When employees transition out of a job, whether due to retirement or severance, they may receive financial packages known as severance or retiring allowances. Knowing how these payments are taxed is crucial for effective financial planning. This blog covers the differences between eligible and non-eligible retiring allowances, their tax treatments, and strategies for minimizing tax impacts.

What Are Severance and Retiring Allowances?

Severance pay is a payment made to employees upon job termination, often as recognition of service. A retiring allowance is sometimes provided upon retirement, acknowledging years of service. These allowances can include payouts for unused sick leave or other final settlements.

Eligible vs. Non-Eligible Retiring Allowances

Tax Treatment of Eligible Retiring Allowances

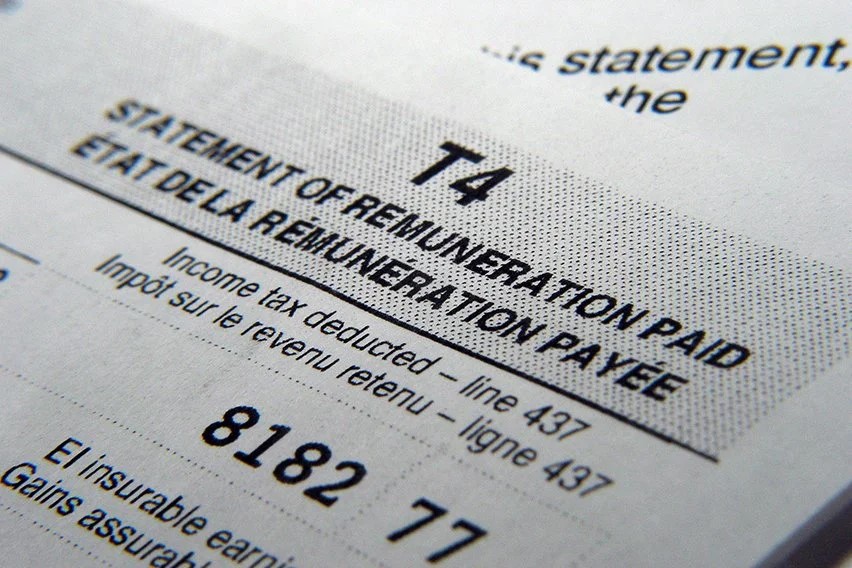

Eligible retiring allowances are reported in box 66 on the T4 slip. Here’s how to manage them for tax advantages:

Practical Example

Alex, who worked from 1988 to 2021, received a $60,000 severance package with $17,500 indicated in box 66. His eligible amount is calculated as follows:

Alex can transfer $17,500 to his RRSP tax-free and report this transfer on his tax return, allowing tax benefits and deferred growth.

Handling Non-Eligible Retiring Allowances

Non-eligible allowances, reported in box 67, are taxed immediately and are subject to RRSP contribution limits.

Conclusion

Understanding eligible vs. non-eligible allowances is vital for tax planning. Eligible allowances allow direct RRSP transfers, deferring tax, and fostering retirement savings growth, while non-eligible allowances require immediate tax reporting and stricter contribution limits.

Posted on 14 November 2024