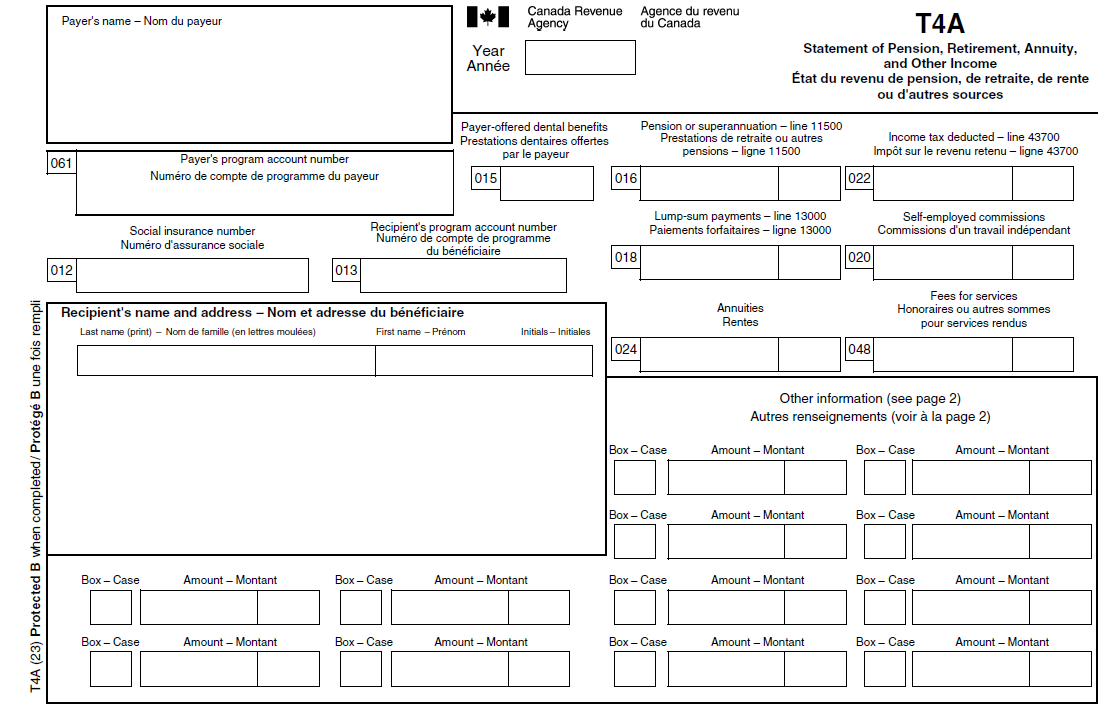

The T4A tax slip, also known as the Statement of Pension, Retirement, Annuity, and Other Income, is a slip that captures various payments you received during the calendar year. These payments can come from diverse sources like self-employment, pensions, annuities, scholarships, grants, and more. Other payments which may be included in the T4A are Registered Education Savings Plan (RESP), Registered Disability Savings Plan (RDSP), death benefits, or medical premium benefits.

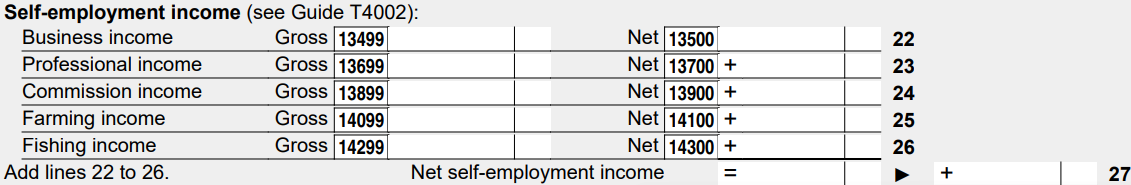

Box 20 – If you are employed as a commission-based sales associate, contractor or a freelancer, your commission income will be reported in this box. It is important to note that you must report the commissions in box 20 net of GST or HST. The reason for this is that if we report the commission including GST or HST, it will result in double taxation when we again report the same income in our GST/HST Return. Gross commission amounts from box 20 are transferred to Form 2125-Statement of Business or Professional Activities where eligible expenses are deducted. Your gross commissions income is reported on line 13899, while the net commissions income is reported on line 13900 of your return.

Box 48 - The amounts in Box 48 correspond to fees received by self-employed individuals for services rendered. Typically, this income is generated from professional services, consulting, or contracted work. Similar to Box 20, amounts in box 48 must be reported net of GST or HST. Gross business or professional income amounts from box 48 are transferred to Form 2125 where eligible expenses will be deducted. Your gross business or professional income is reported on line 13499 or 13699, while the net business or professional income is reported on line 13500 and 13700 of your return respectively.

For further information please contact Taxtron Support at 416-491-0333 or visit www.taxtron.ca

Posted on 05 July 2024