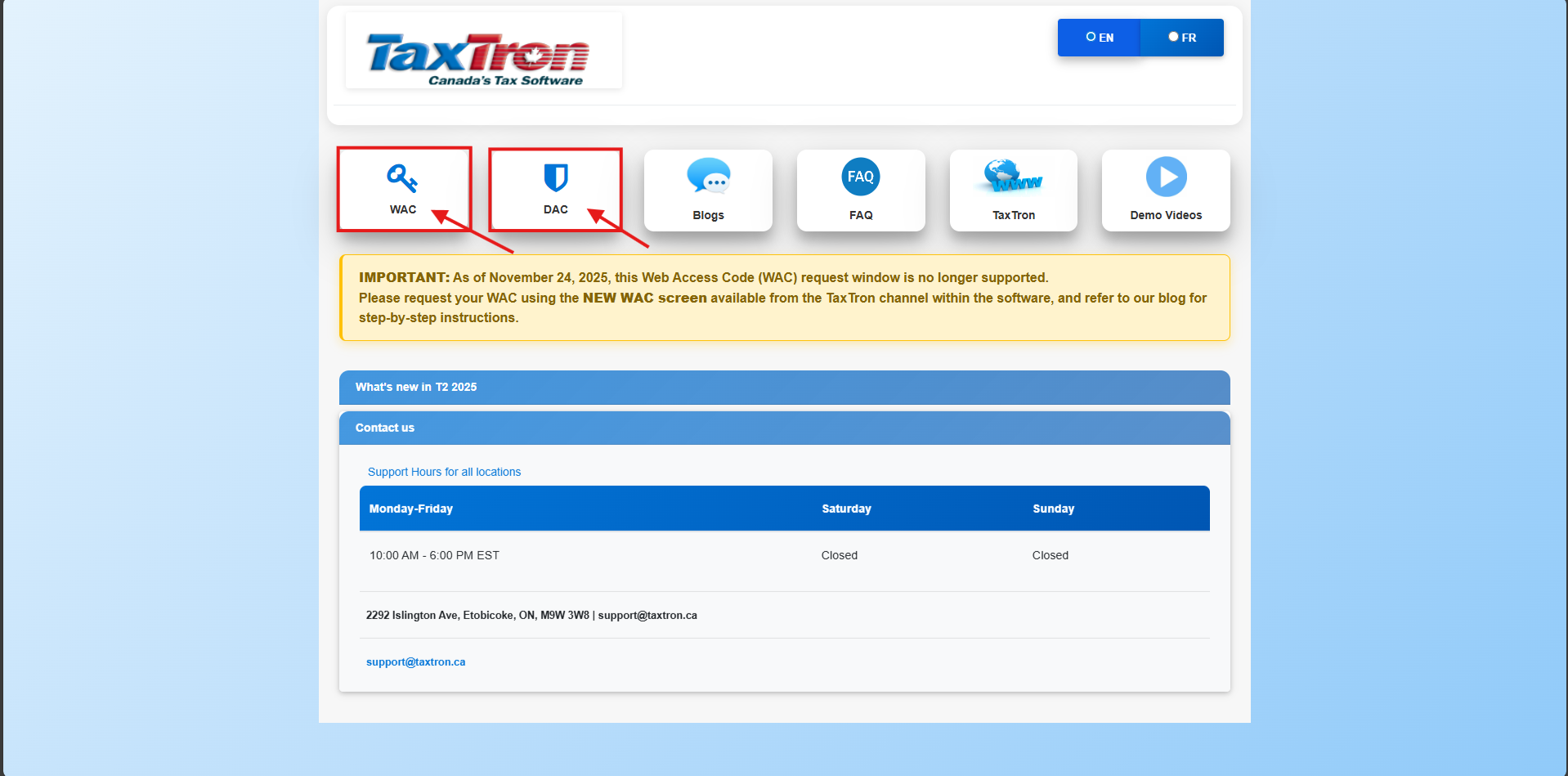

The Canada Revenue Agency (CRA) has strengthened the security requirements for online Web Access Code (WAC)/Digital Access Code (DAC) requests. To enhance verification and protect taxpayer information, the CRA now requires additional mandatory fields when submitting a WAC/DAC request.

Beginning November 24, 2025, the CRA automatically rejects any online WAC/DAC request submitted using TaxTron T2 versions earlier than 2025.2

However, for users working with older versions:

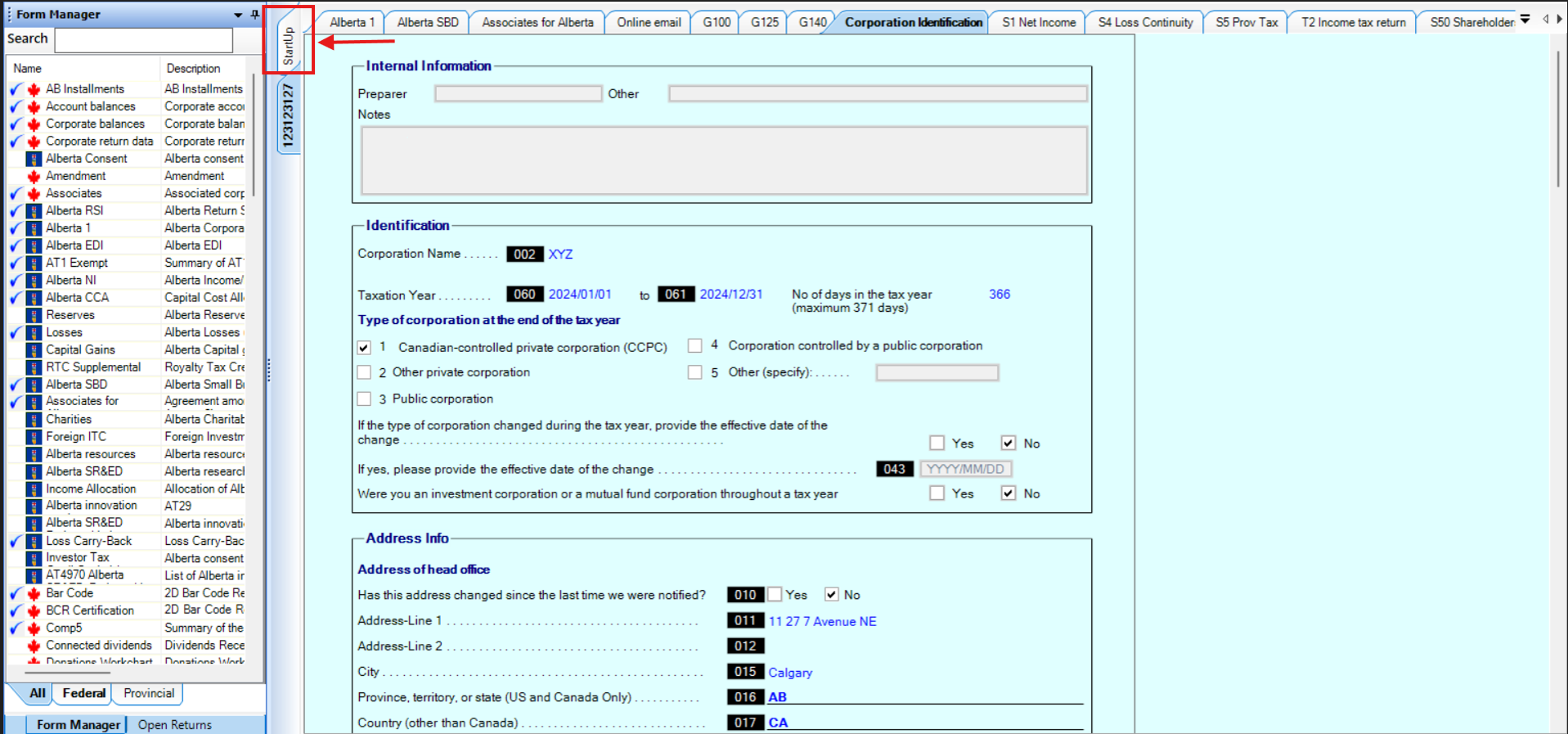

- WAC/DAC requests can still be submitted, but only from the program’s Startup screen/TaxTron Channel Get WAC/DAC Now!

What Information Is Now Required?

When requesting a WAC/DAC online, corporations must provide:

- The issue date from their most recent Notice of Assessment (NOA) or Reassessment

-

Any one of the following amounts from that same NOA:

- Part I Tax

- Total Federal Tax

These new fields ensure that only authorized users can access or submit corporate tax information.

Posted on 20 November 2025