As a parent, paying for your child’s college tuition can be a significant financial commitment especially now when the economy is slowing down and costs are rising. However, the tuition tax credit provides a valuable opportunity to offset some of these costs. This non-refundable credit allows you to use the tuition fees you have paid to reduce your taxable income. In this blog we will explore the intricacies of the tuition tax credit and how you as a parent can claim this credit on your taxes. For the purposes of this blog, we will use screenshots from TaxTron T1 Web to demonstrate how is it is to claim this credit using our software.

The tuition tax credit is a non-refundable tax credit available to post-secondary students in Canada. If you pay for your child’s tuition and other eligible educational costs such as exam fees, you can claim this amount when filing your personal income tax return. The credit equals to 15% of the amount paid in eligible tuition fees during the year, up to a maximum of $5,000 per child. If you have more than one child, your second or third child can also transfer a maximum of $5,000 in tuition amounts to you as the parent. In this case, assuming three children each transferring $5,000 in tuition amounts, the total amount you can claim as transfer tuition is $15,000.

Eligible tuition fees are fees paid by an individual to a post-secondary educational institution in Canada (that provides courses at a post-secondary level) or, fees paid by a deemed resident of Canada, to a post-secondary educational institution outside Canada (that provides courses at a post-secondary level), for courses that are not at the post-secondary school level are eligible for the tuition tax credit if the following conditions are met:

All eligible tuition amounts are reported using the T2202 Form – Tuition and Enrollment Certificate or TL11A – Tuition and Enrollment Certificate – Outside of Canada. The T2202 form is an official tax slip issued by qualified educational institutions in Canada. It's provided to students who have paid tuition or fees for eligible courses. TL11A is issued by universities outside of Canada certifying a student's eligibility for the tuition, education, and textbook amounts. Students show the transfer of tuition, education, and textbook amounts to a designated individual on it.

It is important to note that your child has the first claim to his/her current year's eligible tuition fees and any unused tuition, education, and textbook amounts carried forward from previous years on their Income Tax and Benefit Return, even if you paid his/her fees. This means that if your child has income and will need the tuition tax credit to reduce their tax payable, they have the first claim to the tuition amounts and they can not transfer the credit to you before they reduce their tax payable.

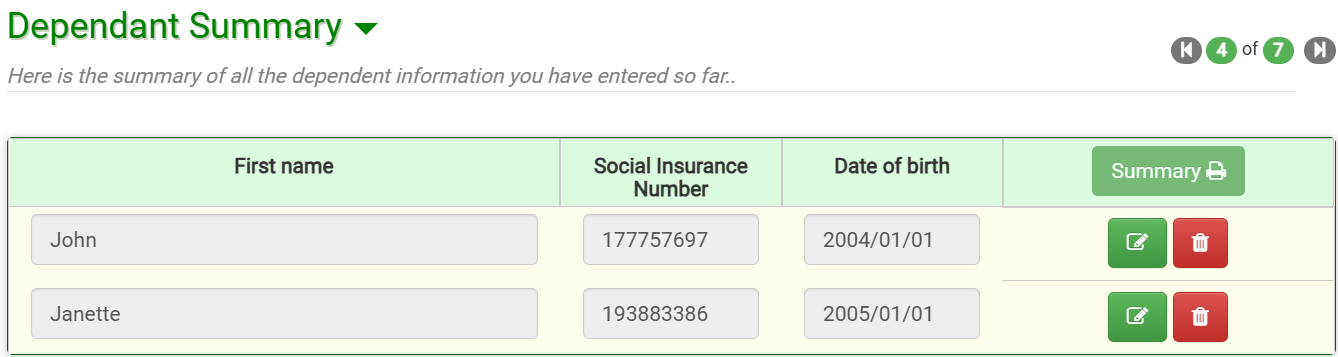

Let’s look at an example using TaxTron WebJohn Doe who is married to Jane Doe pays for his children’s college tuitions. John Doe Jr. attends University of Toronto and Janette Doe attends McMasters University. John paid $30,000 in eligible tuition amounts for John Jr. and $35,000 for Janette. For the purposes of this example, we will assume that both John Jr. and Janette had zero income in the tax year.

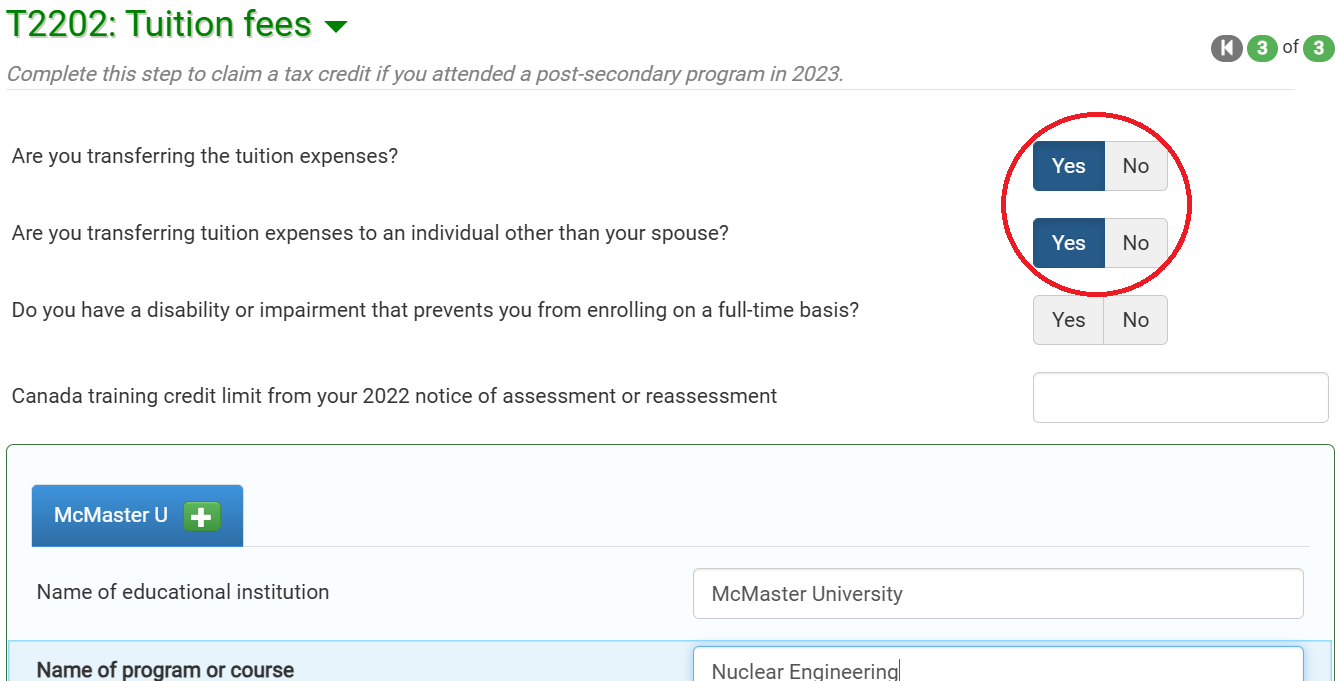

We are also assuming that John Jr. and Janette have filed their taxes using TaxTron Web and they have both transferred their tuition amounts to their parents since they had no income and therefore no taxes payable. The maximum tuition that can be transferred to a parent or a spouse is $5,000 and the remainder will be carried forward to future years. In the case of John Jr. $25,000 (30,000-5,000) will be carried forward to future years and $30,000 in tuition amounts will be carried forward for Janette. Below is a screenshot of Janette’s T2202 Tuition fees screen:

Now in order for John Doe to claim the tuition transfers from his children, he will need to activate the tuition transfer screen as demonstrated below:

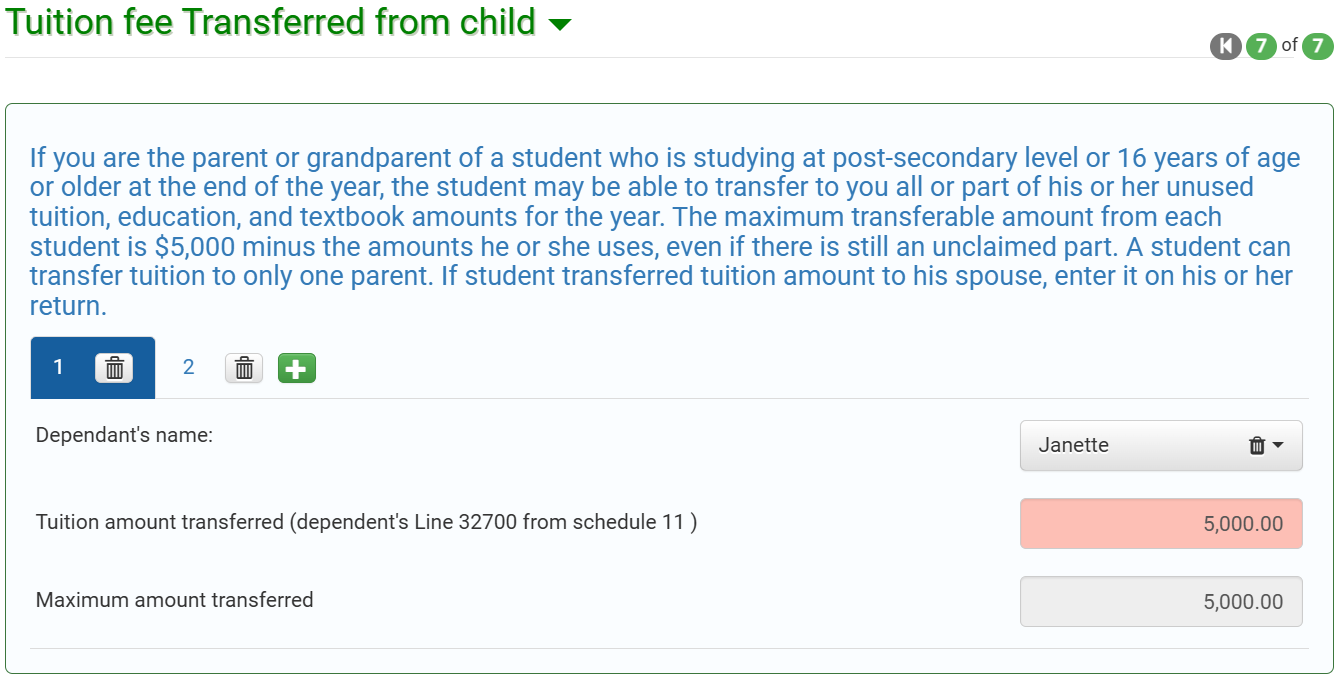

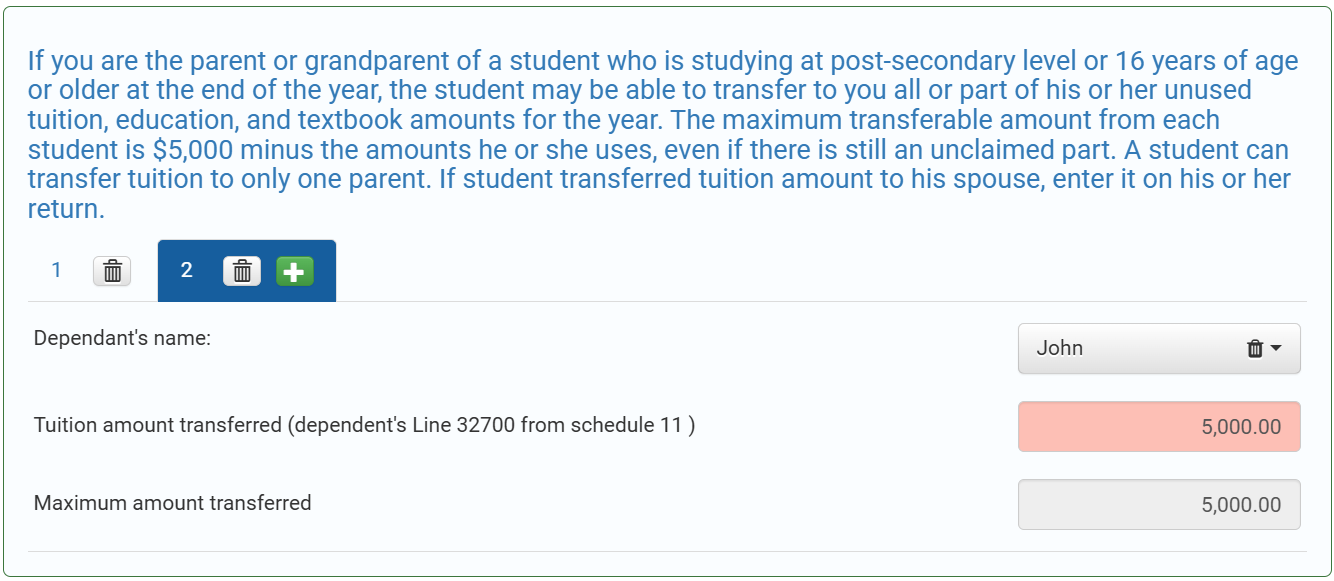

In the next screen, he will be required to input the tuition amounts which have been transferred from John Jr. and Janette:

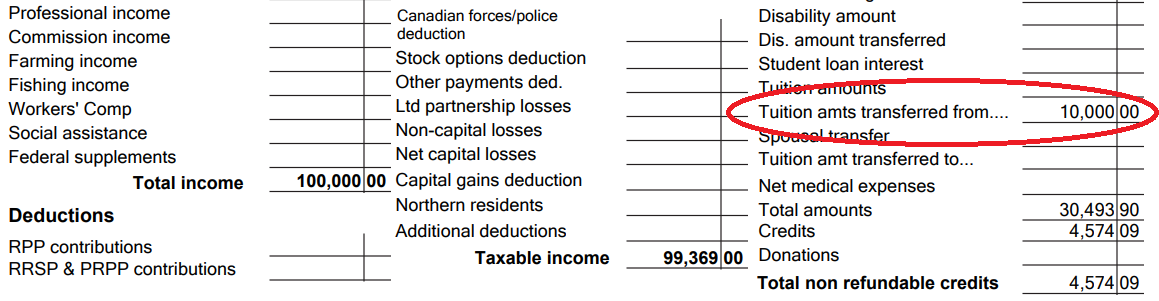

That is all! John has received $10,000 in tuition amounts transferred from his children which will reduce his tax payable by $1,500 (10,000 x 15%).

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 07 July 2024