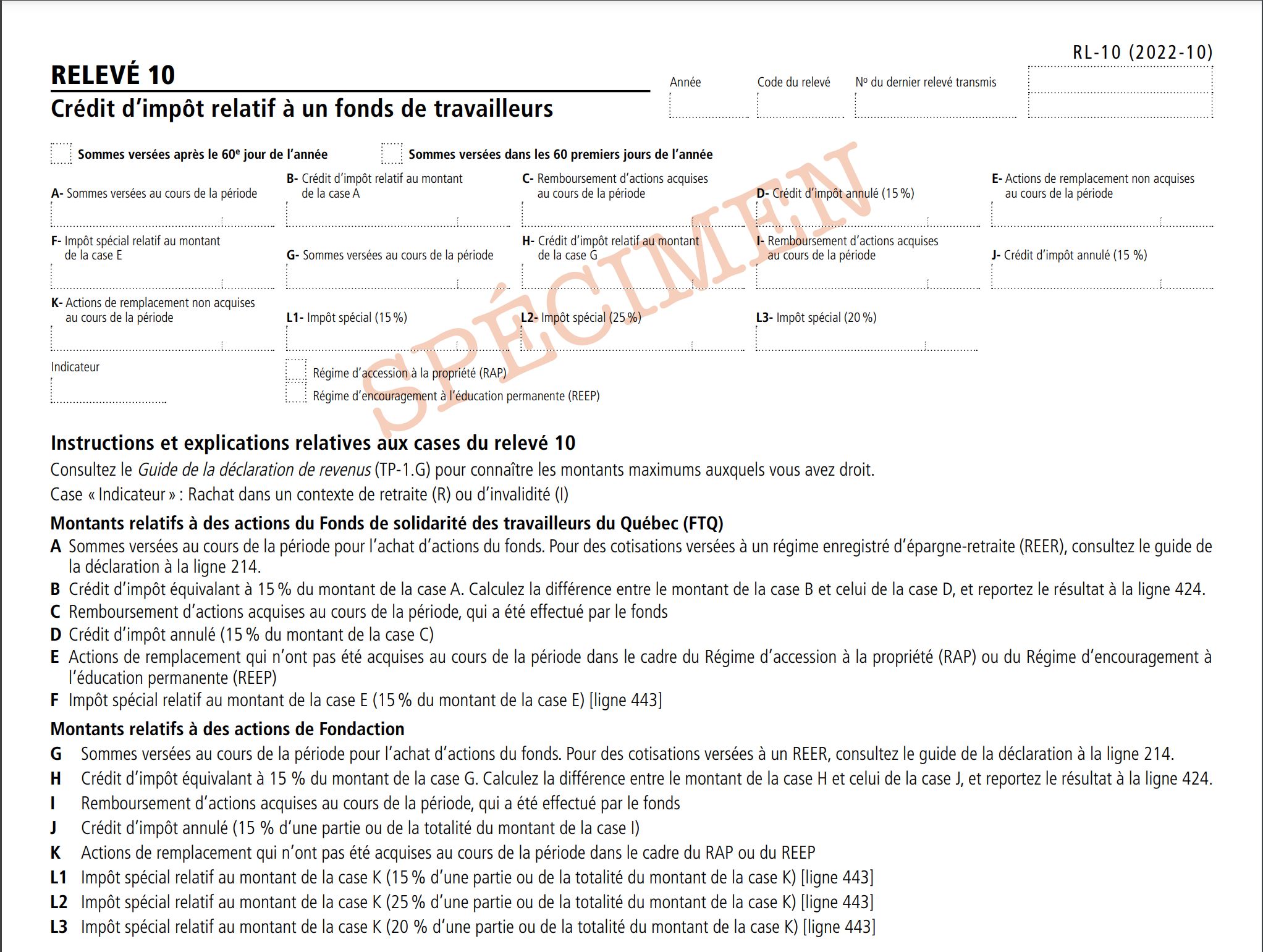

RL-10 Slip – Tax Credit for a Labour-Sponsored Fund

The RL-10 slip must be filed by:

Amounts paid during the period to purchase shares in the fund. For contributions to a registered retirement savings plan (RRSP), see the instructions for line 214 in the guide to the income tax return

Box BTax credit equal to 15% of the amount in box A. Calculate the difference between the amount in box B and the amount in box D, and enter the result on line 424.

Box CAmount received from the fund further to the redemption of shares acquired during the period.

Box DCancelled tax credit (15% of the amount in box C)

Box EReplacement shares that were not acquired during the period under the Home Buyers’ Plan (HBP) or the Lifelong Learning Plan (LLP).

Box FSpecial tax on the amount in box E (15% of the amount in box E). Enter this amount on line 443.

Amounts related to shares in Fondaction Box GAmounts paid during the period to purchase shares in the fund. For contributions to a registered retirement savings plan (RRSP), see the instructions for line 214 in the guide to the income tax return.

Box HTax credit equal to 15% of the amount in box G. Subtract the amount in box J from the amount in box H and enter the result on line 424.

Box IAmount received from the fund further to the redemption of shares acquired during the period.

Box JCancelled tax credit (15% of all or part of the amount in box I)

Box KReplacement shares that were not acquired during the period under the Home Buyers’ Plan (HBP) or the Lifelong Learning Plan (LLP).

Box L1Special tax on the amount in box K (15% of all or part of the amount in box K). Enter this amount on line 443.

Box L2Special tax on the amount in box K (25% of all or part of the amount in box K). Enter this amount on line 443.

Box L3Special tax on the amount in box K (20% of all or part of the amount in box K). Enter this amount on line 443.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 26 June 2024