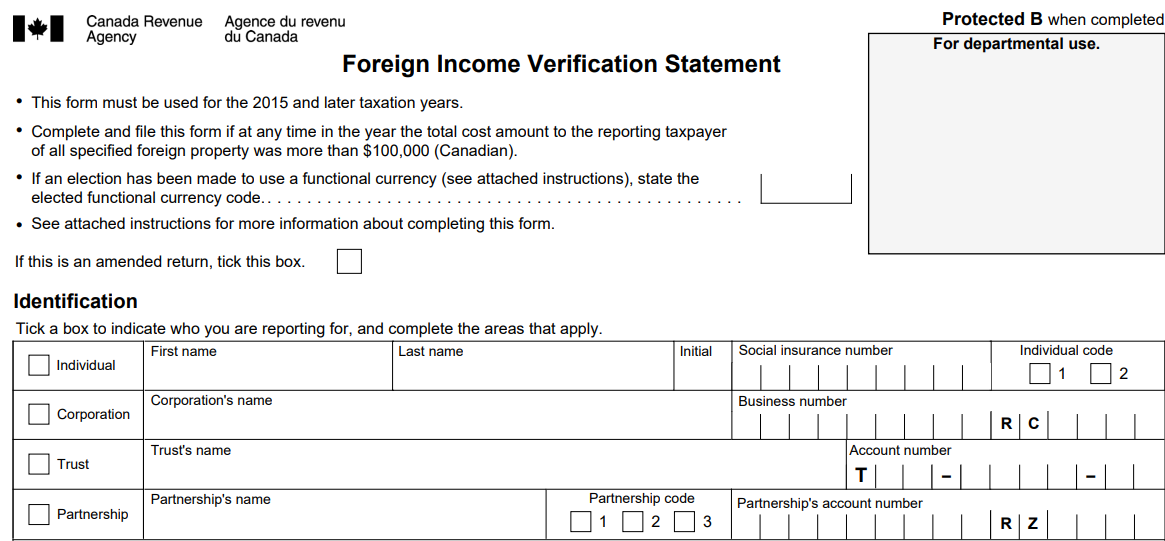

As a Canadian resident, if you own foreign property, it’s crucial to understand the reporting requirements set by the Canada Revenue Agency (CRA). When the total cost of your foreign property exceeds CAD 100,000 at any time during the year, you must report it using Form T1135, the Foreign Income Verification Statement. This guide will walk you through the essentials of foreign property reporting.

Who Needs to Report?

Canadian residents—including individuals, corporations, trusts, and certain partnerships—must report specified foreign property if its total cost exceeds CAD 100,000 at any point during the year.

What Needs to Be Reported?

Specified Foreign Property Includes:

Reporting Exclusions:

Key Dates

Due date for the submission of form T1135 for individuals: April 30th of the following year.

Due date for the submission of form T1135 for Corporations: Six months after the end of the fiscal year.

Penalties for Non-Compliance

Basic Penalty: $25 per day for up to 100 days (minimum $100, maximum $2,500).

Gross Negligence: Higher penalties if the form is not filed after a demand by the CRA.

Information Required on Form T1135

You will need to provide the following details for each type of foreign property:

Steps to File Form T1135

1. Collect Information: Gather all relevant details about your specified foreign properties.

2. Complete Form T1135: Fill out the required sections with the gathered information.

3. Submit: File the form electronically through the CRA’s services (EFILE or NETFILE) or attach a paper copy to your tax return.

Keeping Records

It’s important to maintain detailed records of all specified foreign properties, including purchase details, income earned, and any dispositions, for at least six years from the date you file the return. For more detailed information, you can refer to the CRA's official guide on Form T1135.

By staying informed and compliant with these reporting requirements, you can avoid penalties and ensure that your financial affairs are in order. If you need further assistance, consider consulting with a tax professional who can provide tailored advice based on your specific situation.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 26 August 2024