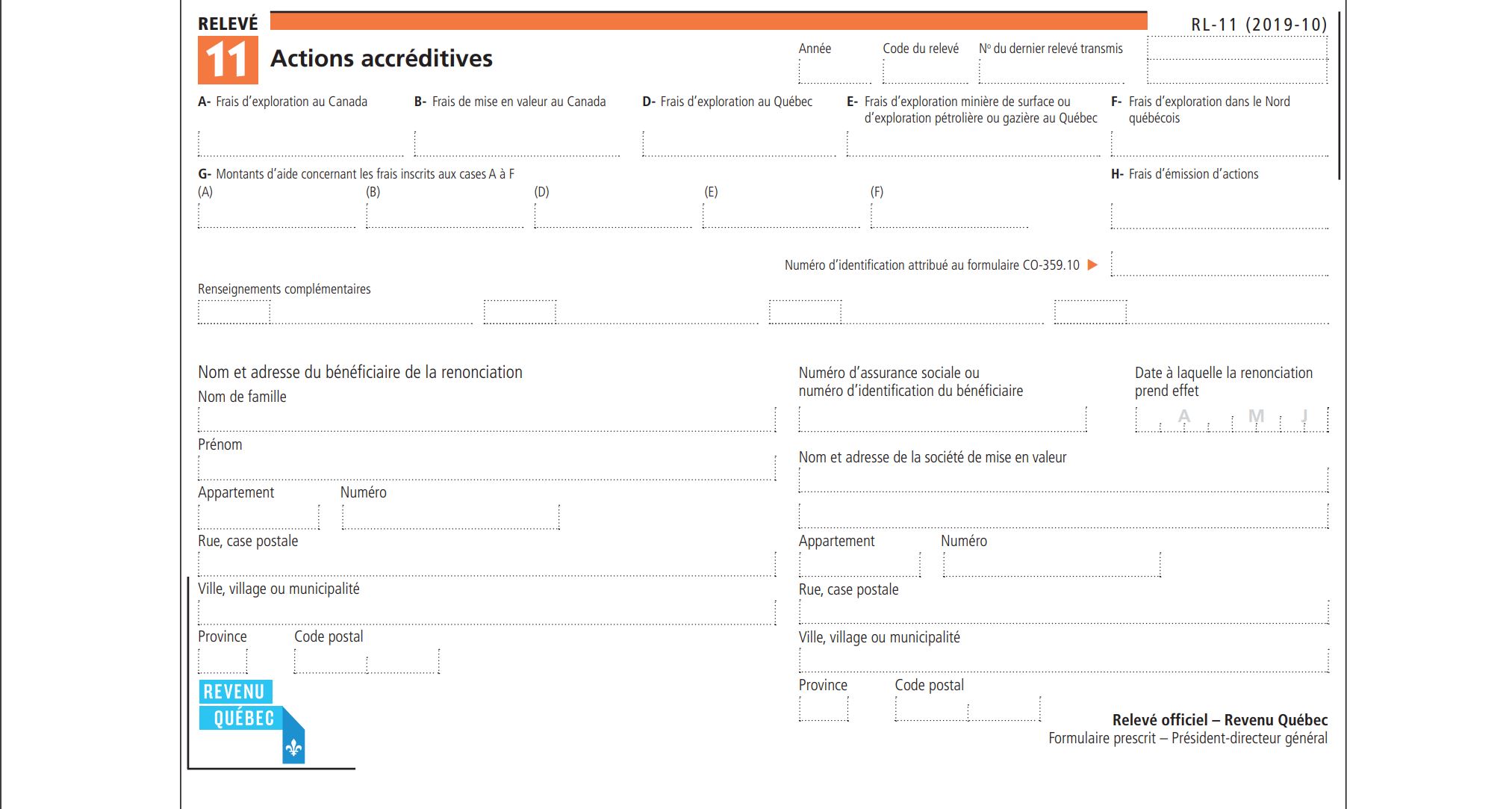

RL-11 Slip – Flow-Through Shares

The RL-11 slip must be filed by any development corporation that entered into a written agreement with investors to issue flow-through shares and, consequently, to incur Canadian exploration expenses or Canadian development expenses and to renounce those expenses in favour of the investors (the beneficiaries of the renunciation).

Purpose of the RL-11 slipThe RL-11 slip is used to report information concerning:

Enter the amount of Canadian exploration expenses.

Enter the amount of Canadian development expenses.

Enter the amount of Québec exploration expenses, which are included in box A.

Box E – Québec surface mining exploration expenses or oil and gas exploration expensesEnter the amount of Québec surface mining exploration expenses or oil and gas exploration expenses, which are included in box D.

Box F – Expenses for exploration in northern QuébecEnter the amount of expenses for exploration in northern Québec, which are included in box D.

Box G – Amounts of assistance corresponding to the expenses reported in boxes A through FEnter in the appropriate box the renouncee’s share of the amounts of assistance corresponding to the expenses reported in boxes A through F.

Box H – Share issue expensesEnter the amount of the share issue expenses renounced by the corporation in favour of a renouncee.

Boxes under “Renseignements complémentaires” (additional information) Box A-1Renewable and conservation expenses incurred in Québec. See the instructions for line 260 in the guide to the income tax return

Box A-2

Québec exploration expenses that do not give entitlement to an additional deduction. See the instructions for line 260 in the guide to the income tax return.

Box B-1Québec development expenses. See the instructions for line 260 in the guide to the income tax return.

Box B-2Accelerated Canadian development expenses. You can claim a deduction for these expenses on line 241 of your return. For information on how to calculate the deduction, contact Revenu Québec.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 26 June 2024