Key Takeaways

Ontario Tax Reduction Credit is designed to reduce or eliminate the amount of Ontario provincial tax payable based on family circumstances.

The amount of the Ontario Tax Reduction Credit depends on residency, amount of provincial tax payable, marital status, and the number of dependents.

A reduction can be claimed for each dependant under the age of 18, and/or each dependant over the age of 18 with mental or physical disabilities.

If you have a spouse, the spouse with the higher income can claim the tax reduction credit.

Ontario Tax Reduction Credit is designed to reduce or eliminate the amount of Ontario provincial tax payable based on family circumstances. Other provinces also offer similar provincial tax reduction credits such as:

Alberta Child and Family Benefit (ACFB)

British Columbia Family Benefit

Prince Edward Island Children’s Wellness Tax Credit

Newfoundland and Labrador Child Benefit (NLCB)

The amount of the deduction will depend on the following factors:

Where you lived at the beginning and end of the tax year

Your provincial income tax payable

Your marital status

The number of dependents

Let’s explore the eligibility criteria in detail:

Ontario residency : The individual must be a Canadian resident on January 1 of the tax year and an Ontario resident on December 31 of the same year. The Ontario Tax Reduction is not allowed for immigrant returns unless the date of entry to Canada is January 1. In the case of Emigrants, the tax reduction is disallowed unless the date of departure was December 31 of the tax year.

The dependants :The individual can claim a reduction for each dependant under the age of 18, and/or each dependant over the age of 18 with mental or physical disabilities. If any dependant turns 18 (or dies) during the tax year, the full reduction amount can still be claimed. If the dependant became the eligible dependant of another individual, the deduction can not be claimed.

Marital status : If you are married as at the December 31, the spouse with a higher net income can claim the tax reduction. If you get separated or divorced in the tax year, the parent receiving the Canada Child Benefit (CCB) will claim the entire tax reduction amount. If both parents receive equal Canada Child Benefit (CCB) amount as part of a court settlement, the parent with the lower income can claim the tax reduction.

In order to claim the Ontario Tax Deduction Credit, you need to file your personal income tax and benefits return (T1), specifically Form ON428 - Ontario Tax.

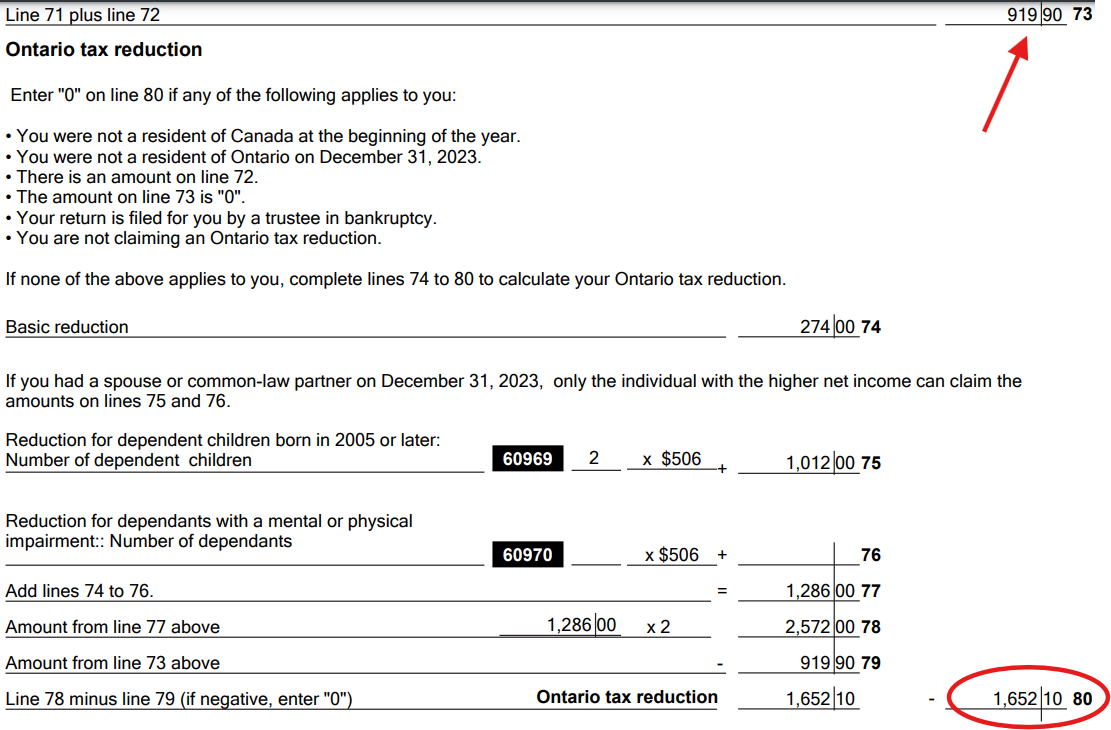

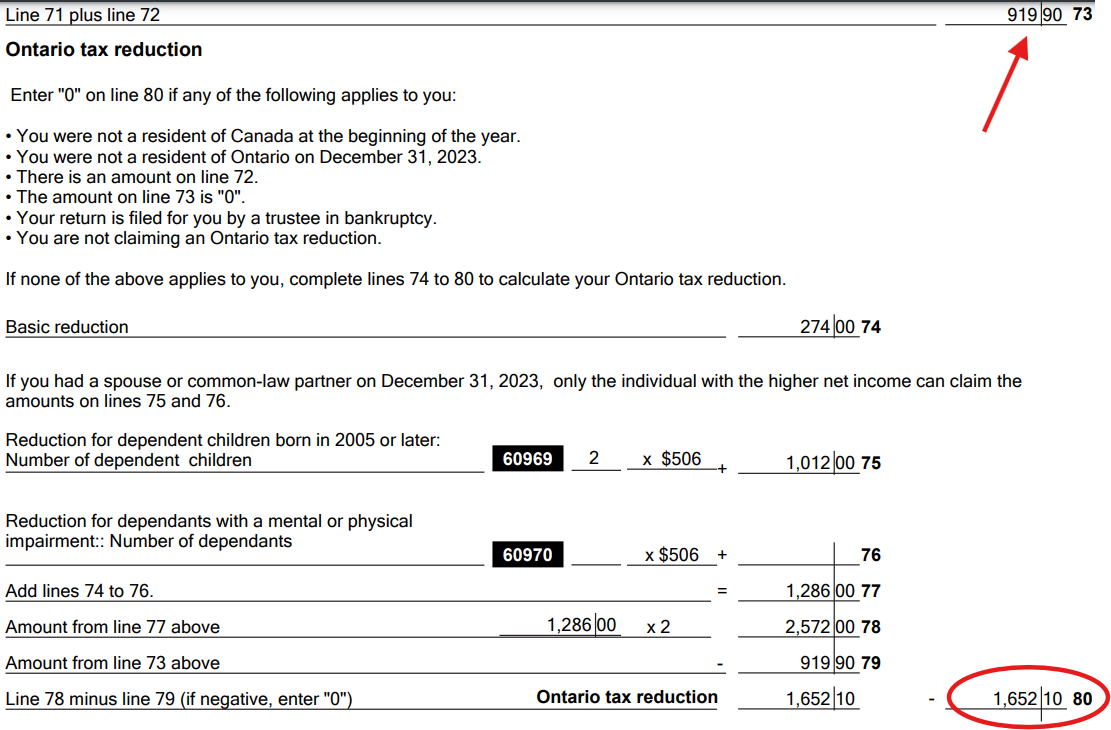

Let’s look at an example. John is married to Sue and they have two children under the age of 18, Mark and Julie. They were Ontario residents as at December 31 of the tax year. Since John has the higher income and he has a tax payable of $919 (line 73), he can claim the Ontario Tax Reduction for his dependants. His Ontario Tax Reduction amount is $1,652 (line 80):

As these amounts and thresholds vary from year to year, you are advised to visit the Canada Revenue Agency (CRA) website (Canada.ca) for the most up-to-date information.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca