Pension splitting is a tax strategy which allows married or common-law couples to allocate up to 50% of eligible pension income from one spouse to the other for tax purposes. The couple must be residents of Canada in order to qualify for pension-splitting. The spouse transferring the income deducts the split amount from their taxable income. The spouse receiving the income includes the split amount in their taxable income. By doing so, they can potentially reduce their overall tax liability. There are no limits on the age of the receiving spouse as long as he/she is of legal age. Eligible couples are individuals who are either married or in a common-law relationship, residents of Canada, and have not lived apart due to a breakdown in relationship.

Not all pension incomes qualify and can be split between couples. Eligible pension incomes for pension-splitting are (source: Canada.ca):

Couples who are filing their income tax returns together must each fill out, sign, and attach Form T1032, Joint Election to Split Pension Income, to their returns. It is critical that the information on both forms is identical. For those who use TaxTron Web, the software will automatically calculate the optimum pension-split amount, fill out both copies of the form and EFILE as an attachment to the return. If you want to amend the amount elected previously, or make any changes to the previously-reported pension income, a new completed and jointly-signed Form T1032 is required. The amendment of the election amount is simplified through the ReFILE function where the user can easily navigate to the T1032 screen, revise the election amount, and ReFILE the return.

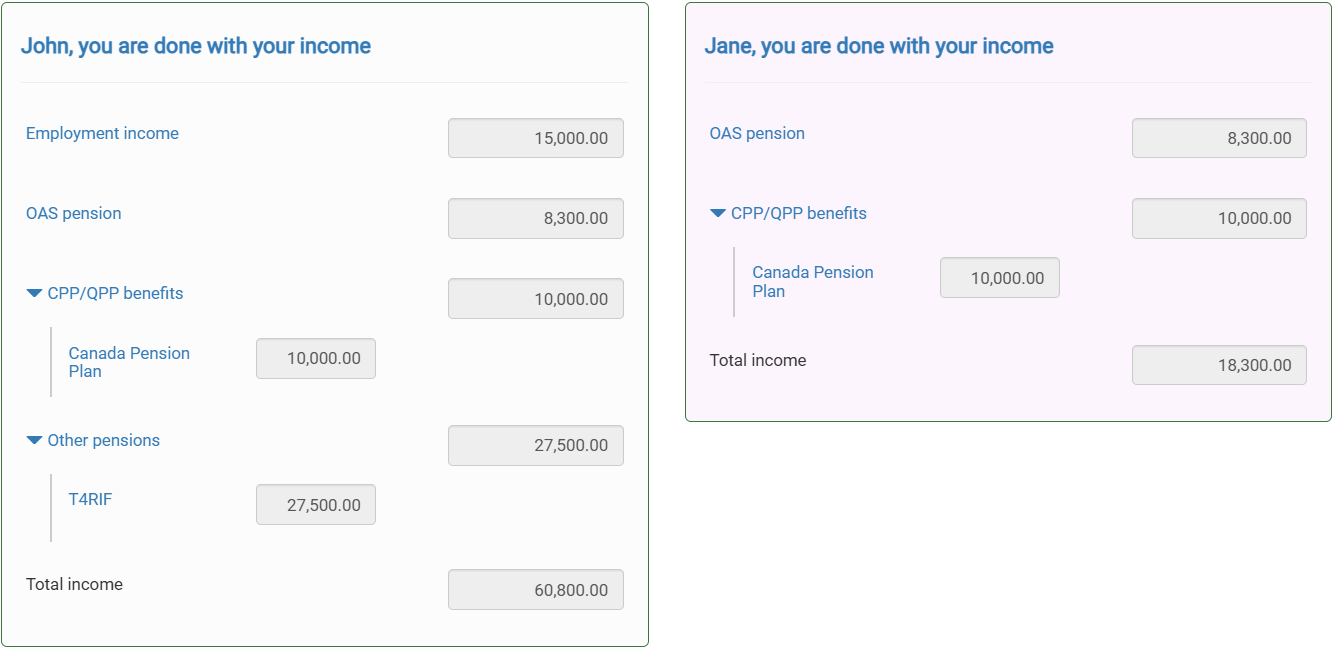

Let’s look at an example using TaxTron WebJohn Doe who was born on January 1, 1950, is married to Jane Doe (January 1, 1950). In addition to his government pension (CPP, OAS), company pension from Manulife (T4RIF), John also works at the local Walmart to supplement his income. Jane only receives government pension. Below is a snapshot of their income summary for the 2023 tax year:

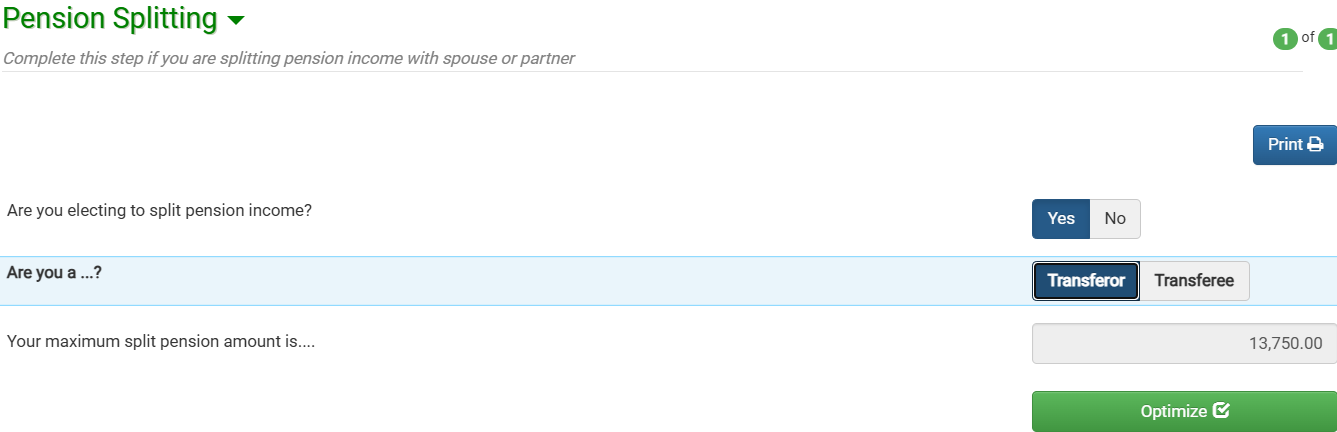

In order to split his pension income with his spouse, John will proceed to the “Pension-Splitting” screen:

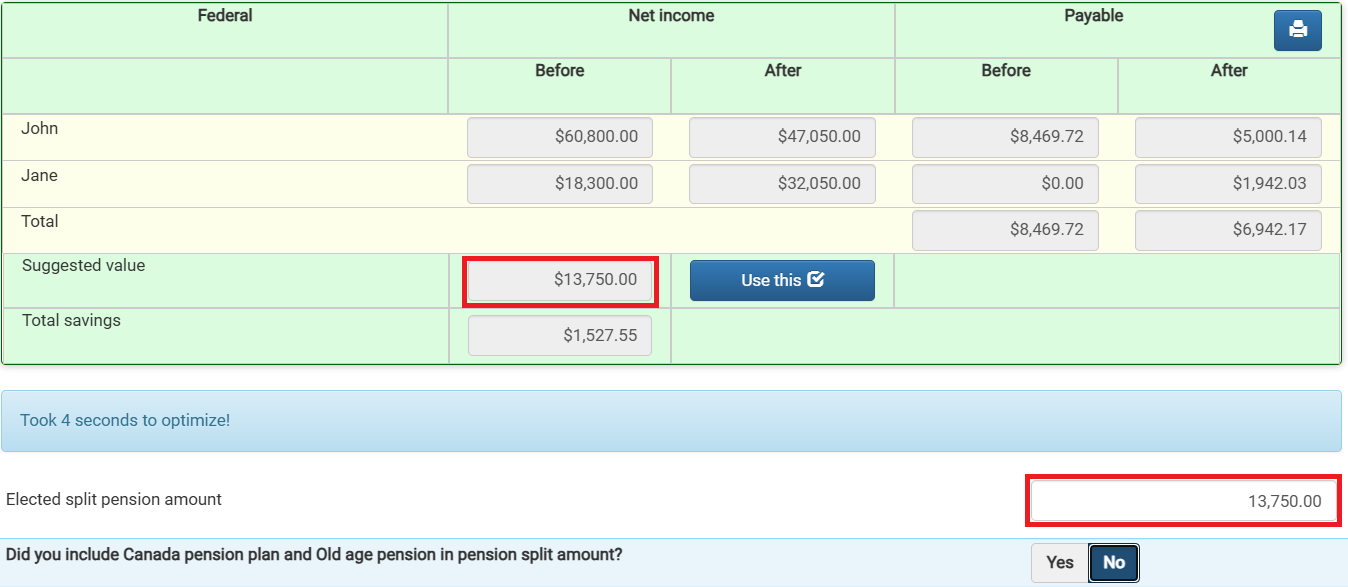

Optimization feature built into TaxTron will automatically calculate the optimal pension amount that will be transferred to Jane and the total savings resulting from the split -pension:

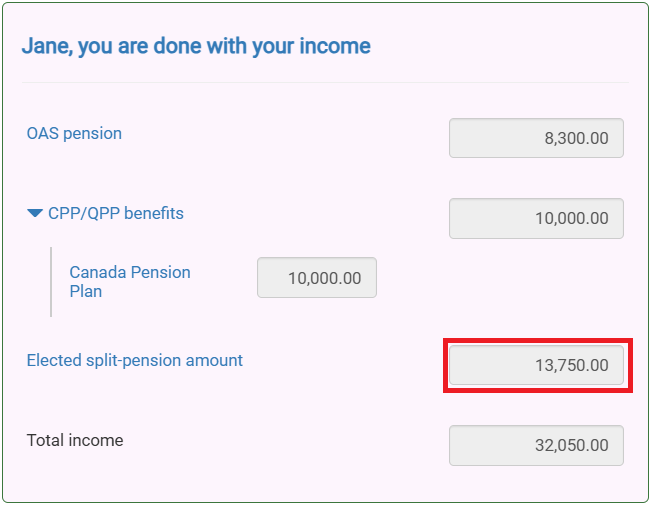

After the split-pension, Janes’s total income increases by the split-pension amount:

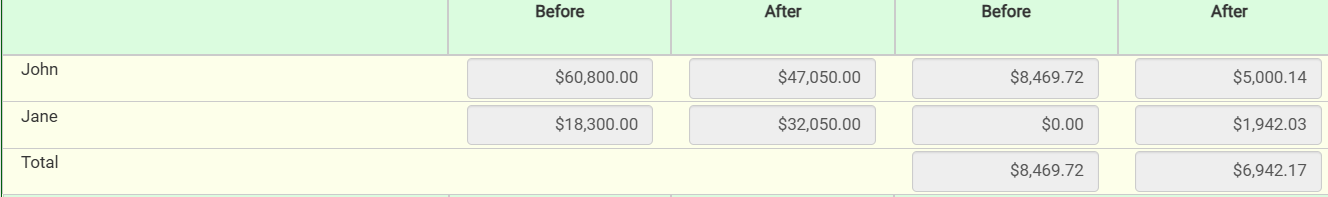

If John and Jane decided to forego pension-splitting their “Total tax payable” would increase by $1,527.55 ($8,469.72 – $5,000.14 - $1,942.03):

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 07 July 2024