible family member) who was a resident of a designated remote area may constitute a taxable benefit for the employee. If this is the case, you must enter the value of the benefit in box K of the RL-1 slip

BOX LEnter in box L of the RL-1 slip (see courtesy translation RL-1-T) the value of all taxable benefits granted to an employee whose value must not be included in the following boxes:

Enter in box M of the RL-1 slip the total of the following amounts:

Enter in box N of the RL-1 slip the total of any amounts withheld as donations and gifts and paid on behalf of the employee to a registered charity or other qualified donee.Special rules apply if the employee received a benefit from the donee because of the donation or gift.

BOX OUse box O to report income that is not entered elsewhere on the RL-1 slip . For more information visit RL-1 SLIP – BOX O

BOX PThe contribution to a group insurance plan (other than insurance for total or partial loss of employment income) that you pay to the administrator of a multi-employer insurance plan may constitute a taxable benefit for a current, former or future employee. If it does, you must enter the value of the benefit in box P of the RL-1 slip

BOX QIf you are an employer, enter in box Q of the RL-1 slip the total of the amounts you paid to a custodian or a trustee of an employee benefit plan, a profit‑sharing plan or an employee trust. These payments are not to be included in boxes A and L.

BOX RIf you are filing an RL‑1 slip for an Indian employee, enter in box R the total of the following amounts:

If you are filing an RL‑1 slip for an employee who worked in the restaurant, bar or hotel sector, enter the total of the following amounts in box S:

If you are filing an RL-1 slip for an employee who worked in the restaurant, bar or hotel sector, enter in box T the tips that you allocated during the year.

BOX UEnter in box U of the RL-1 slip the deemed salary or wages paid under a phased retirement arrangement that has been approved by Retraite Québec.The amount entered in box U is used to calculate additional Québec Pension Plan (QPP) contributions.

BOX VThe allowance you pay to an employee for meals and lodging, and the meals, board and lodging you provide to the employee, may constitute a taxable benefit for them. If this is the case, you must enter the value of the benefit in box V of the RL-1 slip.

BOX WThe personal use of a motor vehicle that you make available to an employee (or to a person related to the employee) may constitute a taxable benefit for the employee. If this is the case, you must enter the value of the benefit in box W of the RL-1 slip.

BOX MARKED “CODE (CASE O)”Where applicable, enter in the box marked “Code (case O)” the alphabetic code corresponding to the type of income reported in box O of the RL-1 slip (see courtesy translation RL-1-T). For information about the codes that must be entered in the box marked “Code (case O),” consult RL-1 Slip – Box O.

If more than one code applies to the amount in box O, enter “RZ” in the box marked “Code (case O).” For each type of income, enter the appropriate code in one of the blank boxes followed by the corresponding amount.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 12 June 2024